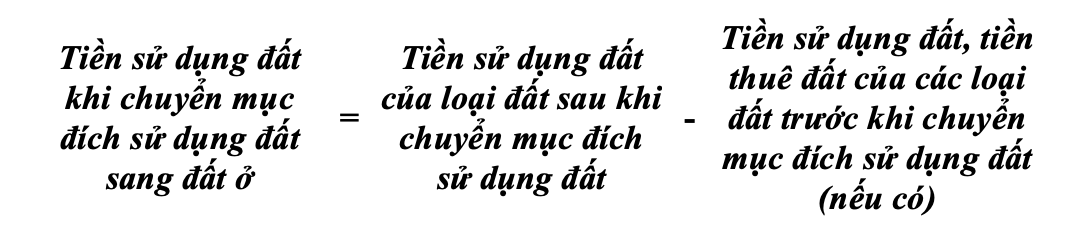

According to Clauses 1 and 3, Article 8 of Decree 103/2024/ND-CP (amended by Decree 50/2026/ND-CP) and Point c, Clause 2, Article 10 of Resolution 254/2025/QH15, households and individuals when authorized by competent state agencies to issue decisions allowing the conversion of land use purpose to residential land, land use fees are calculated as follows:

In which:

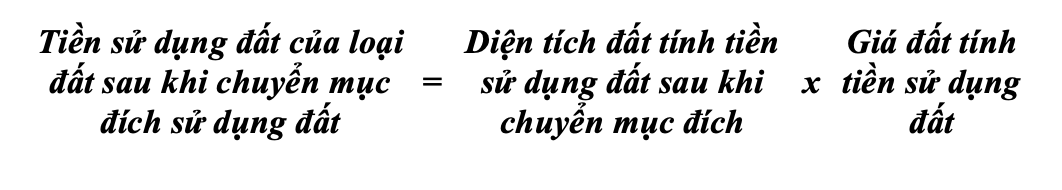

- Land use fees for the type of land after conversion are calculated as follows:

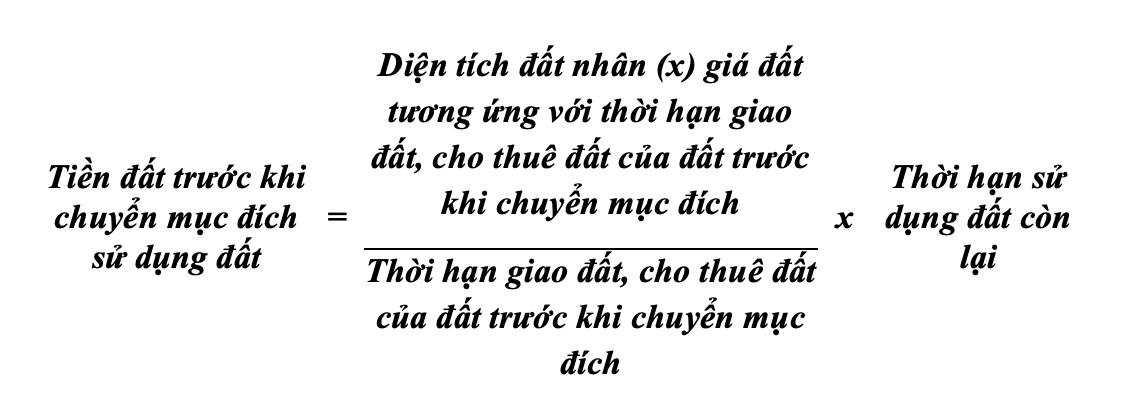

- Land use fees, land rents for land types before changing land use purposes (hereinafter referred to as land fees before changing land use purposes) are calculated as follows:

+ Land before changing purpose is non-agricultural land recognized by the State as land use rights for households and individuals with a long-term stable use term according to the provisions of land law, then land money before changing land use purpose is calculated as land rent paid once for the entire lease period of non-agricultural production and business land corresponding to the Land Price List for a term of 70 years at the time the competent state agency issues a decision allowing land use purpose conversion.

+ If the land before the purpose conversion is leased land with annual land rent payment, the land rent before the land use purpose conversion is calculated as zero (=0).

In case the land user has prepaid land rent for a number of years according to the provisions of the 1993 land law or has advanced compensation and site clearance money and is allowed by state agencies to deduct it from the annual land rent payable by converting it to the number of years and months of fulfilling financial obligations but not fully using (not fully deducted) up to the time of purpose conversion, the number of years and months of paying (completing) land rent but not fully using is converted to the amount according to the unit price of land rent paid annually at the time of purpose conversion to determine the land money before purpose conversion is deducted from land use fees.

+ Land before changing purpose is non-agricultural land in the form of being allocated land by the State with land use fees for a limited time or being leased land by the State with land rent paid once for the entire lease term, the land rent before changing land use purpose is calculated as follows:

In case the land use fee of the type of land after changing land use purpose is less than or equal to the land use fee before changing land use purpose, the land use fee when changing land use purpose is zero (=0).

The land price to calculate land fees before changing land use purposes for the above-mentioned cases is the land price specified in Clause 1, Article 5 of Decree 103/2024/ND-CP calculated at the time when the competent state agency issues a decision allowing land use purpose conversion.

In case garden land, pond land, agricultural land in the same land plot with residential land are determined when recognizing land use rights and changing land use purpose to residential land; converted from land originating from garden land, pond land attached to residential land but land users separate it to transfer land use rights or by the surveying unit when measuring and drawing cadastral maps before July 1, 2014, it has self-measured and separated into separate plots into residential land, the land use fee is calculated according to the collection level equal to:

- 30% difference between land use fees calculated according to residential land prices and land use fees calculated according to agricultural land prices at the time of the decision allowing land use purpose conversion (hereinafter referred to as difference) for the area of land used for purpose conversion within the residential land allocation limit in the locality;

- 50% difference for land area exceeding the limit but not exceeding 1 time the residential land allocation limit in the locality;

- 100% difference for land area exceeding the limit but exceeding 1 time the residential land allocation limit in the locality. The above-mentioned land use fee is only calculated once for one household or individual (calculated per land plot).