Apartment market for sale increases in supply and selling price

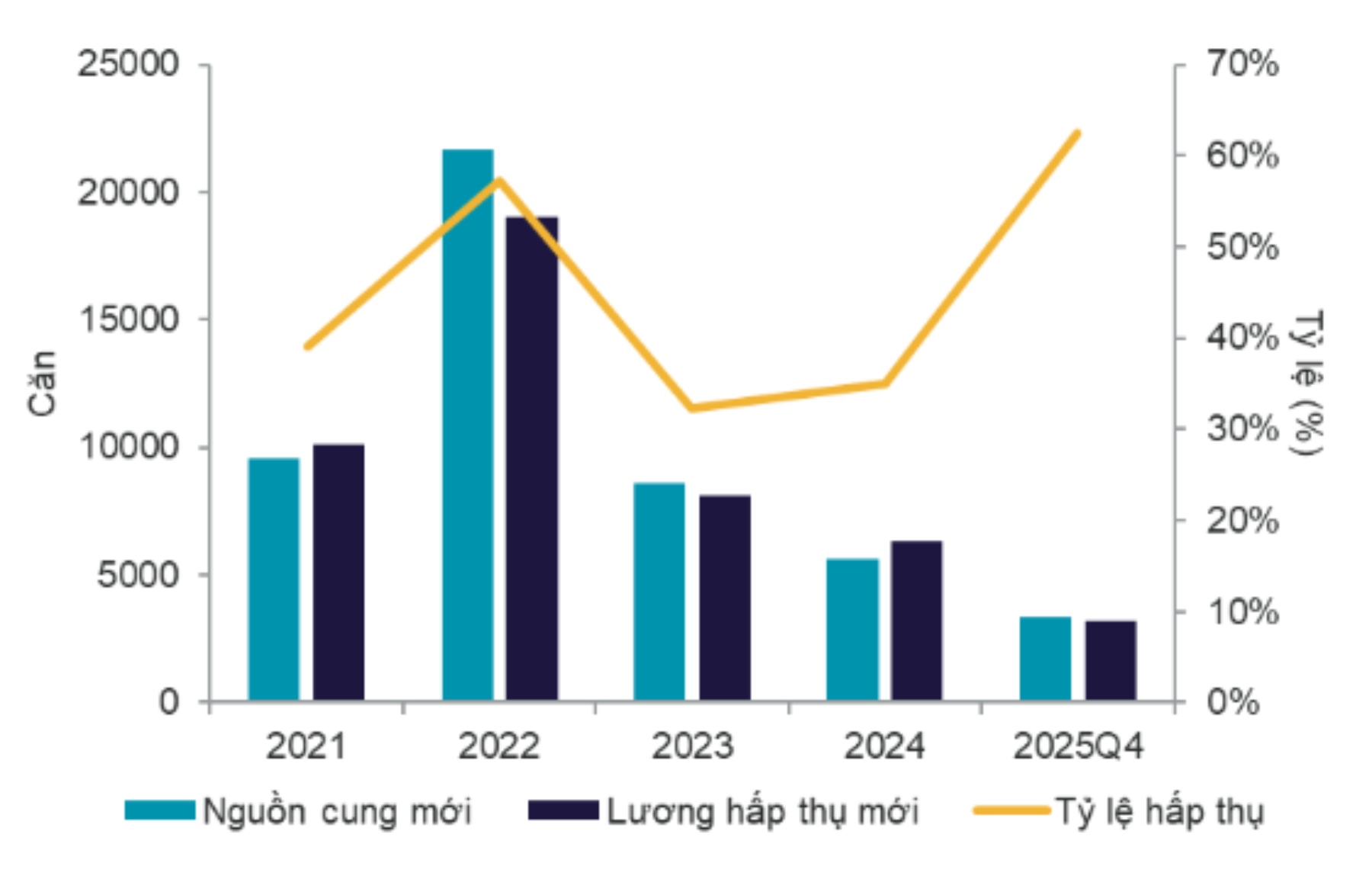

Cushman & Wakefield's Housing Market Report shows that in the fourth quarter of 2025, Ho Chi Minh City recorded 3,358 new apartments offered for sale, a sharp increase of about 5 times compared to the previous quarter, however, only slightly increased by 4% compared to the same period in 2024 - the market is recovering, and selective.

