Canned food market grows rapidly

Vietnam's canned food market is entering a period of strong growth, accompanied by urbanization and changes in consumer habits.

According to the Vietnam Canned Food Market Report released by BlueWeave Consulting in May 2025, the market size in 2024 is estimated at 365.16 million USD. For the period 2025-2031, the market is forecast to grow on average 11.7% per year, reaching about 792.24 million USD in 2031.

The market is divided according to many criteria. By packaging, products include metal cans, glass jars, plastic bags and other types of packaging. By type, the market includes segments such as canned meat, canned seafood, canned fruits and vegetables, canned processed food and other products such as soup and canned beans.

In these segments, canned meat is the product group that is consumed the most thanks to its convenience, rich in protein and suitable for busy life. Long shelf life, not requiring complex cold storage continues to be an advantage of canned foods.

BlueWeave Consulting assesses that the main drivers of the market include urbanization, lifestyle changes, and increased disposable income. High economic growth in recent years has expanded consumer spending and demand for convenience food. In addition, imported canned food from Thailand, Indonesia, and the United States has increased, contributing to increasing market consumption.

However, the market also faces significant pressure from health concerns. Consumers are increasingly cautious about preservatives, high sodium content and artificial additives, thereby promoting the trend of prioritizing fresh, organic or minimally processed foods. Faced with this reality, manufacturers are encouraged to innovate products in a healthier direction, reduce additives and meet new consumer tastes.

Ha Long boxed goods leads the metal boxed goods segment

Considering distribution channels, the Vietnamese canned food market is divided into groups including supermarkets, hypermarkets, convenience stores, specialized stores, online retail and other channels.

Large enterprises participating in the market include: Vissan, CJ Cau Tre (CJ Foods Vietnam), Ha Long Canned Food, Seaspimex, KTC Food, Vifon, Hagimex, Annie’s Farm, F&G Food Vietnam, Gralimexx and KSD Interfoods Vietnam.

For many large food corporations such as Vissan, Masan, CJ Foods or Greenfeed, canned food is just a segment in the product ecosystem, mainly focused on meat and processed meat products.

