From January 1, 2026, the Law on Teachers officially takes effect. Compared to before, the new regulations are assessed as more flexible, suitable for the specific professional characteristics and each group of teachers.

According to the retirement age increase roadmap stipulated in the 2019 Labor Code, applicable to workers in general, including teachers:

Male teachers retire at the age of 61 and 6 months. Female teachers retire at the age of 57.

From the following years, the retirement age will continue to gradually increase until reaching the milestone of 62 years old for men and 60 years old for women according to the roadmap prescribed by law.

Kindergarten teachers are allowed to retire early

A noteworthy new point in the Law on Teachers is that preschool teachers are applied the early retirement mechanism compared to the general retirement age.

Specifically, preschool teachers can retire a maximum of 5 years earlier if they wish and have paid social insurance for 15 years or more, and are not deducted the pension benefit rate.

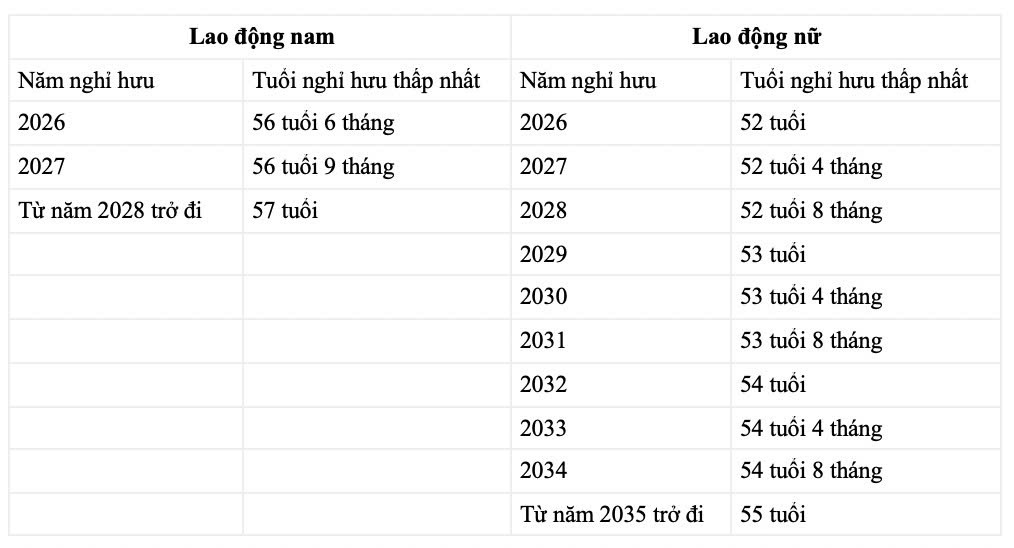

Thus, in 2026, male preschool teachers can retire from about 56 years and 6 months; female preschool teachers can retire from about 52 years. This regulation is considered suitable for the specific nature of heavy work and high pressure of preschool teachers.

Group of teachers with retirement age later than the prescribed age

The Law on Teachers also allows some groups of teachers to retire later than the prescribed age, if they fully meet the conditions and have the needs of educational institutions.

The groups of teachers considered for extending working time include: Teachers with doctoral degrees; teachers with the title of Associate Professor; teachers with the title of Professor; teachers working in deep and specific professional fields.

The maximum duration is as follows:

PhD not exceeding 5 years;

Associate Professor for no more than 7 years;

Professor, no more than 10 years.

During a long period of work, teachers did not take on management positions, only focusing on professional work, teaching, and research.

How to calculate teacher pensions

Law on Social Insurance No. 41/2024/QH15 (Law on Social Insurance 2024), effective from July 1, 2025, adjusts the method of calculating the monthly pension benefit level.

Specifically for female workers: The monthly pension level is calculated at 45% of the average salary level as a basis for social insurance contributions corresponding to 15 years of social insurance contributions.

After that, for each additional year of social insurance contribution, the benefit rate will be calculated at an additional 2%, the maximum level is 75% corresponding to 30 years of social insurance contribution.

For male workers: The monthly pension level is calculated at 45% of the average salary level as a basis for social insurance contributions corresponding to 20 years of social insurance contributions.

After that, for each additional year of social insurance contribution, the benefit rate will be calculated at an additional 2%, the maximum level is 75% corresponding to 35 years of social insurance contribution.

Article 65 of the new Social Insurance Law stipulates early retirement due to reduced labor capacity. However, the pension level of those who retire early will be reduced.

The monthly pension level is calculated as above, then for each year of early retirement, it will be reduced by 2%. In case the early retirement period is less than 6 months, it will not be reduced, from 6 months to less than 12 months, it will be reduced by 1%.