At the Vietnam Real Estate Market Forum 2026 with the theme "Shaping standards for sustainable market development" organized by the Vietnam Real Estate Brokers Association (VARS) on the morning of January 9, 2026, Ms. Pham Thi Mien - Deputy Director of the Vietnam Real Estate Market Assessment Institute (VARS IRE) said that in 2025, the entire market had more than 128,000 new housing products offered for sale, the highest level in the period 2019-2025 and an increase of 88% compared to 2024.

In the fourth quarter of 2025 alone, the market recorded more than 42,000 new products opened for sale, an increase of 24% compared to the previous quarter and 48% compared to the same period last year. Inventory increased rapidly but mainly products being deployed and housing formed in the future, reflecting supply for the next period.

However, the supply-demand mismatch still continues. In some localities, mainly in the Southern region, the supply of commercial housing with more suitable prices has increased sharply, helping to improve the local market balance. Conversely, in Hanoi, Da Nang and Ho Chi Minh City (old), the level of mismatch is increasingly clear as the supply of social housing, despite increasing sharply, still cannot keep up with the supply of commercial housing with common prices above 80 million VND/m2.

In 2025, the entire market recorded more than 80,000 new apartments, 2 times higher than in 2024. However, about 25% of the new apartment supply has prices above 100 million VND/m2, equivalent to more than 20,000 products, nearly 10 times higher than the previous year. In Hanoi and Ho Chi Minh City (old), about 85% of the new apartment supply opened for sale has prices above 80 million VND/m2. The segment structure continues to shift as the proportion of luxury and super luxury apartments increases sharply, while the affordable commercial housing segment continues to be absent.

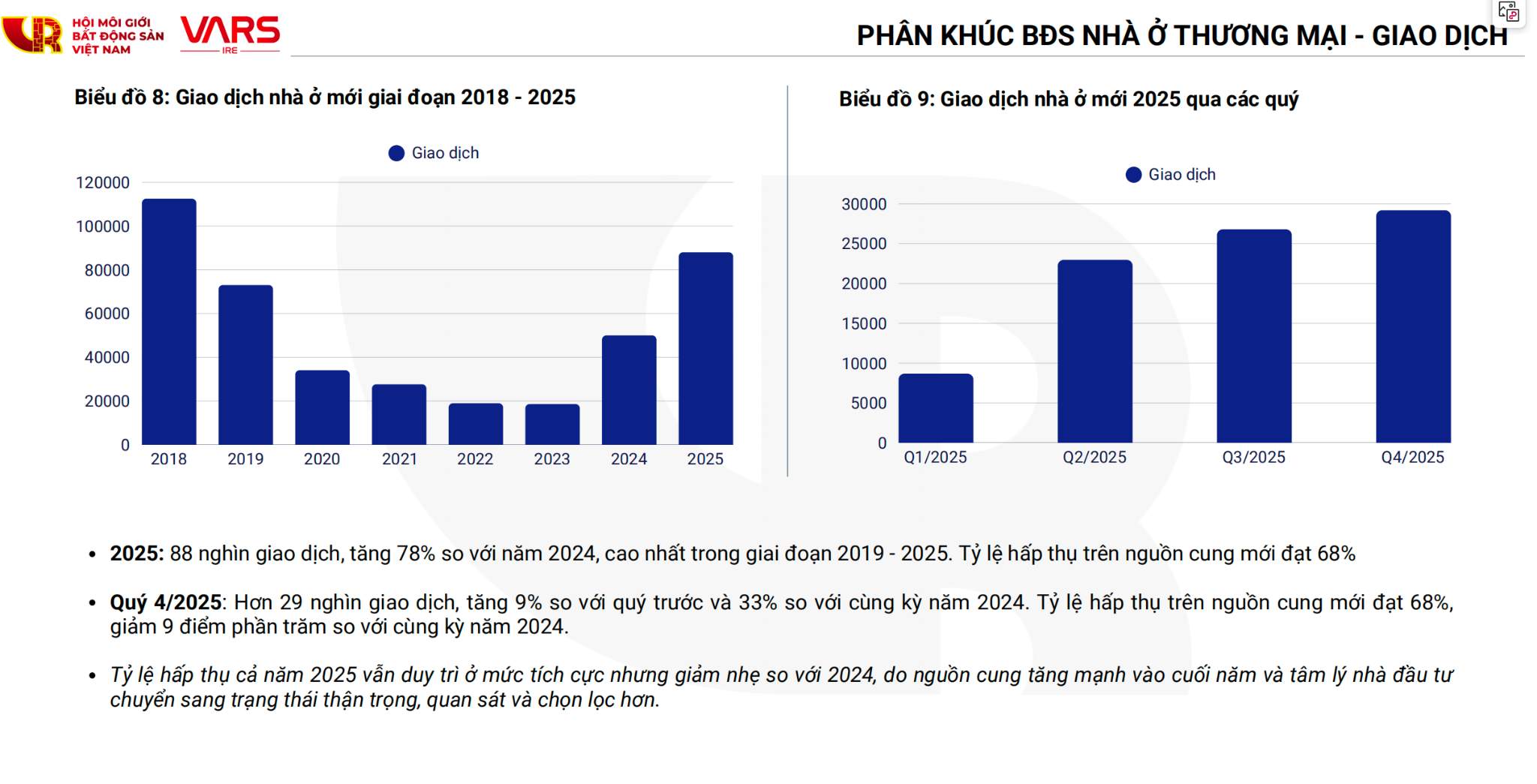

Assessing liquidity, Mr. Le Dinh Chung, General Director of SGO Homes, said that the average absorption rate in 2025 reached about 68% on newly opened supply, equivalent to nearly 88,000 successful transactions.

In the first three quarters of the year, many projects, despite having high prices, still recorded good absorption rates thanks to increased real housing demand and investment. However, in the fourth quarter, absorption rates tended to decrease slightly as supply increased sharply and investor sentiment became more cautious in the context of deposit and lending interest rates starting to increase slightly.

Mr. Chung said that real housing demand continues to play an important role, but the main driving force of the market still comes from investment demand. More than 75% of transactions come from second home buyers or more, of which about 10% are short-term financial leverage investors.

The apartment segment continues to be a hot spot of the market with new offering prices in major cities simultaneously increasing sharply, as new development projects all position products in the high-end segment and above in the context of sharply increasing land-related costs.

In Hanoi, the average new apartment asking price reached about 100 million VND/m2, an increase of 40% compared to 2024. In Ho Chi Minh City (old), the average new asking price reached 111 million VND/m2, an increase of 23% compared to the previous year, with a series of luxury projects opened for sale at the end of the year, affirming the growth signal of the market. In Da Nang, the average new apartment asking price also exceeded the threshold of 83 million VND/m2, an increase of 14% compared to 2024.

In the secondary market, in Hanoi, selling prices increased rapidly in a short time, many areas recorded increases from hundreds of millions to billions of VND per unit, but the upward momentum tended to slow down at the end of the year, appearing the situation of "cutting losses" for sale by a part of investors buying according to FOMO psychology during the hot increase period, however, the price level in the central area is still maintained stably.

In Da Nang, selling prices increased sharply thanks to increased investment demand, especially from investors in the Hanoi area, but liquidity also slowed down at the end of the year with the price level tending to be sideways. Meanwhile, in Ho Chi Minh City, apartment prices continued to accelerate, concentrated in areas with large infrastructure projects being and about to be deployed.

It's a bit of a bit of a bit of a bit of a bit of a bit.