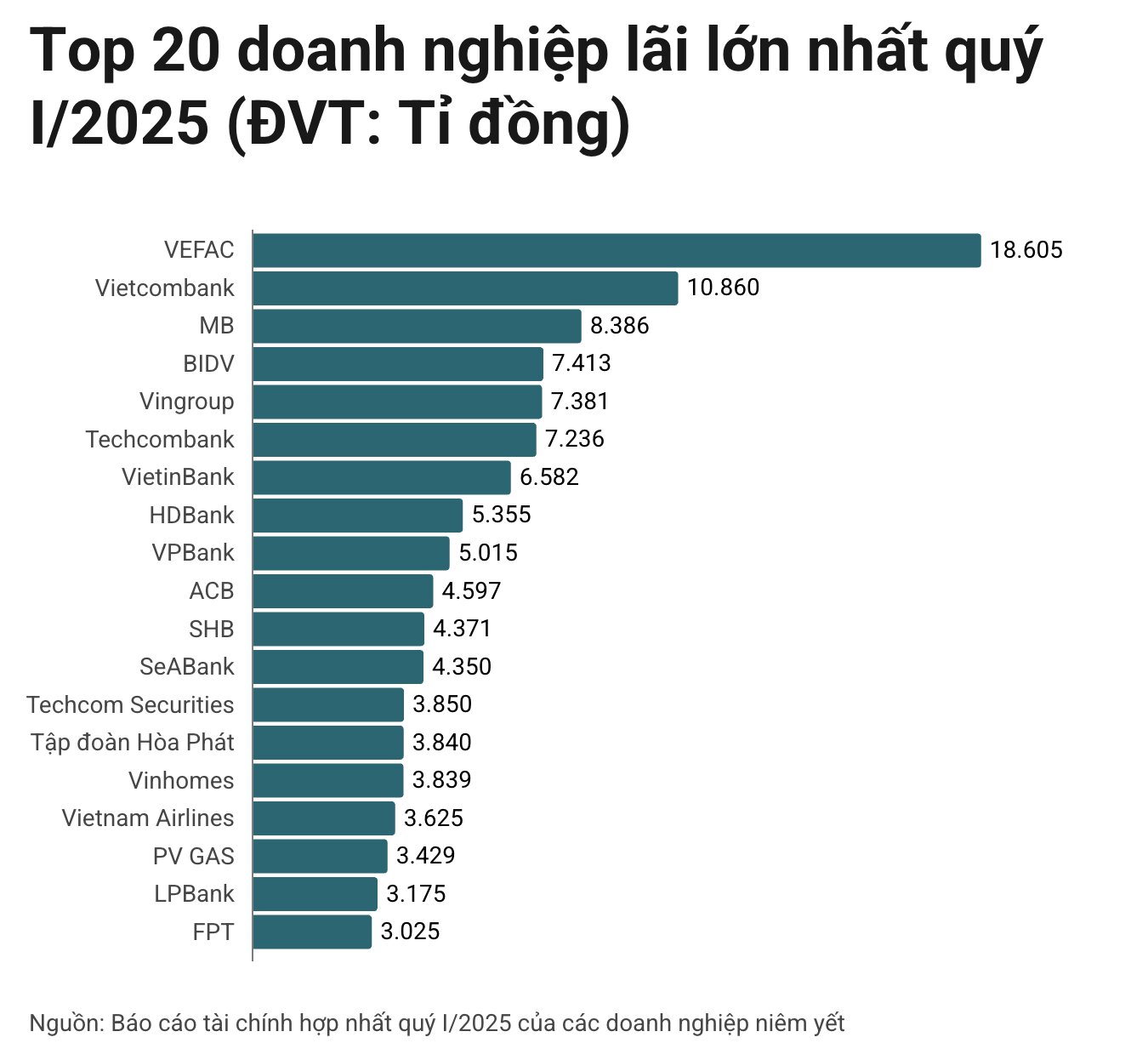

According to statistics from the first quarter financial statements of listed businesses, Vietnam Exhibition Center Joint Stock Company (VEFAC - VEF code) recorded profit before tax of 18,605 billion VND - the highest level in the market, far beyond the banking industry. This profit comes from abnormal income when businesses transfer a part of Vinhomes Global Gate real estate project.

Second place is the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank - code VCB) with pre-tax profit reaching VND 10,860 billion, up slightly by 1% over the same period last year. Military Commercial Joint Stock Bank (MB - code MBB) surpassed BIDV and VietinBank for the first time, rising to third place with a profit of VND 8,386 billion, up to 45%.

Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV - code BID) ranked fourth with VND 7,413 billion in profit, almost unchanged over the same period. Meanwhile, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank - code CTG) dropped to seventh place with VND 6,582 billion, down sharply compared to the previous quarter.

The real estate and industrial group continues to record strong growth results. Vingroup Corporation (code VIC) reported a profit of VND 7,381 billion with a record revenue of VND 84,053 billion, up nearly 3 times over the same period in 2024. Vinhomes Joint Stock Company (code VHM) achieved a profit of VND 3,839 billion, up 171%. Hoa Phat Group (HPG code) recorded VND 3,840 billion in profit, up 18%.

In the banking sector, other enterprises have recorded impressive business results:

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank - code HDB): VND 5,355 billion, up 40%;

Vietnam Prosperity Joint Stock Commercial Bank (VPBank - code VPB): VND 5,015 billion, up 20%;

Asia Joint Stock Commercial Bank (ACB - code ACB): VND4,597 billion, down 6%;

Saigon - Hanoi Commercial Joint Stock Bank (SHB - code SHB): VND 4,371 billion, up 8.8%;

Southeast Asia Joint Stock Commercial Bank (SeABank - code SSB): VND 4,350 billion, up nearly 189%;

Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank - STB code): VND 3,675 billion;

Lien Viet Post Joint Stock Commercial Bank (LPBank - code LPB): VND 3,175 billion.

The technology and aviation sectors also recorded their presence in the rankings:

FPT Joint Stock Company (code FPT) achieved a profit of VND 3,025 billion, up 19%;

Vietnam Airlines Corporation - JSC (Vietnam Airlines - code HVN) reported a profit of VND 3,625 billion, down 20% over the same period.

Notably, Techcom Securities Joint Stock Company (code TCBS) is the only representative of the securities industry to appear in the I/2025 Q1 rankings, with pre-tax profit reaching VND 3,850 billion - the highest level in the securities company sector to date.

Thus, although the banking industry continues to play a key role with more than half of the enterprises in the rankings, the developments in the first quarter of 2025 show a significant increase in non-financial enterprises - especially the real estate group with large-scale transfer deals.