In the proposal to develop a law to amend and supplement a number of articles of the Law on Credit Institutions (CIs), the State Bank of Vietnam (SBV) proposed to legalize a number of contents of Resolution 42/2017/QH14 on bad debt handling.

One of the important changes is to allow banks to seiz collateral assets faster, in order to remove obstacles in handling bad debts.

VAMC: No right to confiscate secured assets causes great difficulties

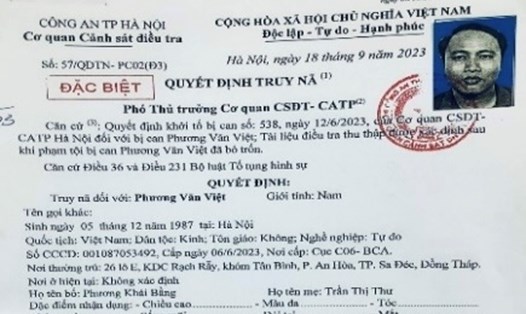

According to the Vietnam Credit institutions Asset Management Company (VAMC), from December 31, 2023, when Resolution 42/2017/QH14 expires, the regulations on the right to confiscate electronic records will no longer be effective. The 2024 Law on Credit institutions also does not legalize this content, making it impossible for banks and debt handling institutions to proactively seize mortgaged assets when customers do not cooperate.

In fact, currently, credit institutions (CIs) and VAMC that want to recover their collateral assets are required to file a lawsuit under Article 301 of the 2015 Civil Code. However, the litigation process was prolonged, overloading the litigation system and creating a sluggish and uncooperative mentality from borrowers. In addition, high legal costs including court fees, attorney fees, and enforcement fees make it more difficult to handle assets through court.

VAMC stated that not having the right to confiscate collateral assets has caused serious difficulties in the bank's debt collection. This not only affects the ability to handle bad debts, but also causes the bank's capital flow to stagnate, limiting the ability to lend new. This indirectly makes it more difficult for businesses and people to access capital, while increasing risks for the financial system.

SBV proposes legalizing the right to confiscate secured assets

According to the SBV, legalizing the right to confiscate collateral will help banks handle bad debts faster, instead of having to file lawsuits and wait for enforcement as at present.

The draft proposes to add regulations on the right to confiscate collateral if there is clear agreement in the credit contract. This helps reduce bad debt settlement time, limit prolonged disputes, thereby increase capital recovery, support banks to lower lending interest rates.

The SBV said that the lawsuit process currently takes many years, forcing banks to set up risk provisions and cannot recover capital in time. This not only increases financial costs, but also affects the access to credit of businesses and people.

In addition, the SBV emphasized that the confiscation of assets will not be done arbitrarily, but must strictly comply with legal conditions such as prior notification, disclosure of information and not violating the legitimate rights of borrowers.

This revised draft is an important step in creating a transparent legal corridor, helping banks have more effective bad debt handling tools, while creating conditions for businesses and people to access credit more easily, limiting black credit.

This proposal is still in the process of collecting opinions and needs to be considered before being officially included in the law.