Many businesses share huge dividends

According to statistics from the latest publications, there are many businesses that are "isturbing" cash dividends at a record high.

HGM: Pay dividends of 138%, shares increase 6.5 times

The "king" of dividends this season belongs to Ha Giang Mechanical and Mineral Joint Stock Company (HNX: HGM). The enterprise has announced the plan to pay the third installment of 2024 in installments in cash at a rate of 88%, the payment date is June 27, 2025.

Previously, HGM had advanced two dividends with a total rate of 50%, raising the total dividend payment in 2024 to 138%, equivalent to 13,800 VND/share. This is the highest cash dividend recorded in this year's dividend payment in the whole market.

Notably, HGM shares have increased in price more than 6.5 times over the past year, currently trading around VND 314,800/episode (up more than 545% over the same period in 2024). However, the average trading volume per session is only around 5,400 units - a very low liquidity level.

Hau Giang Pharmaceutical "pours" 780 billion VND in dividends

Hau Giang Pharmaceutical Joint Stock Company (HOSE: DHG) - the largest pharmaceutical enterprise on the stock exchange - will pay the dividend in cash at a rate of 60% (VND6,000/share), effective date of May 26, 2025, payment date of June 18, 2025.

In addition to the previous 40% deposit, the total dividend in 2024 that DHG shareholders will receive is 100%, equivalent to 1 share receiving VND 10,000. With more than 130 million outstanding shares, DHG's total cash dividend payment is up to about 1,300 billion VND.

D2D pays 84% dividend, cash division of over VND 250 billion

Industrial Urban Development Joint Stock Company No. 2 (HOSE: D2D) announced the settlement of the 84% cash dividend on May 23, payment on June 10, 2025. With 30.3 million outstanding shares, D2D plans to spend more than VND254 billion to shareholders.

D2D shares have also had a slight increase in recent times, currently trading around VND62,000/ep, the actual dividend yield is about 13.5% - very attractive in the context of low bank interest rates.

Not high dividends are good stocks

Although high dividend payment shows interest in shareholders, investors need to look at the financial foundation and the ability of the business to maintain long-term profits, instead of just "following" the dividend information.

In particular, stocks such as HGM have very low liquidity, although they are divided with high dividends and increased prices strongly, there are also potential risks of liquidity if investors want to get rid of the goods.

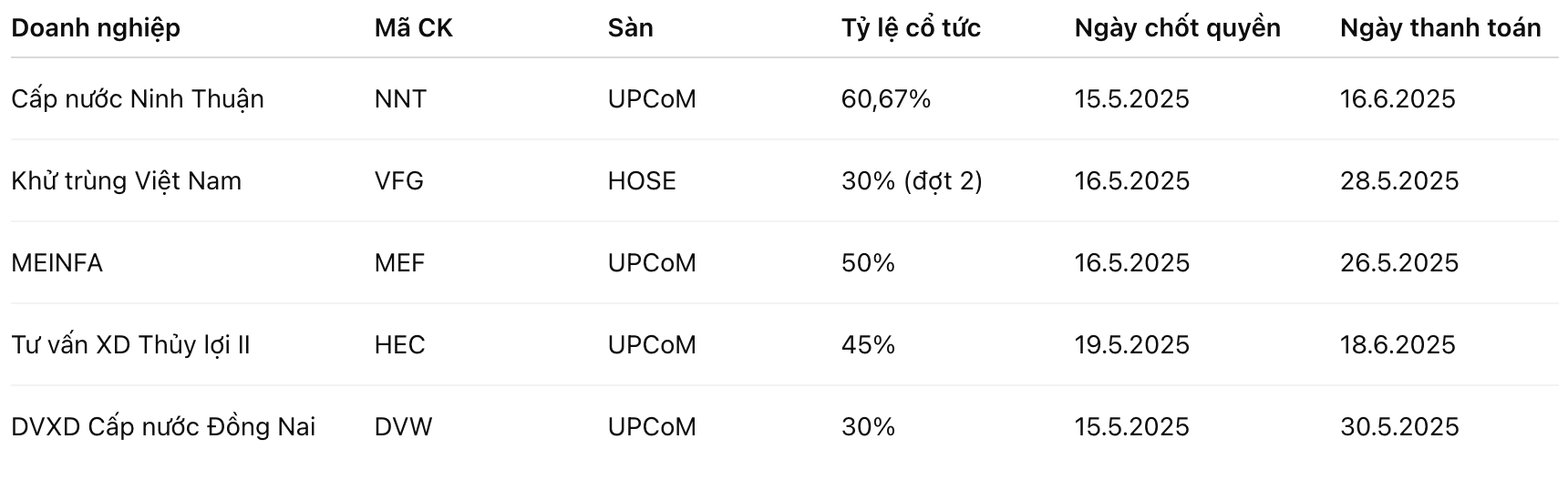

In addition to the above enterprises, a series of listed enterprises are also paying cash dividends at a notable level:

Banks simultaneously divide cash dividends

The 2025 dividend season is witnessing a strong return of the banking sector with a series of cash payment plans for shareholders. Leading is LPBank with a dividend ratio of up to 25% of the face value, equivalent to VND 2,500/share, maturing on May 20 and paying from May 28, 2025. With more than 2.99 billion outstanding shares, LPBank plans to spend nearly VND 7,500 billion in cash to shareholders - the highest level in the banking group this year.

In addition to LPBank, many other banks also joined the competition such as Techcombank (TCB) with a ratio of 10%, VPBank (VPB) expected to share 5%, ACB shared 10% cash with 15% of shares, or TPBank (TPB) paid 10% in cash. VIB, SHB, MB, OCB also announced a dividend division plan of 3 - 7%, depending on the financial situation and the orientation of retaining profits.

Notably, many banks have returned to distributing cash dividends after a long time of prioritizing capital increase and retaining profits to serve growth. This not only shows the internal recovery of the financial system, but also reflects pressure from shareholders in the context of long-term investment needing to be "repaid" with real cash flow.