According to Lao Dong, since the beginning of September, 12 banks have increased interest rates, including: Dong A Bank, OceanBank, VietBank, GPBank, Agribank, Bac A Bank, NCB, OCB, BVBank, PGBank, Nam A Bank; with the increasing trend mainly in short terms.

However, the interest rate market also recorded a downward trend in interest rates from a bank that used to lead the market with the highest interest rate, ABBank. On the contrary, there were banks that increased interest rates consecutively during the month to significantly high levels, such as OceanBank and Dong A Bank. This opposite trend created strong fluctuations in the interest rate rankings at banks.

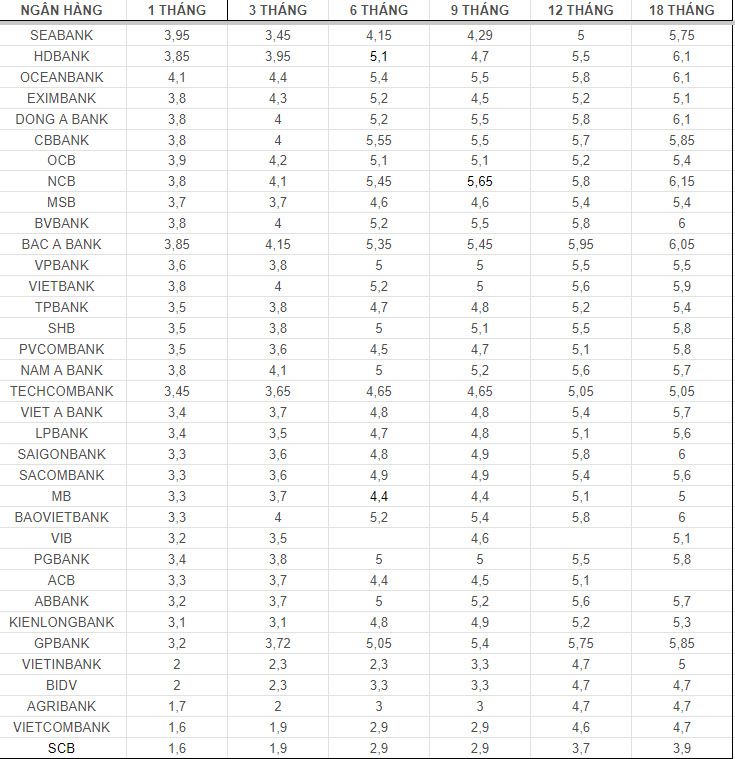

Highest Interest Rate for 1-3 month term

According to Lao Dong, at the 1-month term, the highest deposit interest rate currently belongs to OceanBank with an interest rate of 4.1%/year; second is SeABank with an interest rate of 3.95%/year, followed by OCB's interest rate of 3.85%/year.

At the 3-month term, the highest interest rate is 4.4%/year currently listed by OceanBank. The next highest interest rate is 4.3%/year currently listed by Eximbank. The rate of 4.15%/year is listed by Bac A Bank and NCB.

Highest Interest Rate for 6-9 month term

At term 6, CBBank leads with an interest rate of 5.55%/year. NCB pays interest of 5.45%/year. Next is the interest rate of 5.4%/year at OceanBank.

At the 9-month term, the highest interest rate is 5.65%/year at NCB, followed by 5.5%/year, currently listed by BVBank, Dong A Bank, OceanBank and CBBank.

Highest Interest Rate for 12-month term

At the 12-month term, the leading bank with the highest interest rate is Bac A Bank with an interest rate of 5.9%/year.

Following are BVBank, Saigonbank, NCB and OceanBank with interest rates of 5.8%/year and BaovietBank, Dong A Bank with interest rates of 5.75%/year.

Details of deposit interest rates at banks, updated on September 27, 2024