According to the Vietnam Association of Realtors (VARS), in the third quarter of 2025, the whole market recorded about 34,000 successful transactions, raising the absorption rate to 66%, an increase of 12 percentage points compared to the previous quarter thanks to free inventory. New supply reached an absorption rate of 77%, equivalent to 27,000 transactions, up 23%. Of which, apartments account for more than 66% of total transaction volume, with an absorption rate of up to 81%, while the low-rise segment reaches 60%.

In the first 9 months of the year, the absorption rate on newly opened supply reached 68%, equivalent to more than 58,000 successful transactions, double the same period in 2024. VARS said that most of the transactions come from the needs of second-hand real estate buyers or more, showing that the investment trend continues to dominate the market.

Mr. Le Dinh Chung - General Director of SGO Homes - commented that the prices of housing products for the first time for sale continue to be "affordable" at a high level, causing the secondary price level to increase sharply. Secondary transactions are therefore more vibrant because primary goods are mostly products formed in the future, making buyers more likely to switch to existing transfer products.

In the third quarter of 2025, Hanoi continues to lead the country in terms of apartment price increase, followed by Da Nang, while Ho Chi Minh City also recorded a significant increase in both primary and secondary selling prices. Compared to the original period, the average selling price increased by: Hanoi 96.2%, Da Nang 72.6% and Ho Chi Minh City 56.9%, respectively. The average selling price of apartments in Hanoi reached 78.9 million VND/m2, an increase of 5% compared to the previous quarter; Ho Chi Minh City reached 81.6 million VND/m2 while Da Nang reached 67.4 million VND/m2, an increase of about 7%.

The selling price of villas, townhouses and townhouses in the third quarter ranged from 50-400 million VND/m2, an increase of 5-10% compared to the previous period.

The selling price of low-rise products continued to increase by 10-15% compared to the same period last year in the context of scarce supply and escalating high-rise apartment prices, causing part of the investment capital to shift to the low-rise segment. Hanoi recorded the strongest increase, especially in projects with a price base of less than 200 million VND/m2.

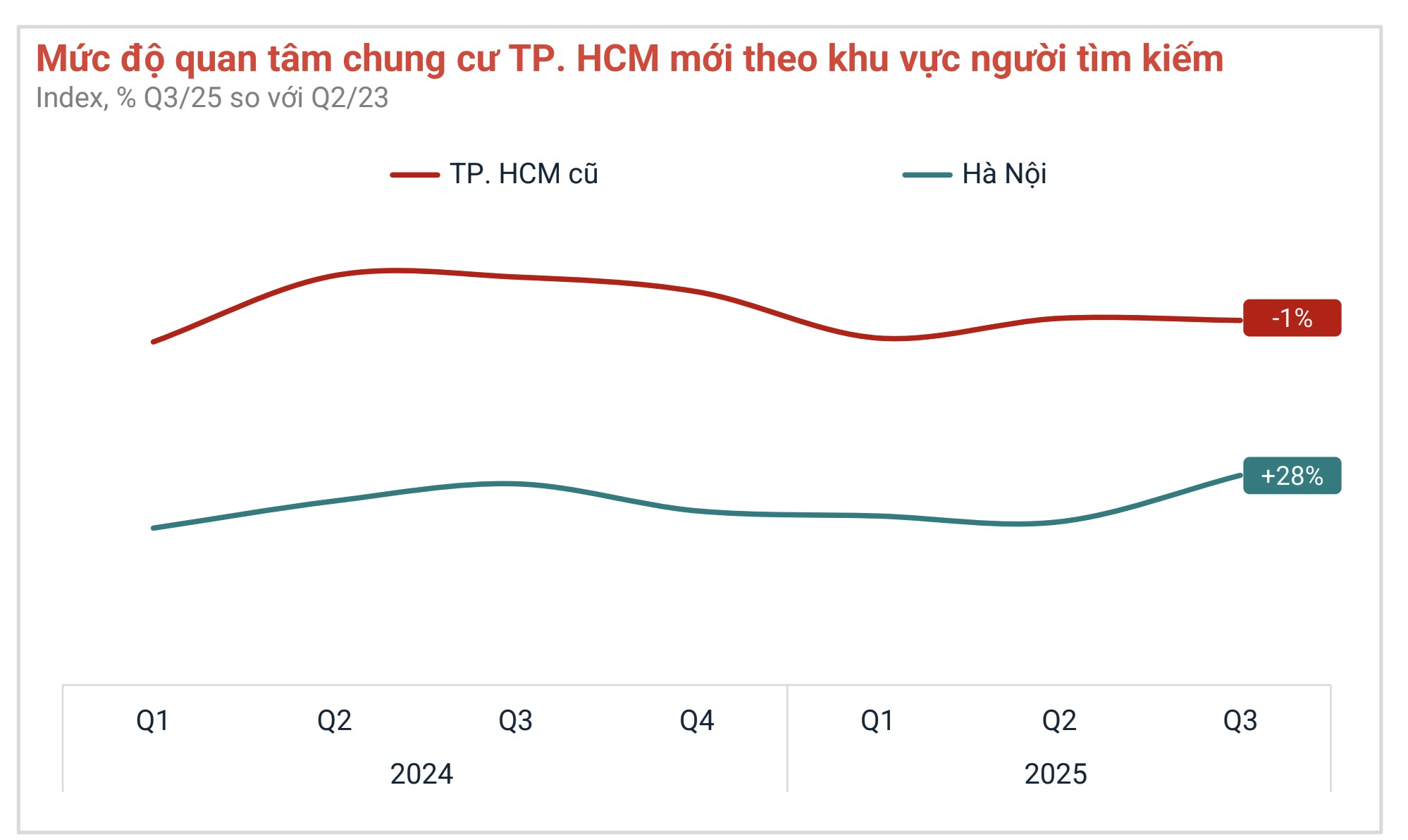

A recent report by Batdongsan.com.vn shows that cash flow from the Northern region is tending to shift to the South due to large growth space. In the first 6 months of the year, 75% of the total number of customers looking to buy real estate in Ho Chi Minh City came from non-local investors, of which the northern provinces accounted for 61%. The proportion of investors from Hanoi accounts for 33%, Hai Phong and Nam Dinh are at 24%, Quang Ninh is at 10%.

Mr. Dinh Minh Tuan - Director of Batdongsan Southern region - said that price difference is the main reason why Northern investors return to the Southern market. Housing prices in Hanoi have risen too high, making the investment profit margin no longer attractive, while real estate in the South still has lower prices and good infrastructure room for price increases.

The expert added that the interest of customers in the North is concentrated in areas with strong infrastructure investment or within the TOD planning direction (urban development according to the orientation of public transport) of Ho Chi Minh City. Not only stopping at the center, this cash flow also expands to neighboring provinces such as Dong Nai and Tay Ninh, following the belt axes and metro.

According to Mr. Tuan, investors in the North expect Ho Chi Minh City real estate to increase prices quickly similar to Hanoi in the period of 2023-2024. In addition to profit, many people are also more interested in sustainable cash flow from leasing and the advantage of completed infrastructure. The trend of capital flow shifting between the two ends of the country shows the flexibility of investors in the new period, when they are ready to expand their areas to seek higher profit opportunities in areas with potential.