Apartment market for sale: sustainable recovery

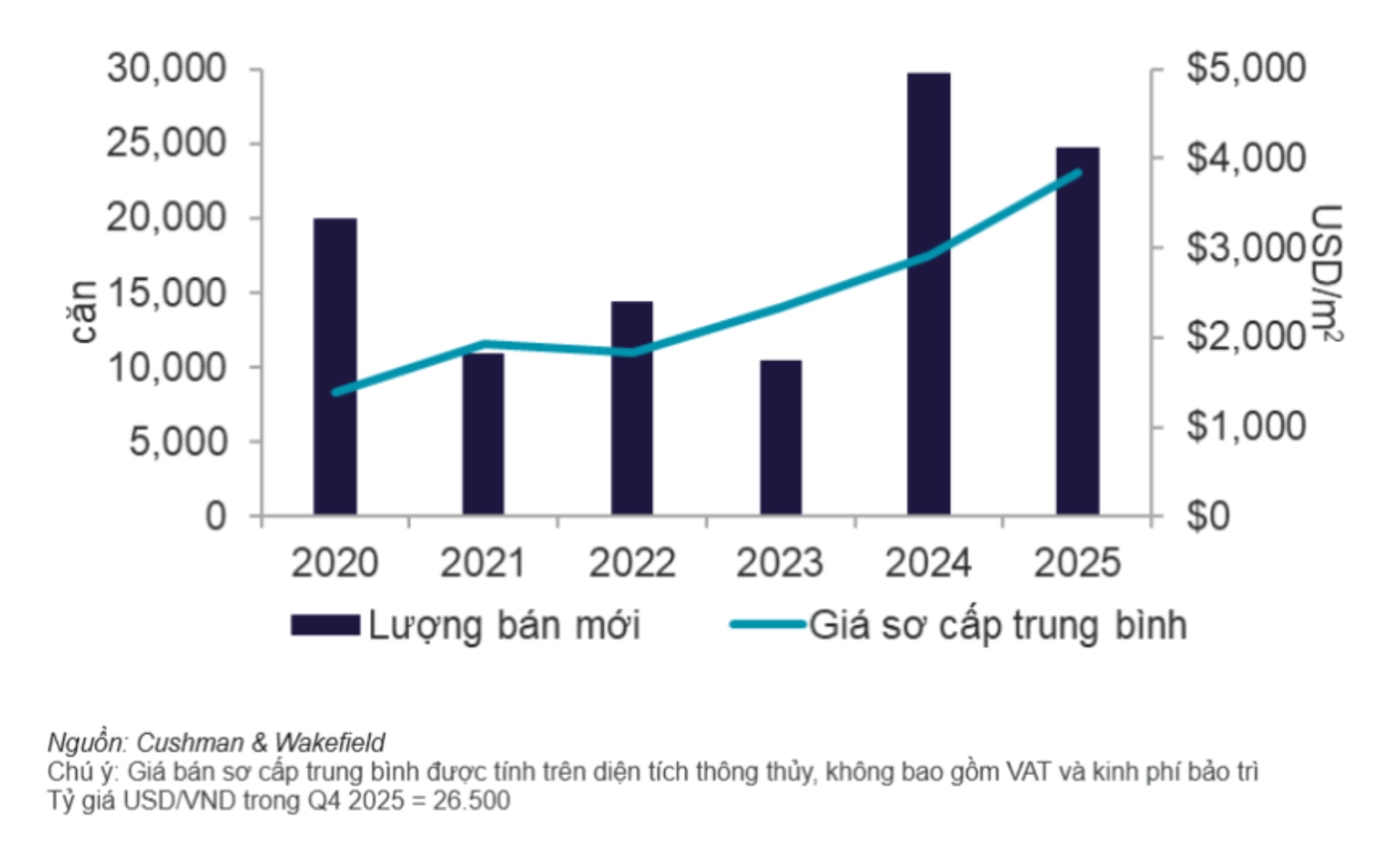

According to Cushman & Wakefield's Hanoi Housing Market Report, in 2025, the Hanoi apartment market recorded about 24,500 units for sale, down 14% compared to 2024 but still 2.9 times higher than the same period in 2023. In the fourth quarter of 2025 alone, new supply increased by 34% compared to the previous quarter, but still 32% lower than the same period last year, showing an adjustment in the delivery rate.

