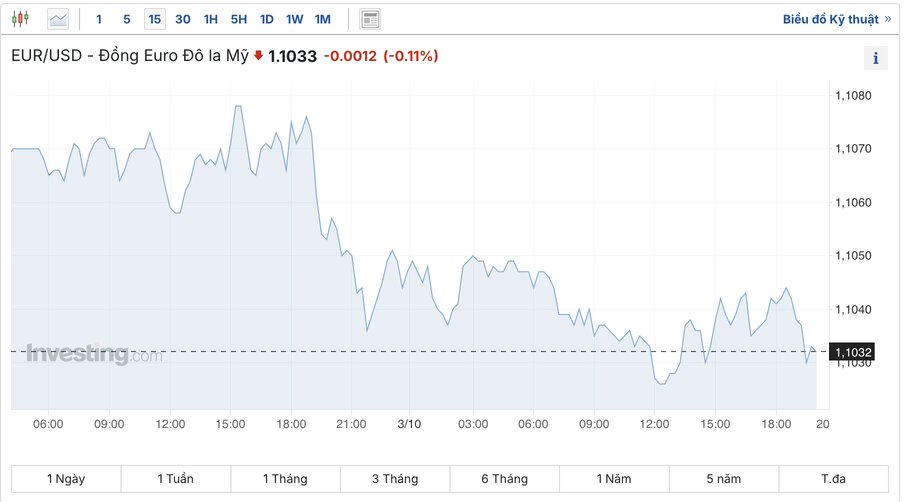

The euro fell on Thursday, after retreating from a 14-month high reached last week, Reuters reported on October 3.

Traders have since raised odds that the European Central Bank (ECB) will cut interest rates this month to around 90% as slowing inflation and worsening business sentiment prompt central bank officials to back easing.

Markets are speculating that the ECB will lag the US Federal Reserve in cutting interest rates. Strong US jobs data this week has also dampened bets on another half-point cut by the Fed. Markets are also waiting for key US payrolls data due next Friday.

"The combination of the Fed not rushing to ease and strong market expectations that the ECB could cut interest rates later this month continues to put pressure on the euro-dollar pair," currency strategists at UniCredit SpA including Roberto Mialich wrote in a note.

The Euro has fallen more than 1% against the US Dollar so far this week and is approaching key technical support at $1.1028.

If the euro breaks above that level, more losses would appear, challenging the forecast of strategists in a Bloomberg poll that the currency will end the year at $1.11.

The last time the euro suffered such a loss was in April, also as traders pushed back expectations for a Fed rate cut. Money markets now expect the Fed to cut by about 180 basis points and the ECB to cut by about 170 basis points by the end of 2025, a much narrower gap than expected two weeks ago.

EUR/VND exchange rate at commercial banks today: