NCB suddenly adjusted

According to Lao Dong, on October 24, National Citizen Commercial Joint Stock Bank (NCB) issued a new interest rate schedule, recording an alternating trend of increases and decreases between terms. Accordingly, before the interest rate adjustment, NCB was the bank with the highest interest rate in the market, with an interest rate of 6.15%/year for terms of 18-36 months.

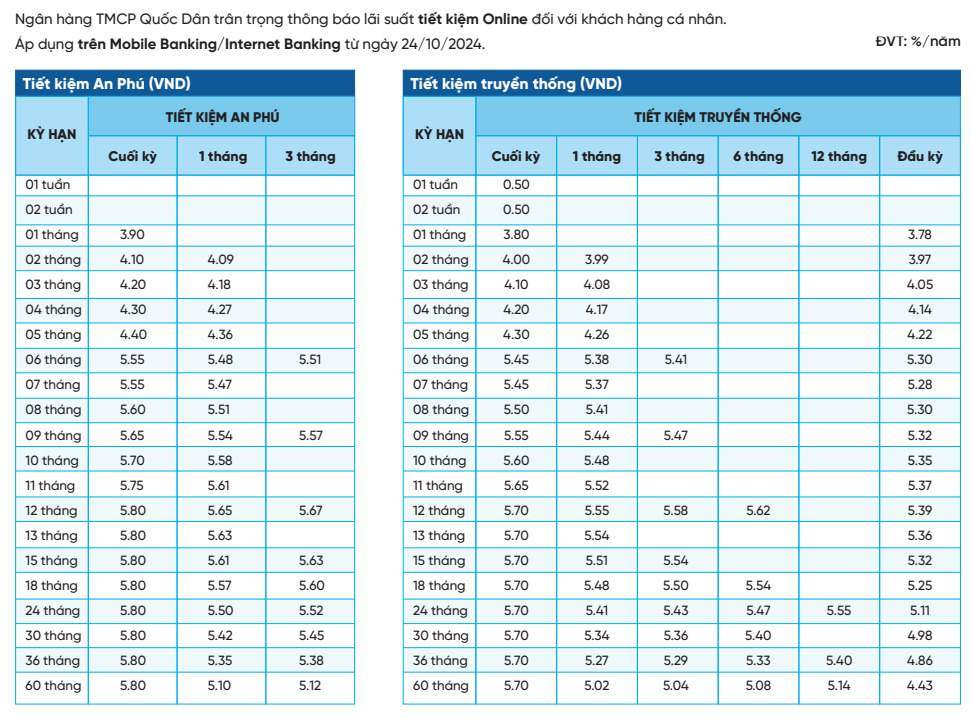

NCB's online deposit interest rate table (An Phu savings) records the following changes:

The 1-month Interest Rate increased by 0.1 percentage point to 3.9%/year.

The 3-month Interest Rate increased by 0.1 percentage point to 4.2%/year.

Interest Rate for 6-month term increased by 0.1 percentage point, to 5.55%/year.

Interest Rate for 9-month term is at 5.65%/year.

Interest Rate for 12-month term is 5.8%/year.

Interest Rate for 18-36 month term decreased by 0.35 percentage points, down to 5.8%/year.

NCB's counter deposit interest rate table records the following changes:

Interest Rate for 1 month term is 3.8%/year.

Interest Rate for 3-month term is 4.1%/year.

Interest Rate for 6-month term is 5.45%/year.

Interest Rate for 9-month term is at 5.55%/year.

Interest Rate for 12-month term is 5.7%/year.

Interest Rate for 18-36 month term is 5.7%/year.

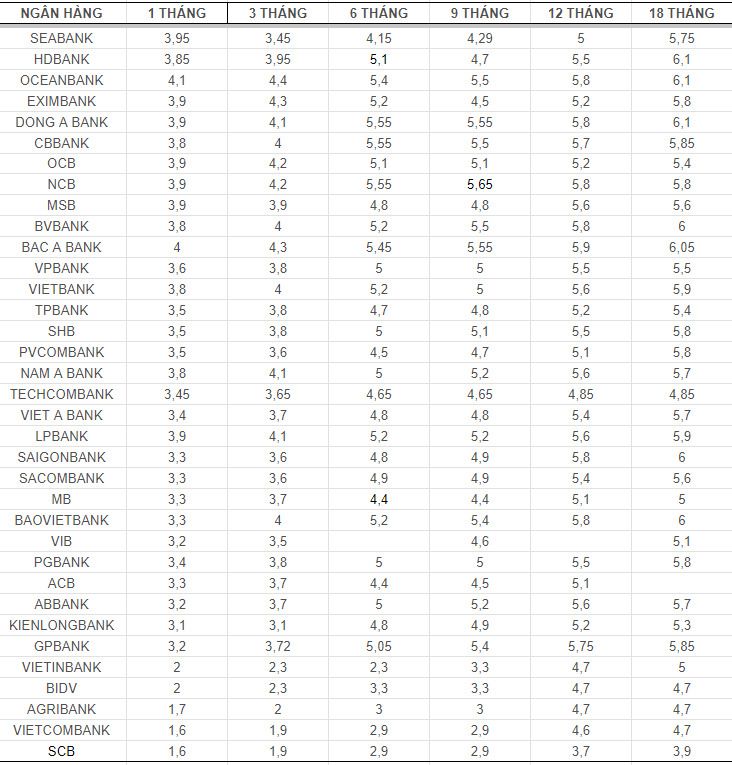

The interest rate level recorded 7 banks increasing interest rates. Banks increasing interest rates in October include Bac A Bank, Eximbank, LPBank, MSB, NCB and VietBank. Notably, a large bank in the Big 4 group, Agribank, also recorded an interest rate increase in October.

See more highest bank interest rates HERE.

Details of deposit interest rates at banks, updated on October 24, 2024