Two options to reduce, but keep the highest tax rate at 35%

According to current regulations in the Law on Personal Income Tax, Income from Salary and wages, the progressive tax rate is applied in installments with 7 levels, from 5% to 35%. However, the Ministry of Finance assesses that the current tax table has many limitations, notably the large number of levels and the narrow gap between tax levels, leading to the risk of "jumping levels", increasing tax obligations that are not commensurate with increased income.

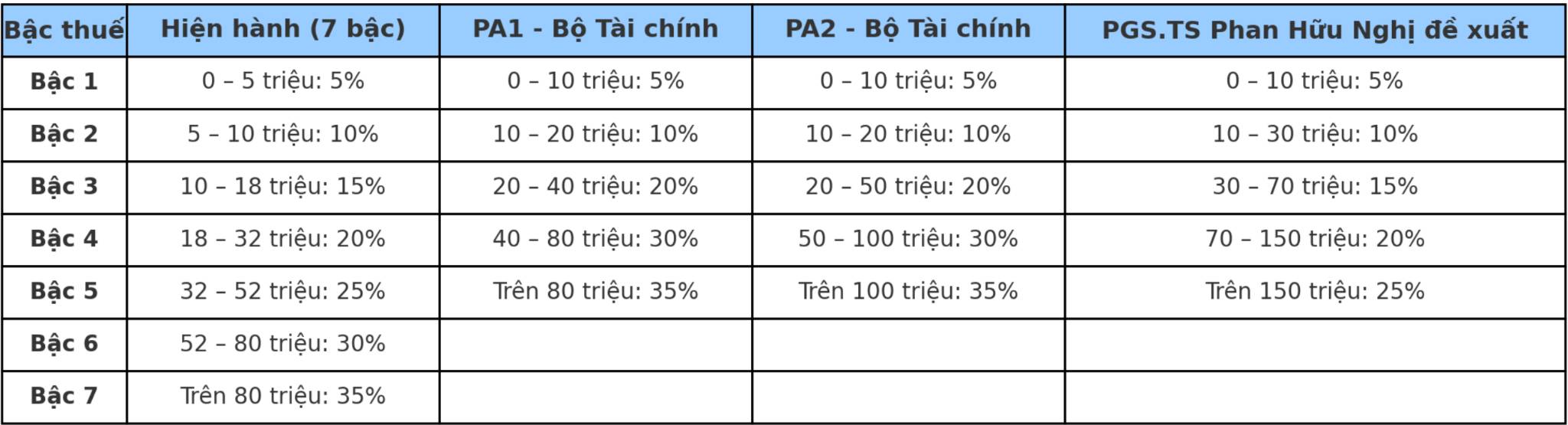

In the Draft Law on Personal Income Tax (replacement), the Ministry of Finance proposed to shorten the tax table to 5 levels with two options, in the direction of extending the tax calculation income levels more reasonably.

Option 1: Income over 80 million VND/month is subject to a tax rate of 35%.

Option 2: The tax rate of 35% is increased with an income of over 100 million VND/month.

Both options keep the starting tax rate at 5% for taxable income up to 10 million VND/month. The Ministry of Finance said that option 1 helps balance the budget better, while option 2 is more beneficial for people with high incomes (from 50 million VND/month or more).

Experts propose the highest tax rate should be only 25%

Speaking with Lao Dong, Associate Professor, Dr. Phan Huu Nghi - Deputy Director of the Institute of Banking and Finance, National Economics University - said that streamlining the tax table to 5 levels is a reasonable direction, in line with international practices and current tax reform requirements.

However, he said that both options proposed by the Ministry of Finance are unreasonable in terms of tax rate structure. "About the 10% and 20% tax rates - which are two important levels in the progressive system, but keeping the highest tax rate at 35%, will create a huge tax slump between the mid and high levels," he said.

According to Mr. Nghi, the highest tax rate should be adjusted to 25% to better suit income practices and ensure fairness - efficiency in tax regulation. The progressive tax system needs to comply with the principle of a certain extension coefficient, while creating motivation to work for high-income people.

He proposed to declare the tax as follows:

Level 1: From 0 - 10 million VND/month - 5%

Level 2: From 10 - 30 million VND/month - 10%

Step 3: From 30 - 70 million VND/month - 15%

Step 4: From 70 - 150 million VND/month - 20%

Level 5: Over 150 million VND/month - 25%

Comparison table of current accumulated tax tables, 2 proposed options of the Ministry of Finance and expert's proposal:

According to Associate Professor, Dr. Phan Huu Nghi, the progressive tax table has inherently ensured vertical fairness, but if not designed properly, it will lose motivation for labor, especially in the context of a rapid increase in average income.

"Income increases by 30%, but if the range is not extended and the tax rate is adjusted accordingly, workers will suffer the loss. In the long term, this affects the mentality of dedication and transparency in tax declaration, he said.

From a policy perspective, he believes that tax declaration is not only for budget collection but also a tool to guide behavior. Therefore, the design of tax plans needs to harmonize the requirements of fairness, transparency and encourage economic development.

It should be noted that groups with stable high incomes

Meanwhile, Mr. Nguyen Quang Huy - CEO of the Faculty of Finance - Banking, Nguyen Trai University, said that reducing the number of tax rates but still maintaining the highest tax rate of 35% can increase pressure on people with stable high incomes, while creating a "tax flight" effect if not accompanied by policies to encourage investment or reduce corresponding deductions.

Mr. Huy commented that option 1 (taxes 35% from income over 80 million VND/month) can easily cause "tax shock" for high-level workers in FDI, technology, and financial enterprises - sectors competing for human resources in the region. Meanwhile, option 2 with a tax rate of 35% from 100 million VND or more is more reasonable, reflecting the true nature of "very high" income and avoiding the situation of progressive taxation too early.

Mr. Huy proposed: Choose option 2 to keep a competitive environment in terms of human resources and attract talented people, while ensuring the principle of fairness. Maintain a 5-level tax rate table but extend the gap between levels, especially between levels 3 and 4. Combine personal income tax reform with high-end asset and consumption tax policies to regulate the rich without eliminating labor incentives.