The difference between buying and selling domestic gold is very high.

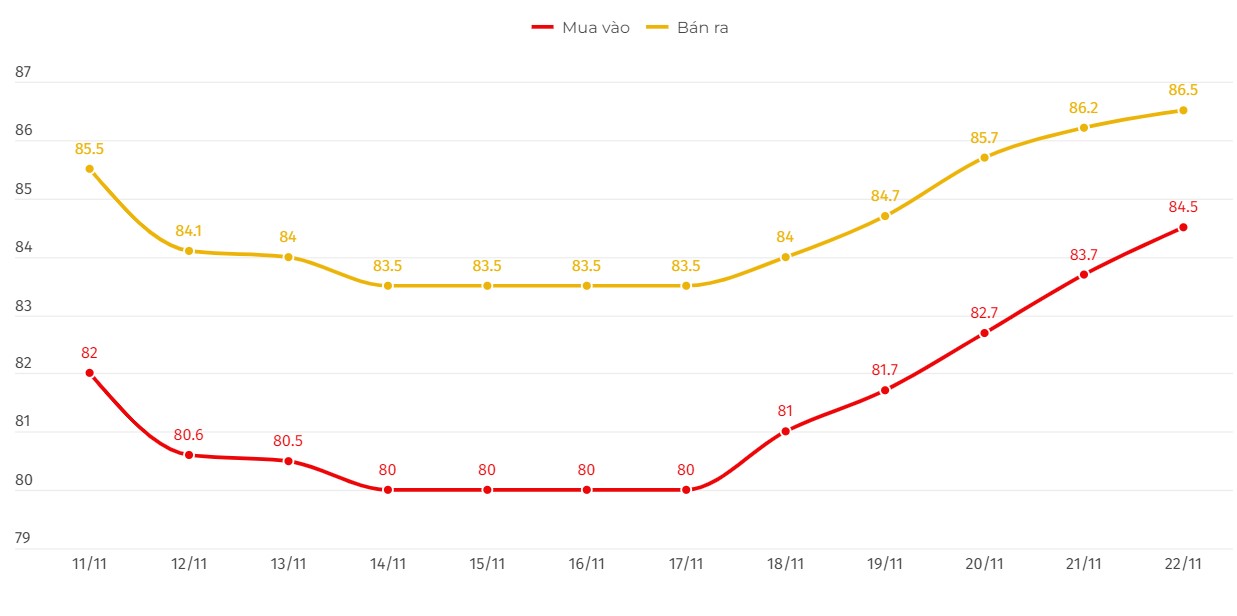

According to Lao Dong reporter on November 22, 2024, the difference between buying and selling domestic gold is anchored at a high level, especially SJC gold bars.

This morning, the price of SJC gold bars was listed by DOJI Group at 84.5-86.5 million VND/tael (buy - sell). The difference between the buying and selling price of SJC gold at DOJI Group is 2 million VND/tael.

Saigon Jewelry Company SJC listed the price of SJC gold at 84.5-86.5 million VND/tael (buy - sell). The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

At the same time, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 85-86 million VND/tael (buy - sell); the difference between buying and selling is 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 84.83-85.78 million VND/tael (buy - sell), the difference between buying and selling is 950,000 VND/tael.

It is understandable that when buying SJC gold bars at DOJI this morning, November 22, the gold price must increase by 2 million/tael for investors to break even. Therefore, the larger the difference between buying and selling gold, the higher the risk of loss for investors.

The difference is too high, what do the experts say?

Talking to Lao Dong reporter, Dr. Nguyen Tri Hieu - economic expert said that the difference between buying and selling prices of domestic gold is too high: "Normally, a difference of 300,000 - 500,000 VND/tael is a lot. Currently, most businesses push the difference to 2 - 3 million VND, sometimes up to 5 million VND/tael".

Experts explain that some of the reasons for such a difference in gold prices are that gold traders see large fluctuations in gold prices, so they buy at very low prices but sell at high prices.

"That is a backup plan to avoid gold traders being greatly affected by price fluctuations.

Whenever the world gold price fluctuates strongly, gold traders in Vietnam will increase the difference. Taking advantage of the Vietnamese people's love for gold, especially when the world gold price fluctuates, people rush to buy gold. That is also a way for gold traders to pass the risk onto consumers," said this expert.

In the face of the constantly fluctuating gold price, short-term gold investment models or speculative purchases often carry many risks. Expert Nguyen Tri Hieu recommends monitoring the world and domestic gold markets regularly; observing the difference in world and domestic gold prices, if it is too high, it will carry many risks.

Monitoring the domestic gold price with a buy-sell difference of about 500,000 VND/tael is reasonable; and the difference between domestic and world gold prices of 3 to 5 million VND is appropriate.

This expert believes that people should allocate their savings into many areas such as saving in savings books, buying stocks... if they have a lot, they should buy real estate. "Absolutely do not borrow money to invest in gold to avoid huge risks" - Dr. Nguyen Tri Hieu emphasized.

See more news related to gold prices HERE...