Supply is mainly concentrated in areas outside the city center - where traffic infrastructure connecting with the inner city is increasingly complete, development land fund is still abundant and selling prices are more reasonable than in the core urban area. Mid-range apartments prevail with a proportion of about 45%, reflecting the actual needs and affordability of the main customer group. The high-end segment accounts for nearly 40%, concentrated in projects with good locations and synchronous amenities, while the affordable segment is still absent.

In the fourth quarter of 2025, the average primary selling price in Hanoi reached about 3,852 USD/m2 (about more than 102 million VND/m2), down 10% compared to the third quarter of 2025 but still up sharply by 32% compared to the same period in 2024. The quarterly decrease is mainly due to the increase in the proportion of the mid-range segment, accounting for nearly 45% of the total new supply, pulling the general price level down.

According to forecasts, in the period 2026-2028, the market may receive more than 68,000 new apartments, continuing to maintain the trend of supply shifting to satellite areas. This not only reflects the strategy of population reduction and satellite city development, but also shows the long-term orientation of investors in anticipating the wave of population migration and real housing needs. This trend is forecast to create strong competition in terms of amenities, product quality and selling price between large-scale projects, especially in the context that buyers are increasingly interested in green living spaces, synchronous infrastructure and long-term added value.

Landed house market: best absorption in 6 years

In 2025, the landed house market in Hanoi recorded about 3,500 new units for sale, down 10% compared to the previous year but still the second largest supply year, only after 2024. In the fourth quarter alone, the supply reached more than 220 units, a slight increase of 3% compared to the previous quarter but a sharp decrease of 87% compared to the same period in 2024.

In 2025, the Hanoi landed house market recorded nearly 4,800 units consumed, reaching the highest level in 6 years since 2020, mainly thanks to strong absorption from integrated megacities in suburban areas. However, in the fourth quarter of 2025 alone, the transaction volume only reached more than 200 units, down 64% compared to the previous quarter and 77% compared to the same period in 2024. The main reason comes from limited supply in this quarter.

Notably, most transactions are concentrated in urban areas that converge key factors such as strategic location, transparent legality, synchronous utility system and investor reputation, reflecting the trend of buyers increasingly prioritizing quality and long-term value.

The average primary selling price in Q4 in Hanoi reached about 9,917 USD/m2 (about more than 262.8 million VND/m2), down 8% compared to the previous quarter and 14% compared to the same period in 2024. This adjustment mainly stems from the market receiving new supply with more reasonable prices in suburban areas such as Hoai Duc and Thach That.

In the medium term from 2026 to 2028, the supply of landed houses in Hanoi is expected to reach about 10,800 units, mainly concentrated in suburban areas. This shift reflects an inevitable trend in the context of increasingly limited inner-city land funds, and is also consistent with the development orientation of satellite cities to reasonably expand population and reduce infrastructure pressure for the core area. Future projects will prioritize integrated urban models with synchronous utility systems, transparent legal status and convenient traffic connections.

Ms. Le Hoang Lan Nhu Ngoc - Senior Director, Strategic Consulting, Cushman & Wakefield Vietnam, said that both apartment and townhouse segments in the Hanoi housing market are entering a more mature development phase, in which location quality, infrastructure connectivity and product positioning are becoming increasingly important compared to scale-based expansion.

Although opening sales activities have stalled by the end of 2025, demand for well-planned suburban projects is still maintained at a positive level, especially projects with synchronous utility systems, transparent legal status and sustainable housing values in the long term" - Ms. Ngoc assessed.