According to information from the Ministry of Finance, the Draft Law on Personal Income Tax (amended) has been submitted by the Government to the National Assembly in Submissions No. 844/TTr-CP dated September 29, 2025 and Submission No. 985/TTr-CP dated October 24, 2025.

Based on the reviewed opinions of the National Assembly's Economic and Financial Committee, the opinions of the Delegates discussed in the Group on the afternoon of November 5, 2025 and in the Hall on the afternoon of November 19, 2025, the drafting agency organized research to absorb, revise and submit to the Government a report on the plan to complete the draft Law with many notable contents.

Individuals without dependents pay taxes from the income of 17 million VND/month

On October 17, 2025, the National Assembly Standing Committee passed a Resolution on adjusting the family deduction of personal income tax (PIT), accordingly, raising the family deduction for taxpayers to 15.5 million VND/month, for each dependent to 6.2 million VND/month.

According to the goal of this new family deduction, individuals only have to pay taxes with an income of 17 million VND/month (if there are no dependents) or 24 million VND/month (if there are 01 dependents) or 31 million VND/month (if there are 02 dependents).

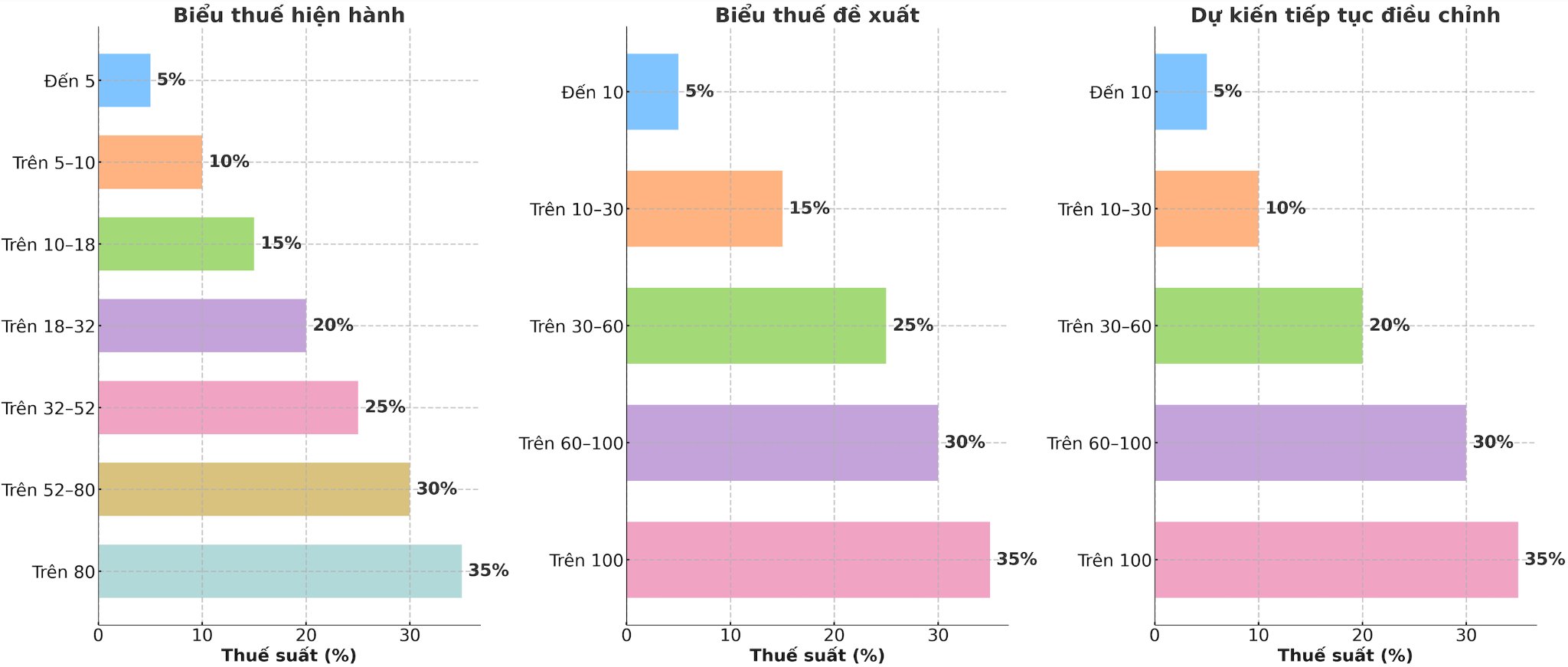

Reducing tax rates at all levels in the progressive tax table

The Government has proposed and reported to the National Assembly in the draft Law on adjusting the progressive tax system in part to apply to residential individuals with income from salaries and wages in the direction of reducing the number of tax rates from 7 levels to 5 levels and expanding the gap between levels.

Based on the opinions of National Assembly deputies, the drafting agency plans to report to the Government to complete the Southern Progressive Tax Plan in part in the direction of being able to study and consider the option of adjusting the tax rate down to 15%, 25% to 10%, 20% to unify the tax rates of the Tax Plan.

With this new tax rate, all individuals who are paying taxes with income at the current levels will have their tax obligations reduced compared to the current tax rate. In addition, the new tax table has also overcome the sudden increase of some levels (level 2, level 3) as proposed in the previous draft Law, ensuring the more reasonable nature of the tax table.

Regarding tax-exempt income, tax reduction

The draft Law adds a number of provisions on tax exemption and reduction of personal income tax to institutionalize the Party's guidelines and policies and the State's laws in the documents of Resolution No. 46, Resolution No. 71, Resolution No. 72 and Resolution No. 68 of the Politburo and a number of recently issued Laws.

Amend and complete regulations for some tax-exempt income, such as: Income paid by the supplementary pension insurance fund, voluntary pension fund, overtime pay, pay for days of actual work, severance pay, unemployment benefits paid by enterprises, interest on local government bonds...

