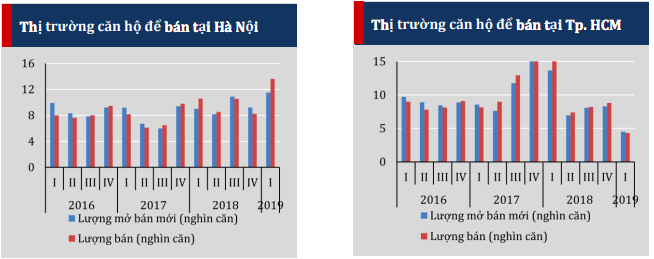

Tại Báo cáo Kinh tế vĩ mô Quý I 2019 công bố mới đây, Viện Nghiên cứu Kinh tế và Chính sách đánh giá thị trường bất động sản tại các thành phố lớn đang được hỗ trợ bởi nguồn cầu lớn. Tuy nhiên, thị trường căn hộ đối mặt với suy giảm nguồn cung căn hộ ở cả hai thành phố lớn là Hà Nội và TP.HCM.

Báo cáo chỉ rõ, tại Hà Nội, căn hộ hạng A giảm 84%, hạng B và C giảm 35% (so với đầu Quý). Nhưng so với cùng kỳ năm 2018, số lượng căn hộ được tung ra thị trường vẫn tăng 76% nhóm căn hộ tầm trung vẫn là phân khúc được ưa chuộng nhất, chiếm hơn 70% số lượng giao dịch (theo Savills).

Tại Hà Nội, giá bán căn hộ hạng B khoảng 1.390 USD/m2 , giảm 2% theo quý nhưng tăng 8% theo năm.

Tại TP.HCM, các diễn biến cũng xảy ra tương tự, số lượng căn hộ được tung ra thị trường đạt 4500 căn, giảm 51,5% theo Quý và giảm 57% so với Quý 1/2018.

Giải thích cho nguyên nhân giảm nguồn cung căn hộ, PGS.TS. Nguyễn Đức Thành, Viện trưởng VEPR cho biết là do quá trình thẩm duyệt pháp lý kéo dài.

Ngoài ra, thị trường căn hộ hạng C cho người thu nhập thấp chiếm hơn 85% thị phần tập trung nhiều ở ngoại thành cũng đối diện với giảm cung dù nhu cầu luôn tăng cao.

"Dự báo nguồn cung trong các quý tiếp theo sẽ được cải thiện nhanh chóng bởi hơn 34 dự án sẽ được gia nhập thị trường như VinCity Ocean Park, BRG Smart City tại Hà Nội, quá trình xét duyệt pháp lý cũng được đẩy nhanh. Tuy nhiên, trước việc ngân hàng liên tục siết vốn vay với lãi suất ở mức cao hơn so với 2018, thị trường bất động sản cũng sẽ đối mặt với không ít khó khăn từ cả phía cung và cầu.

Việc siết vốn ngân hàng được coi là biện pháp cần thiết khi thị trường bất động sản phát triển nóng trong 5 năm trở lại đây, quỹ đất hạn chế. Để vượt qua rào cản này, doanh nghiệp cần phải xây dựng quỹ đất sạch cùng với các dự án đang triển khai trong khi các nhà đầu tư cá nhân cần tránh tận dụng đòn bẩy tài chính để đầu cơ.

Bên cạnh đó, thị trường BĐS vẫn là lĩnh vực sẽ thu hút được sự chú ý của các nhà đầu tư nước ngoài tại Việt Nam. Theo Cục Đầu tư Nước ngoài - Bộ KHĐT, trong những tháng đầu năm 2019, BĐS tiếp tục được đầu tư 500 triệu USD, chiếm 5% tổng FDI, đứng thứ hai sau ngành công nghiệp chế biến, chế tạo" - ông Nguyễn Đức Thành giải thích.