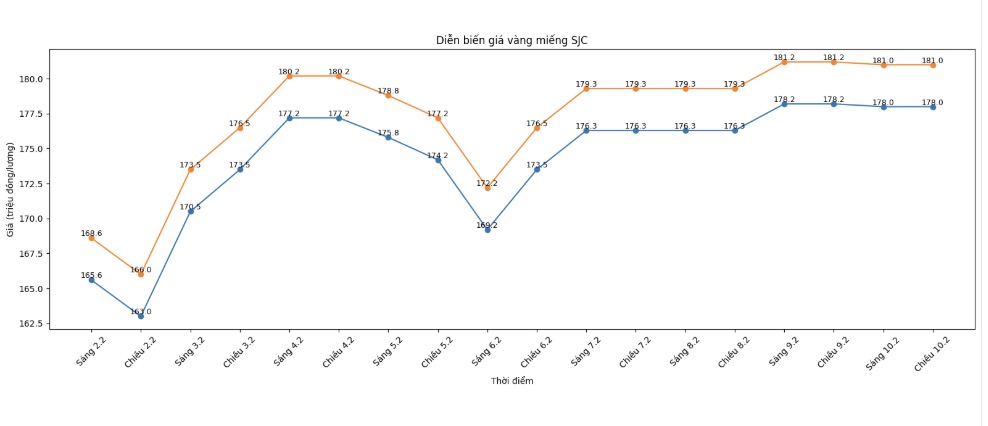

SJC gold bar price

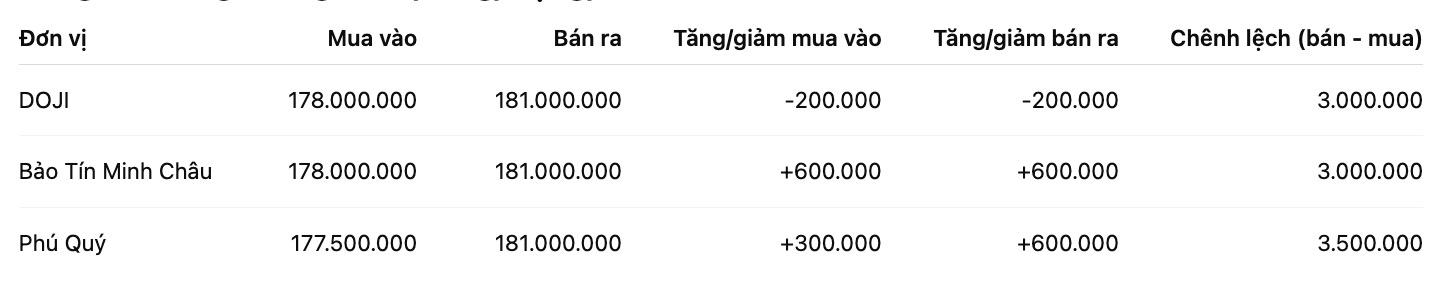

As of 5:30 PM, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), down 200,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at 178-181 million VND/tael (buying - selling); an increase of 600,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Phu Quy Gold and Gems Group at the threshold of 177.5-181 million VND/tael (buying - selling); an increase of 300,000 VND/tael on the buying side and an increase of 600,000 VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3.5 million VND/tael.

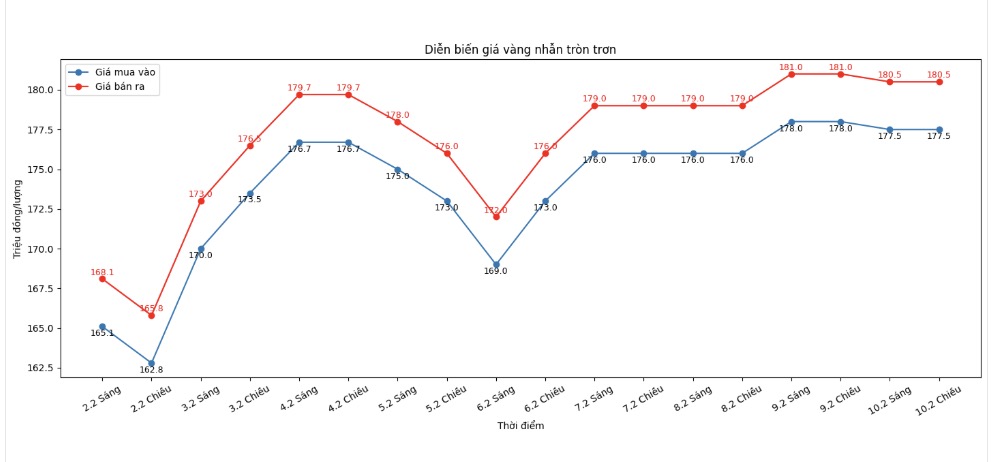

9999 gold ring price

As of 5:30 PM, DOJI Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling); down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 177.6-80.6 million VND/tael (buying - selling, an increase of 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), an increase of 700,000 VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

