World gold prices turned down after two increasing sessions, as investors took profits in the context that the market is still volatile and has not found a stable bottom after a historic sell-off.

In the first trading session of the day, gold prices at one point fell by 1.4%, falling below the 5,000 USD/ounce mark, before narrowing the decline. Compared to the historical peak set on January 29, this precious metal has lost about 10%, but still maintains a significant increase since the beginning of the year.

The precious metals market plummeted at the end of January, when the speculative wave pushed prices to overheating levels. However, many fundamental factors that once supported the long-term upward momentum of gold remain, including increased geopolitical risks, central bank buying activity and the trend of avoiding government bonds as well as legal tenders.

Many large banks and asset management organizations, including Deutsche Bank AG and Goldman Sachs Group Inc., still maintain a positive view of gold, saying that long-term demand will help this precious metal recover. Notably, the Central Bank of China extended its gold buying streak to the 15th consecutive month in January, showing that official demand is still persistent.

In the coming days, investors will closely monitor a series of US economic data to find more signals about the policy direction of the US Federal Reserve (Fed), after President Donald Trump nominated Mr. Kevin Warsh for the position of President of the US Central Bank. The January jobs report, expected to be released on Wednesday, is expected to show that the labor market is gradually stabilizing, while inflation data will be released on Friday.

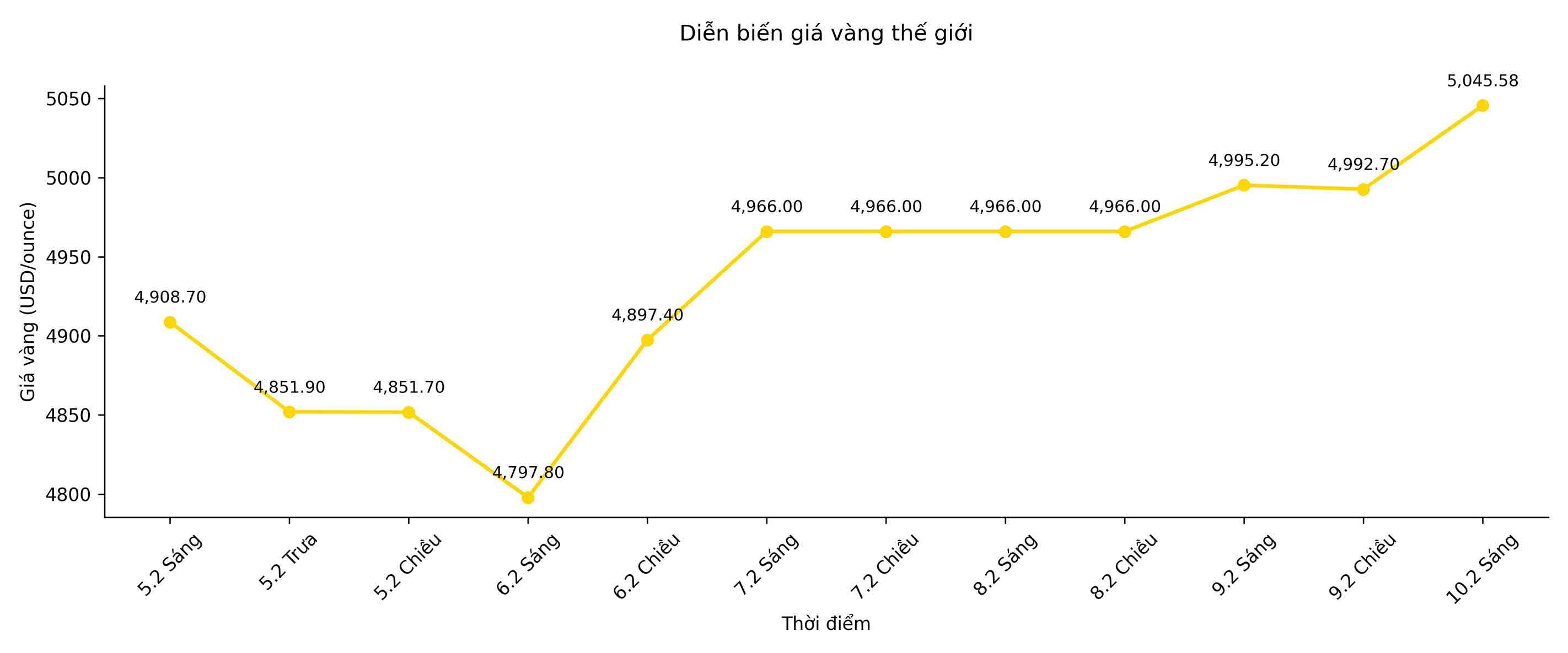

In this morning's trading session, spot gold prices fell 0.5%, to 5,045.58 USD/ounce. Silver prices lost 1.8%, to 81.92 USD/ounce; platinum and palladium also simultaneously went down. Meanwhile, the Bloomberg Dollar Spot Index increased by 0.1%, after falling 0.6% in the previous session.