Gold prices are under adjustment pressure after a series of positive US jobs data reduced expectations that the US Federal Reserve (Fed) would soon begin an interest rate cut cycle.

The precious metal at one point lost up to 0.6% on Thursday, although it had previously increased by 1.2%. The report shows that the US non-farm payroll recorded the strongest increase in more than a year, while the unemployment rate unexpectedly decreased in January. This development shows that the US labor market continues to maintain a stable state since the beginning of 2026.

After the above figures, traders have adjusted their monetary policy expectations. Instead of forecasting the Fed to cut interest rates in June, the market is currently leaning towards the possibility that the first cut may be postponed to July, meaning that high interest rates will be maintained longer than expected. In the context that gold is a non-rotating asset, the prospect of delaying monetary easing has put pressure on the price of precious metals.

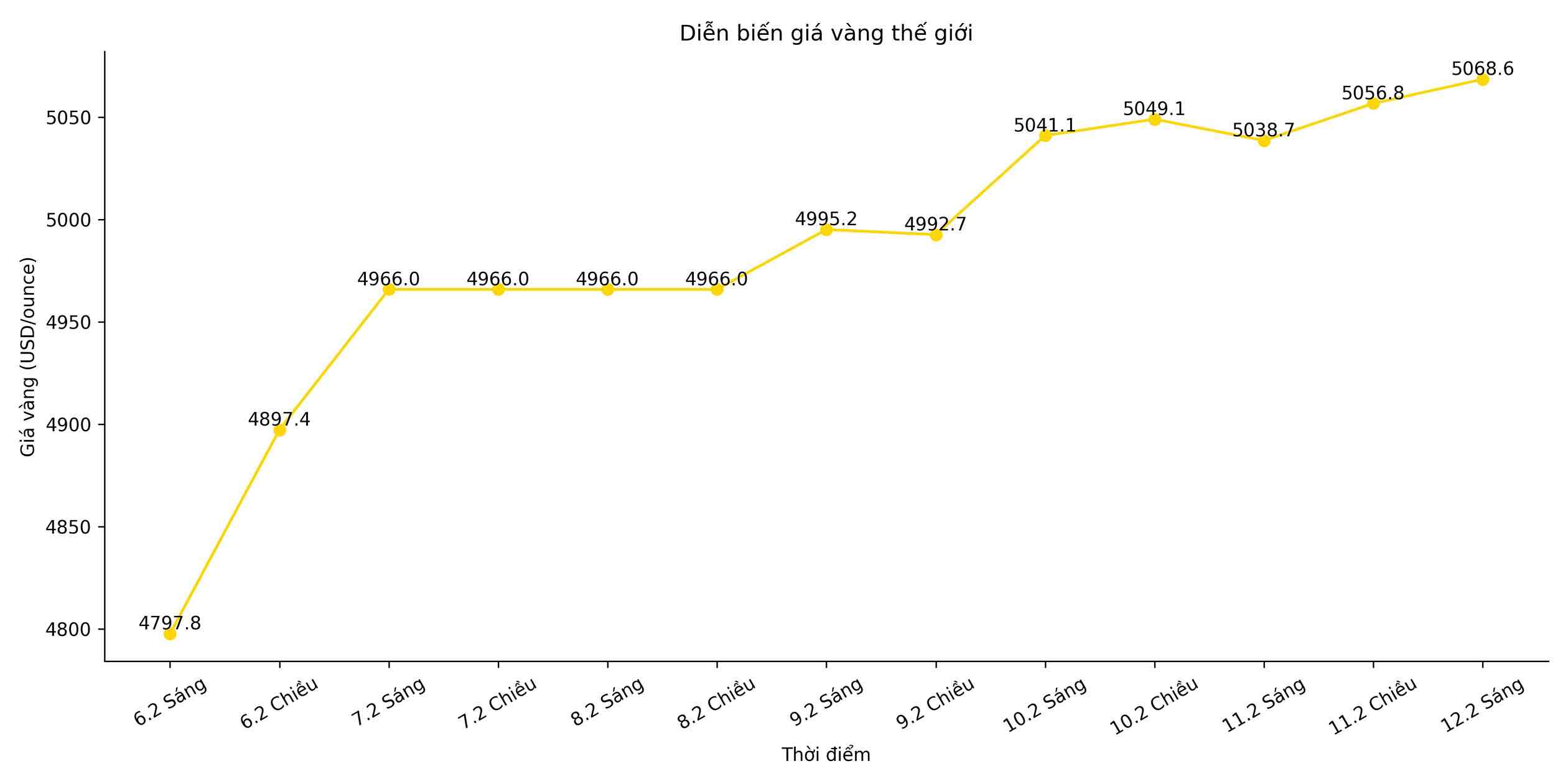

However, gold still maintained the 5,000 USD/ounce mark and has recovered about half of the decline after a historic sell-off at the beginning of the month. Previously, the price had set a new record above 5,595 USD/ounce at the end of January, but a strong speculative wave made the upward momentum too hot, leading to a sharp drop of about 13% in just two sessions.

Many international banks still maintain an optimistic view of the medium and long-term trend. Factors that previously boosted the upward momentum – including geopolitical tensions, controversy over the Fed's independence and a shift away from traditional assets such as currency and government bonds – remain unchanged. BNP Paribas SA forecasts gold could reach $6,000 by the end of the year, while Deutsche Bank AG and Goldman Sachs Group Inc. also offer positive scenarios for the precious metal.

In this morning's trading session, spot gold prices fell 0.4% to 5,068.62 USD/ounce. Silver lost 0.8% to 83.60 USD/ounce; platinum fell 1% and palladium retreated 1.5%. The Bloomberg Dollar Spot index – a measure of the strength of the USD – went sideways after falling 0.1% in the previous session.