The East continues to lead the supply, accounting for about 85%, while the West and South respectively contribute 10% and 5%, reflecting the number of projects with high legal status that are ready to be put on the market for the next cycle. The luxury segment dominates with 57% of new supply, followed by mid-range (28%) and high-end (14%).

In the fourth quarter of 2025, the market recorded a new absorption volume of about 3,196 units, an increase of 19% compared to the same period last quarter, and about 10% compared to the same period last year. This development shows that demand is recovering positively in the short term, especially in the context that the number of new apartments offered for sale is maintained at a stable level compared to the same period last year. The clear improvement in absorption rates reflects improved buyer psychology, and also shows that the product structure offered for sale is suitable for market demand.

The average primary selling price in the fourth quarter of 2025 reached about 6,113 USD/m2 (equivalent to nearly 160 million VND/m2), a sharp increase of about 16% compared to the third quarter of 2025 and an increase of about 65% compared to the same period in 2024, because new projects always have a higher positioning than old projects.

Key factors driving the market include infrastructure connectivity, increased supply and demand, and sales policies and payment schedules still play a key role in selling price formation.

The trend of primary average selling prices in the Ho Chi Minh City market is expected to continue to cling to high prices due to increased input cost pressure, and real estate purchase loan interest rates are adjusting upwards. Cash flow from other regions, especially investors from the North, is pouring into Ho Chi Minh City with the expectation of room to increase after a long period of silence due to a shortage of new supply.

Landed house market breaks through

After a long period of silence, the supply of landed houses had a strong breakthrough in the fourth quarter of 2025 with record growth. The new supply is about 1,535 units, more than 50 times higher than the third quarter of 2025, and compared to the same period last year - clearly showing the picture of a booming market after a period of "squeezing" extremes.

Notably, about 92% of the new supply is not in the inner city but shifts to the suburbs, with the launch of the super project in the Can Gio area (about 60 km from the center of Ho Chi Minh City), the remaining 8% of the new supply is distributed equally in Thu Duc and Binh Tan respectively.

In the fourth quarter of 2025, the newly absorbed volume is about 1,167 units, more than 20 times higher than the third quarter of 2025, and the same period last year, showing the huge attraction of this type when there is new supply from large projects.

The average primary selling price of the whole market decreased sharply by more than 50% from 13,014 USD/m2 (equivalent to 339.2 million VND/m2) to 6,330 USD/m2 (equivalent to 164.9 million VND/m2).

Meanwhile, in other key areas, the value of landed houses still maintains its position with a record high: Old Thu Duc City continues to lead with a level of about 13,214 USD/m2 (equivalent to 344.4 million VND/m2), followed by Binh Tan about 5,378 USD/m2 (equivalent to 140.1 million VND/m2).

Sharing about the new cycle of the housing market in the core Ho Chi Minh City area, Ms. Le Hoang Lan Nhu Ngoc - Senior Director, Strategy Consulting, Cushman & Wakefield Vietnam - said that the fourth quarter of 2025 marks an important turning point in the Ho Chi Minh City housing market, when both apartment and landed house segments recorded a clear return of supply.

The relative balance between the number of newly launched products and the absorption rate shows that buyer confidence is gradually recovering, especially for projects with good locations and legal status. In the coming time, market developments will continue to depend on the controlled sales rate of investors, credit access and legal clearance progress; while infrastructure development and the expansion of administrative boundaries of Ho Chi Minh City are expected to shape the price level and demand in the next cycle" - Ms. Ngoc assessed.