Supplementing regulations that taxpayers are allowed to deduct some expenses during the year at a suitable level for medical and educational expenses before calculating taxes and assigning the Government to specify in detail to ensure flexibility and suitability with the socio-economic situation.

Proposed adjustment of tax calculation method for business households

According to the current Law on personal income tax, the revenue not subject to personal income tax is 100 million VND/year or less, this level is being applied uniformly to value added tax (VAT) of business households and individuals, and is 100 million VND/year for business households not subject to VAT.

On November 26, 2024, the National Assembly passed Law on VAT No. 48/2024/QH15, accordingly, adjusted this level, raising it from VND 100 million/year to VND 200 million/year and applying it from January 1, 2026. To ensure consistency in the legal system, the Government has submitted to the National Assembly to adjust the annual non-taxable revenue of business individuals to 200 million VND/year.

Based on listening to the opinions of the delegates, the Ministry of Finance said that it will continue to study and adjust this level to be appropriate, ensuring relatively fairness for individuals with income from salaries and wages and plans to amend the Law on Value Added Tax to increase the revenue level not having to pay VAT to ensure similarity.

Currently, the Ministry of Finance plans to report to the Government on the plan to adjust the non-taxable revenue level of business individuals to ensure compliance with the actual situation, demonstrating the State's sharing with households and individuals with revenue of VND3 billion or less, towards the goal of social security.

In addition, the Ministry of Finance will continue to study the tax calculation method for households and individuals with revenue of 3 billion or less as follows:

To ensure consistency and accurate representation of the nature of income tax, the Ministry of Finance plans to report to the Government on the plan to collect tax on income (revenue - cost) for all individuals with revenue according to the new revenue threshold. The plan is expected to add a provision: Individuals with a tax rate above the non-taxable threshold of up to VND 3 billion will be paid with the tax rate corresponding to the corporate income tax applied to enterprises with a revenue of VND 03 billion or more.

In case a business individual has a revenue of less than VND 3 billion, if the cost cannot be determined, they will continue to pay tax according to the current revenue rate (with tax rates of 0.5%, 1%, 2% depending on the industry) and these households and individuals will be deducted according to the tax-free threshold before calculating tax, not including tax from the first total revenue as currently prescribed.