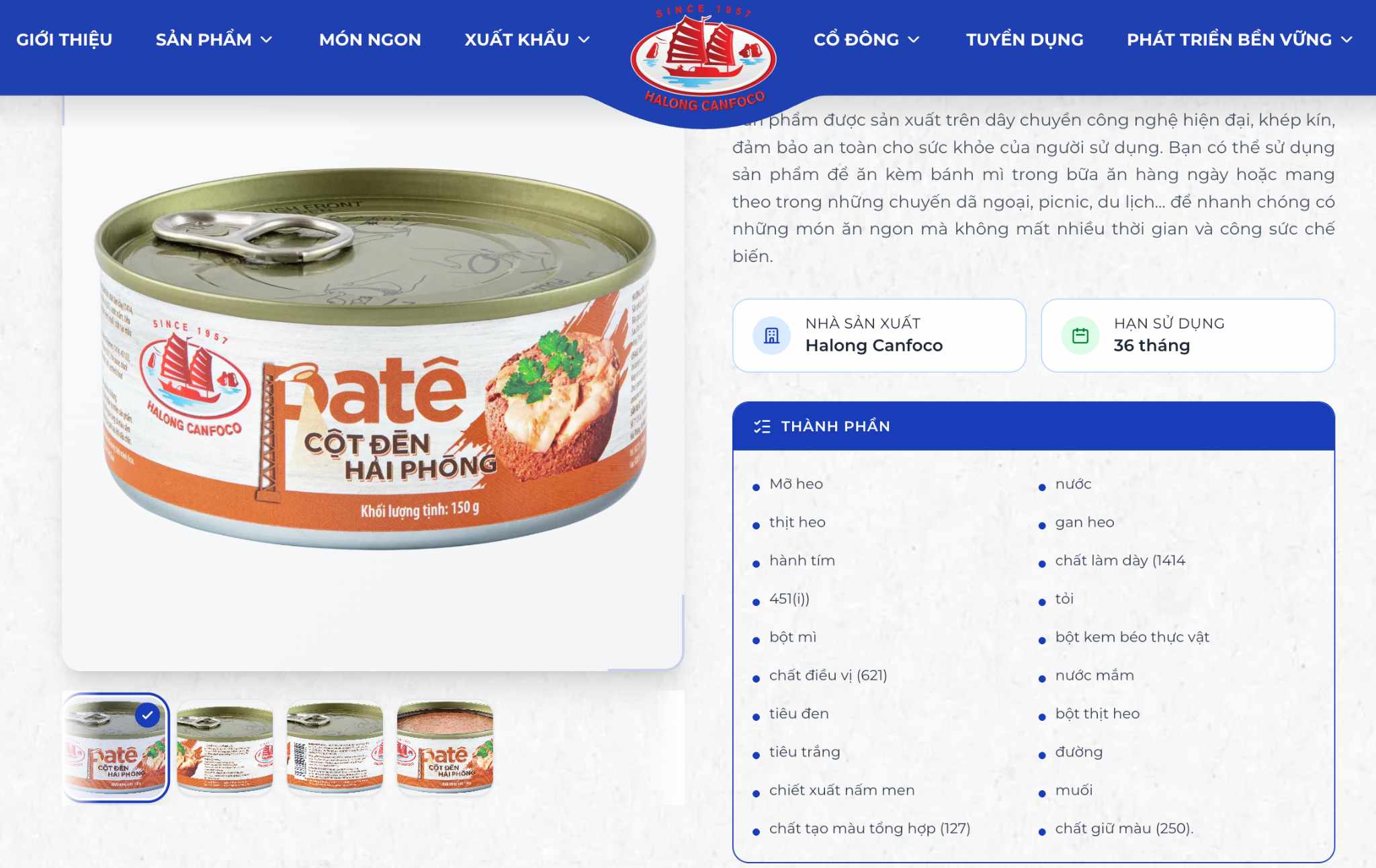

Especially in the metal box segment, Ha Long Boxes attracted much attention with the leading market scale. The enterprise is one of the few domestic units producing both salty boxes from meat, seafood and sweet boxes from fruits and agricultural products such as fabric and lotus seeds. The product portfolio covers both daily consumption needs and gift and processed food segments.

According to the introduction, Ha Long Canned Food currently has more than 37 products, a high level compared to the general market level. Recently, the business has promoted the development of processed food lines, used directly under the Expect brand such as black pepper ribs, black pepper beef steak, smoked tuna pate, sweet and sour stir-fried ribs. This is a product group considered one of the notable growth trends of the canned food market.

Hai Phong Lamp Pole Pathe achieves revenue of 21 billion VND on e-commerce platforms

In Ha Long Canned Food's product portfolio, Pate Cot Den Hai Phong is a brand that creates a clear mark in the market. According to Metric's report, in 2025, Vietnamese consumers spent about 21 billion VND to buy more than 217.9 thousand Pate Cot Den products on 4 major e-commerce platforms including Shopee, TikTok Shop, Lazada and Tiki.

The entire market recorded 64 booths doing business in this product line, with a total of 226 products generating sales in the analysis period. TikTok Shop is the leading platform in terms of sales, reaching VND 14.3 billion. Shopee ranked second with sales of VND 6.3 billion, accounting for 30.1% market share.

Regarding business results, in 2025, Ha Long Canned Food recorded net revenue of 170 billion VND, down 14% compared to the same period. The cost of goods sold decreased more sharply than the revenue decrease, helping gross profit reach 43 billion VND, up 13%. After deducting expenses, after-tax profit reached 7.6 billion VND, nearly 4 times higher than the same period.

Accumulated for the first 9 months of 2025, enterprise revenue reached 471 billion VND, down nearly 11%. In the context of revenue decline, cost control helped after-tax profit reach 11.4 billion VND, a clear improvement compared to the loss of 6 billion VND in the same period last year.