The apartment segment continues to be the focus of real estate in 2025 when transaction volume and selling prices increase sharply.

According to Ms. Pham Thi Mien, Deputy Director of the Vietnam Real Estate Market Assessment Research Institute (VARS IRE), in 2025 the market recorded about 88,000 new housing transactions, an increase of 78% compared to 2024, the highest level in the period 2019–2025. The absorption rate on new supply reached 68%.

In the fourth quarter of 2025 alone, the market recorded more than 29,000 transactions, an increase of 9% compared to the previous quarter and 33% compared to the same period in 2024.

In terms of transaction structure, apartments continue to account for a large proportion of total housing transactions. In the fourth quarter, mid-range apartments accounted for 24%, high-end 16%, luxury 27% and luxury 2%. For the whole year 2025, the proportion of apartments is still overwhelming with 21.2% mid-range, 18.2% high-end, 25.3% luxury and 1% luxury.

Notably, more than 75% of transactions came from second home buyers or more, of which about 10% are short-term financial leverage investors.

Regarding supply, in 2025, the entire market recorded more than 128,000 new housing products offered for sale, an increase of 88% compared to 2024, the highest level in the period 2019–2025. The apartment segment alone has more than 80,000 new apartments, 2 times higher than in 2024. About 25% of the new apartment supply, equivalent to more than 20,000 units, is priced at over 100 million VND/m2, nearly 10 times higher than the previous year.

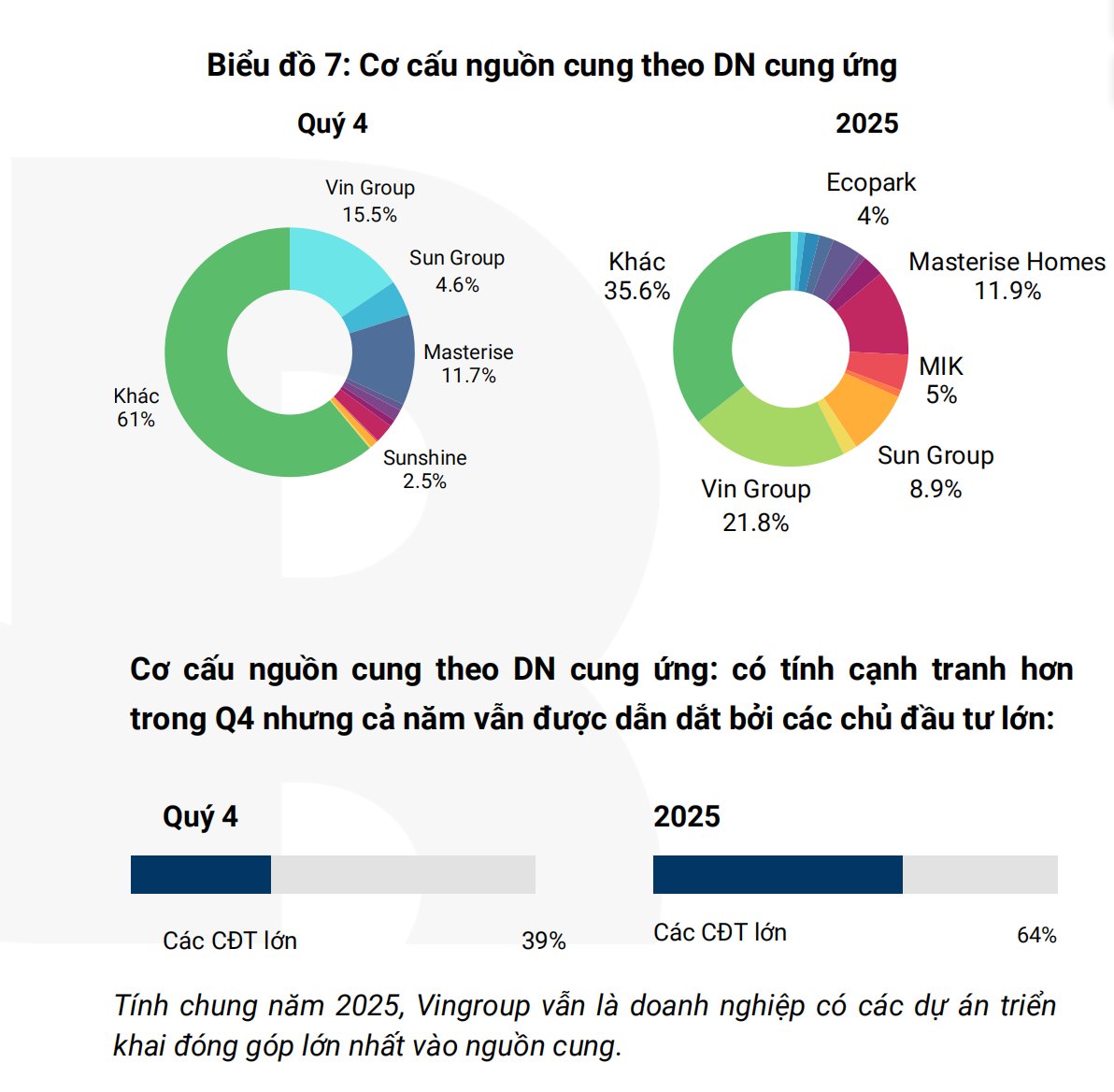

The supply of commercial housing in 2025 is still mainly led by large investors, although the level of competition tends to increase in the fourth quarter. In the fourth quarter of 2025, the group of large investors accounted for about 39% of the total supply, in the whole year of 2025, this figure reached 64%.

Regarding selling prices, in the primary market, apartment prices continue to increase sharply in major cities. In Hanoi, the average new offering price reached about 100 million VND/m2, an increase of 40% compared to 2024. In Ho Chi Minh City (old boundaries), the price reached 111 million VND/m2, an increase of 23%, while Da Nang recorded 83 million VND/m2, an increase of 14% compared to the previous year.

According to Mr. Le Dinh Chung, General Director of SGO Homes, the apartment price index increased very strongly compared to the original quarter of Q1/2019. By the end of 2025, Hanoi increased by 111%, Ho Chi Minh City increased by 65% and Da Nang increased by 68%. Since 2023, especially in the period 2024-2025, apartment prices have entered a clear upward cycle, far ahead of other housing segments.

Mr. Chung said that the demand for buying houses to live in is still maintained at a high level, stemming from the psychology of "settling down and doing business", urbanization, economic growth and the expansion of the middle and upper class. However, the high price level is clearly affecting purchasing power, making buyers increasingly cautious.

From an investment perspective, 2025 recorded a strong increase in real estate investment demand thanks to low interest rates, improved supply and preferential sales policies, and payment delays. Although from the fourth quarter, deposit interest rates increased, leading to increased lending interest rates, causing localized investment stagnation in some areas that has increased sharply, there has been no decline in long-term investment demand, especially for the apartment segment that meets real housing needs.