Impressive credit growth and mobilization

The highlight of the LPBank's first quarter business picture is strong credit growth. By the end of March 31, 2025, customers' loans reached VND 352,194 billion, impressive growth of more than 6.2% after the first 3 months of the year (compared to the end of 2024) and an increase of nearly 15% over the same period in 2024. This is a significant higher number compared to the average of the whole industry (estimated at 2.5% as of the end of March 3, 2025) shows that the Bank has been active in the first year of the premises of the first year. In addition, mobilizing capital from customers also recorded a good growth, reaching 293,155 billion dong, up 3.5% compared to the end of 2024.

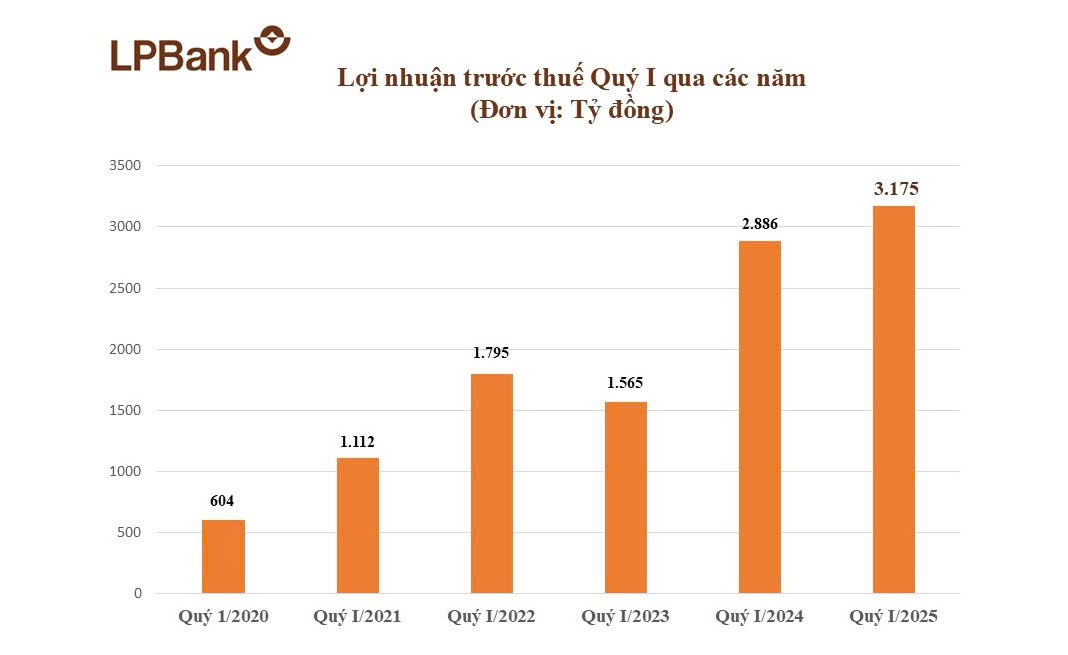

Also according to the financial report for the first quarter of 2025, LPBank's total operating income (TOI) reached VND 4,688 billion, up nearly 5% over the same period. Of which, net interest income accounts for the largest proportion with VND 3,282 billion.

Another notable point in LPBank's Q1 business results is income from service activities and other non-interest sources that effectively contribute to total income. Accordingly, non-interest income accounts for nearly 30% of total operating income, showing that the Bank's efforts to diversify revenue sources are on the right track.

In recent times, LPBank has proactively expanded and upgraded non-credit services such as digital banking, credit cards, electronic payments, personal financial management, etc. to diversify revenue sources, effectively manage risks and increase sustainability in business operations.

In addition to expanding the service portfolio, LPBank constantly increases the technology content of financial products and services, helping to improve user experience and increase customer loyalty such as: Loc Phat Profit, Center without pressing button, balance notification service right on LPBank application... have contributed to helping the Bank attract millions of new customers in recent times.

Optimizing operations, improving profit efficiency

In parallel with profit growth, LPBank's operational efficiency in the first quarter of 2025 continued to be strongly affirmed through cost optimization and risk management.

The rate of expenses on income (CIR) of the first quarter of the bank decreased from 30.7% to 28% compared to the same period in 2024, showing management capacity and optimization of operation. In addition, the cost of provision for credit risks in the first quarter recorded 198.4 billion dong, down nearly 8% compared to the same period last year. The reduction of the provisioning pressure not only directly supports the profit results but also more important, also reflects the quality of the credit portfolio is being maintained stably and the positive results in the processing and recovery of the bank's debt.

ROA profit indexes (2.0%) and ROE equity profit ratio (23.0%) affirm LPBank's outstanding operational efficiency and ability to create sustainable profits, maintaining LPBank's leading position.

Sharing about the achieved results, Mr. Vu Quoc Khanh, General Director of LPBank, said: The business results of the first quarter of 2025 are a positive start, reflecting the efforts of the entire LPBank system in proactively implementing flexible business solutions, supporting customers to access capital effectively, while optimizing operations and diversifying revenue sources. We believe that, with the existing foundation and a clear strategy, LPBank will continue to achieve important goals in 2025.

On April 27, LPBank plans to hold the 2025 Annual General Meeting of Shareholders in Ninh Binh. At the Congress, the Bank will present to shareholders a business plan for 2025 with a pre-tax profit target of VND 14,868 billion, an increase of 22.2% compared to the 2024 results. In particular, LPBank also plans to divide 2024 dividends in cash at a rate of 25% - one of the highest rates in the current banking industry - which is expected to be an important highlight, demonstrating the Bank's efforts to maximize benefits for shareholders