The gold market continues to show signs of stability when maintaining an increase above the 5,000 USD/ounce mark. Meanwhile, disappointing consumer data showing that US consumers spent less in December may stimulate safe-haven demand, according to some analysts.

US retail sales remained almost unchanged in the last month of 2025, according to a US Department of Commerce announcement on Tuesday. This consumer data was weaker than forecast, as economists previously expected an increase of 0.4%.

In the past 12 months, retail sales increased by 2.4%, according to the report.

Core sales - excluding vehicle purchases - also remained unchanged in December, after increasing by 0.4% (adjusted) in November. This core figure was also lower than expected, with a consensus forecast for a 0.3% increase.

Meanwhile, the control group - excluding sales from car dealerships, building material stores, gas stations and stationery stores, and also a direct component of US GDP - decreased by 0.1%, not reaching the expected increase of 0.4%.

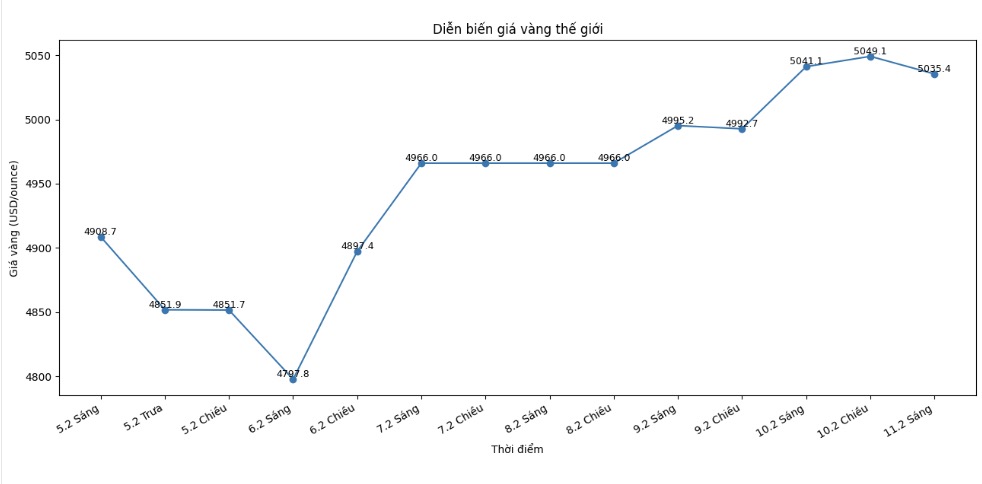

Neils Christensen - Kitco News analyst - said that the gold market has not yet recorded a significant response to these unfavorable economic data. Spot gold price at 0:30 am (Vietnam time) was listed around 5,035.4 USD/ounce; down 23 USD compared to the previous day.

However, some analysts believe that weak consumer data may affect interest rate expectations, as the US labor market begins to show signs of cooling down.

Regarding technical analysis, Jim Wyckoff - senior analyst at Kitco - predicts that gold prices will "slightly decrease or move sideways". Gold futures for April delivery are in a state of stalemate, as both buyers and sellers are focusing their attention on important price levels.

Accordingly, the buying side sets the next target to pull the closing price beyond the strong resistance zone at 5,250.00 USD/ounce. If this milestone is conquered, the upward trend of the market will be consolidated more clearly.

In the opposite direction, sellers are trying to put pressure to push gold prices down below the important technical support zone at the February bottom, at 4,423.20 USD/ounce.

In the short term, the notable resistance levels of the market are at 5,113.9 USD/ounce - the peak of last week, followed by the psychological level of 5,200 USD/ounce. On the support side, the lowest level of this week at 4,988.6 USD/ounce is playing the role of the nearest support level, before the price may retreat to the next support level at 4,900 USD/ounce.

The market rating index according to the Wyckoff method is currently at 6.5, showing that the buying side is holding a certain advantage in the market, the upward trend is still dominant, but not strong enough to completely overwhelm the selling side. This means that gold prices may still have short-term corrections, especially when approaching important resistance zones.