Talking to Lao Dong, Lawyer Tran Tuan Anh - Director of Bright Legal Company said that from January 1, 2026, it will be easy to apply for converting agricultural land to residential land, but it will cost a lot of money to change the purpose of use.

Lawyer Tran Tuan Anh analyzed that according to the 2024 Land Law, households and individuals can apply for residential land more easily for 2 reasons.

Firstly, for agricultural land in residential areas or agricultural land located in the same plot of land with residential land, the conversion of land use purposes from agricultural land to residential land only needs to be consistent with the land use planning of the district level, this is stipulated in Clause 5, Article 116 of the 2024 Land Law without the need for an annual land use plan of the district level. Land use planning is long-term stable (10 years, vision 20 years), while the annual plan will be less flexible and unstable.

Second, after having Decree No. 115/2025/ND-CP on the regulation on the division of authority of local authorities at 2 levels, decentralization and delegation in the field of land, the authority of the People's Committee at the district level will be transferred to the People's Committee at the commune level for implementation, including the authority to change the land use purpose. This shortens administrative procedures in the land sector in general and procedures for changing land use purposes in particular.

Lawyer Tran Tuan Anh said that according to the Land Law, when households and individuals want to change the purpose of land use, they must pay the following 4 fees: Land use fee when changing the purpose of land use to residential land; certificate issuance fee; registration fee; file appraisal fee.

"Land use fees are one of the major and important costs when changing land use purposes, usually up to several hundred million VND. And from January 1, 2026, when the new land price list is officially applied, it will certainly have a significant impact on the land use fee that people have to pay" - Lawyer Tuan Anh assessed.

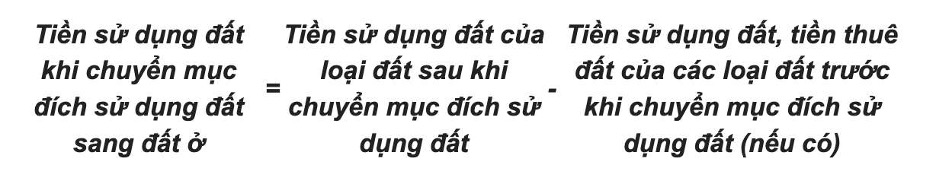

Currently, the formula for calculating land use fees when converting the purpose from agricultural land to residential land is stipulated in Clause 1, Clause 2, Article 8 of Decree 103/2024/ND-CP as follows:

In which:

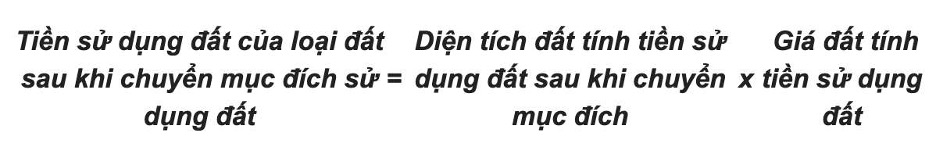

(1) Land use fee of the land type after changing land use purpose is calculated as follows:

(2) Land use fees and land rents of land types before changing the purpose of use are calculated as follows:

- In case the land before changing purpose is agricultural land allocated by the State without collecting land use fees or has the origin of legal transfer and has been allocated by the State without collecting land use fees:

Land fee before changing land use purpose = Land area x Land price of corresponding agricultural land type in land price list

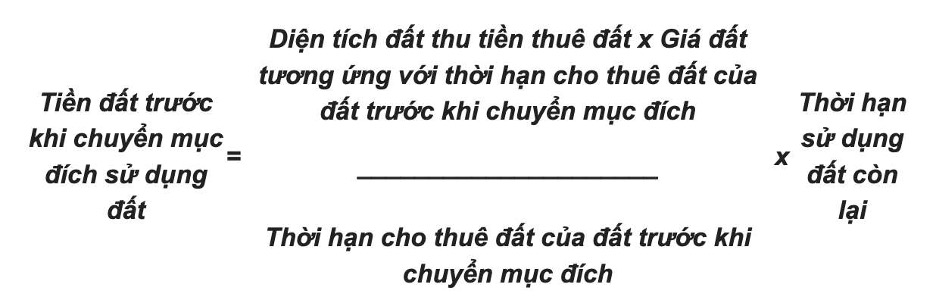

- In case the land before changing purpose is agricultural land leased by the State with one-time rental payment for the entire lease term, the land fee before changing purpose of use is calculated as follows:

According to Lawyer Tuan Anh, it can be seen that the formula for calculating costs of converting land use purposes is closely linked to the land price list. The solid increase in the land price list also leads to people having to pay land use fees when changing the purpose of use much more than before January 1, 2026.

"Although the conditions for applying for residential land are easier, if done after January 1, 2026, people will spend a lot of money to change the purpose of use" - Lawyer Tuan Anh said.