Within the scope of this article, transactions on land use rights mean the exercise of rights to convert, transfer, lease, sublease, inherit, donate land use rights; mortgage, contribute capital with land use rights according to the provisions of the 2024 Land Law and other relevant laws.

Pursuant to the provisions of Article 4 of Circular 257/2016/TT-BTC on the collection of notary fees for land use rights transactions as follows:

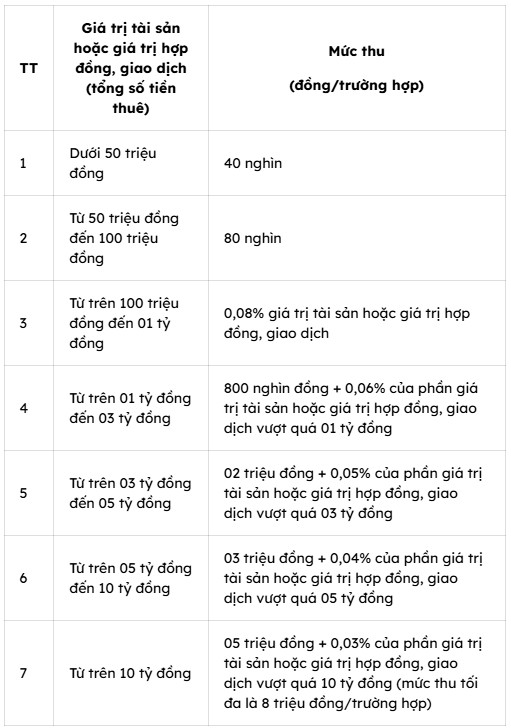

- The fee collection rate for notarization of the following contracts and transactions is calculated as follows:

+ Notarize the contract for transfer, donation, donation, division, division, merger, exchange, capital contribution using land use rights: Calculated on the value of land use rights.

+ Notarize the contract for transfer, donation, donation, division, merger, exchange, capital contribution using land use rights with assets attached to land including houses and construction works on land: Calculated on the total value of land use rights and the value of assets attached to land, the value of houses and construction works on land.

+ Notarize contracts for sale, donation of other assets, capital contribution in other assets: Calculated on the value of assets.

- Fees for notarizing land use rights lease contracts; renting houses; leasing, subleasing assets:

Note: For contracts and transactions on land use rights and assets with prices prescribed by competent state agencies, the value of land use rights and the value of assets subject to notarization fees shall be determined according to the agreement of the parties in the contract and transaction; in case the land price and the price of assets agreed by the parties are lower than the price prescribed by the competent state agency at the time of notarization, the value of the notarization fee shall be as follows:

Value of land use rights, value of assets for notarization = Land area, number of assets recorded in contracts, transactions (x) Land price, property price prescribed by competent state agencies.