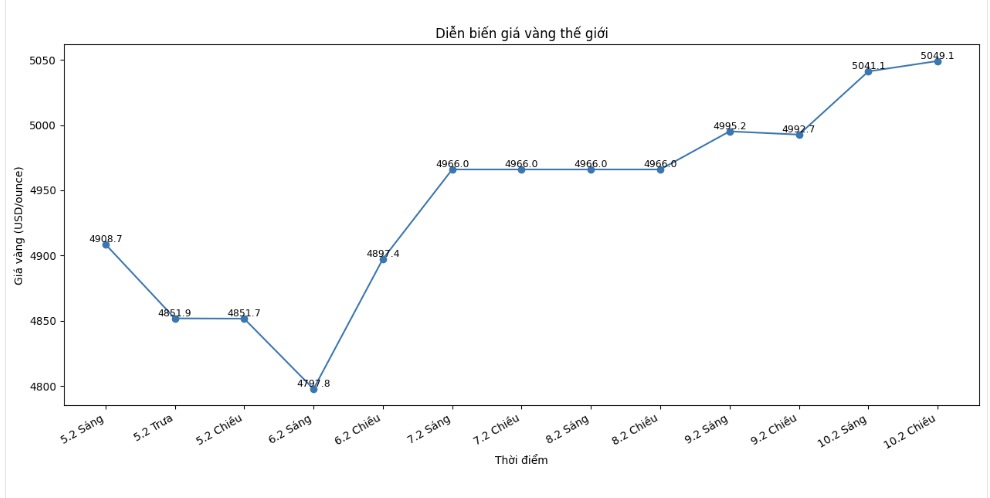

World gold price

At 5:30 PM, world gold prices were listed around the threshold of 5,049.1 USD/ounce; up 56.4 USD compared to the previous day.

Gold price forecast

World gold prices are entering a period of strong fluctuations rarely seen in recent years, as traditional supporting factors gradually give way to speculative cash flow and increasingly clearly influenced by the digital asset market.

Instead of operating as a safe haven channel, gold is showing the characteristics of an asset with a higher risk level, forcing investors to be more cautious in holding strategies.

According to Heraeus's assessment, the recent strong correction is an inevitable consequence of the prolonged hot period of increase before that. In a decade, gold prices have increased many times, while the strength of the USD has hardly changed significantly. When prices reversed sharply, the wave of closing positions using leverage along with exchanges raising margin requirements has amplified the fluctuation range of this precious metal.

The possibility of gold setting new price peaks in the short term is not high, because the market needs more time to absorb the excitement that has been pushed up too much in the past time" - experts at Heraeus commented, while saying that the support zone around 4,400 USD/ounce is likely to continue to be tested.

In the opposite direction, long-term investment demand is still an important supporting factor for the gold market. The World Gold Council report shows that total global gold demand is still maintained at a high level, with significant buying power from central banks and institutional investors, although it has cooled down compared to the previous year.

Notably, a new factor contributing to increasing gold price fluctuations is the digital gold wave. The fact that stablecoin issuing organizations are increasing physical gold hoarding has created a large source of demand, directly competing with traditional ETF funds.

Mr. Fahad Tariq - Senior Vice President at Jefferies - said that Tether has now become one of the non-sovereign organizations holding the largest amount of gold in the world, thereby potentially having a significant impact on market developments in sensitive times.

In that context, investors need to prepare psychologically for the strong ups and downs of gold prices in the coming time, especially when the market is still dominated by inflation data, US jobs and expectations of monetary policy adjustments from the US Federal Reserve.

Notable economic calendar of the week

US Retail Sales.

US non-farm payroll.

US Weekly Unemployment Benefit Application; Current House Sales in the US.

US Consumer Price Index (CPI).

Gold price data is compared to the previous day.

See more news related to gold prices HERE...