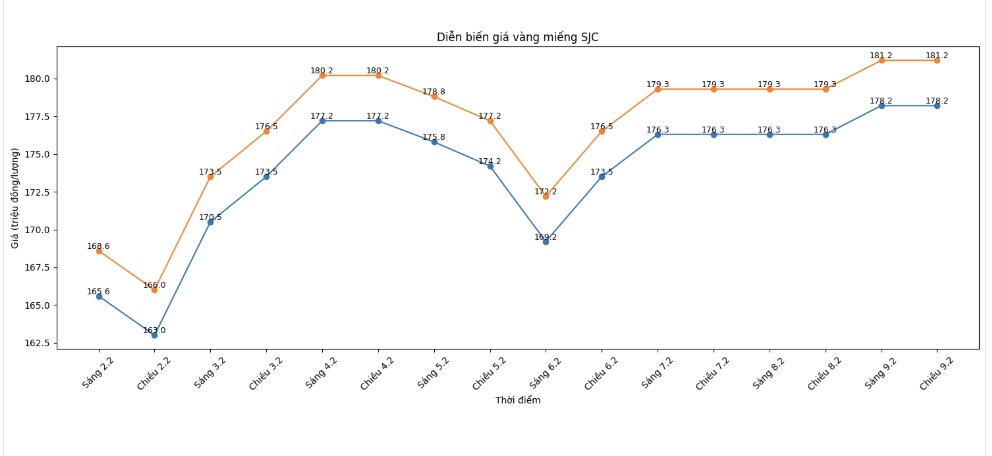

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 178.2-181.2 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Phu Quy Gold and Gems Group at the threshold of 177.2-180.4 million VND/tael (buying - selling); an increase of 900,000 VND/tael on the buying side and an increase of 1.1 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3.2 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at the threshold of 177,4-140.4 million VND/tael (buying - selling); an increase of 1.1 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

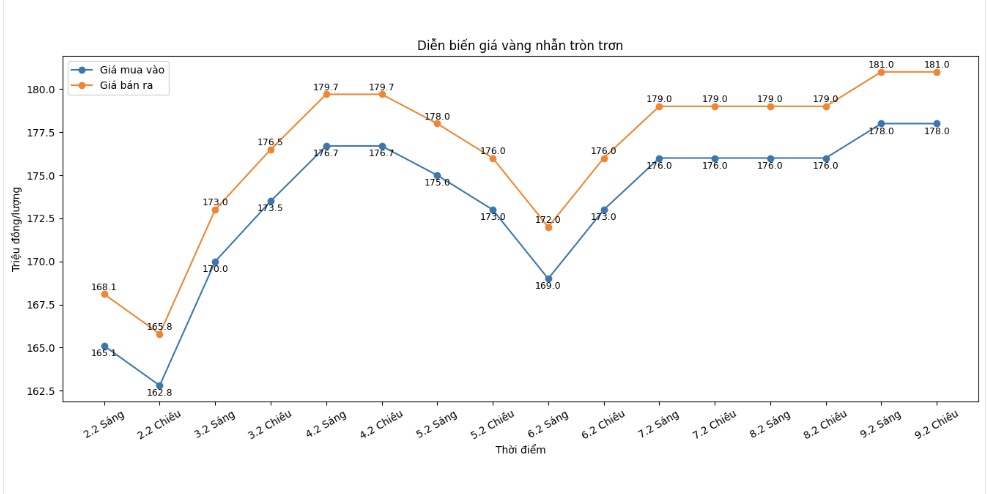

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 178-181 million VND/tael (buying - selling); an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 176.9-179.9 million VND/tael (buying - selling), an increase of 600,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 176.8-179.8 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

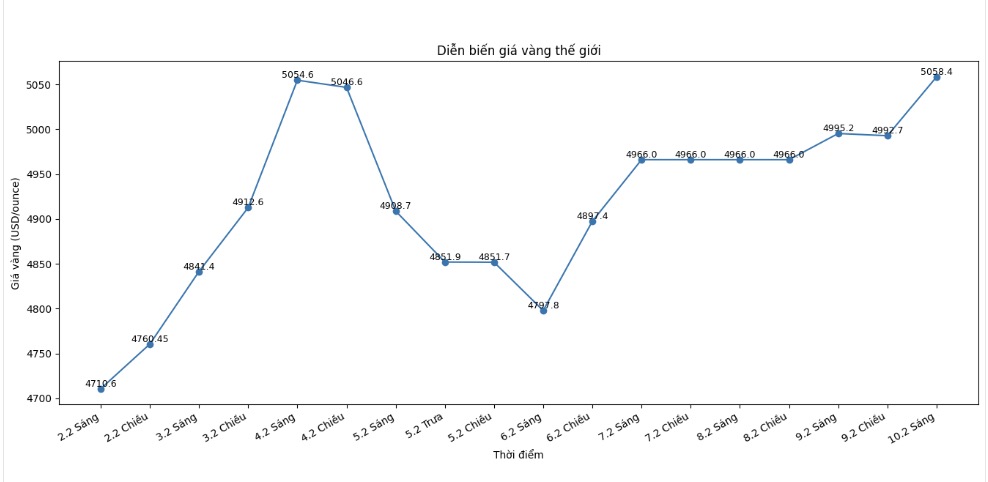

World gold price

At 5:30 AM, world gold prices were listed around the threshold of 5,058.4 USD/ounce; up 92.4 USD compared to the previous day.

Gold price forecast

Gold and silver prices rose sharply as the precious metals market recorded increased safe-haven demand amidst unpredictable fluctuations in the global economy and finance. In addition, the USD index weakened significantly along with crude oil prices rising in today's session, also contributing to supporting the prices of the two precious metals.

According to US financial officials, active trading in some Asian markets is a factor contributing to strong fluctuations in gold prices recently. Some risk management measures, including tightening margin requirements, have been applied to limit excessive speculation. This development shows that the gold market is heavily influenced by short-term speculative cash flows.

Previously, the strong increase in precious metals was driven by speculative buying and concerns related to global economic prospects, but quickly stalled at the end of January.

Meanwhile, the US Commodity Futures Trading Commission (CFTC) said that fund managers have significantly cut down on positions betting on gold prices to rise, bringing net holdings to their lowest level since October. This move comes after gold prices recorded their sharpest drop in more than a decade.

Hedge funds and major investors reduced 23% of net buying contracts, to 93,438 contracts in the week ending February 3. According to published data, this is the lowest level in 15 weeks.

This week, the market paid special attention to important US economic data, including the jobs report released on Wednesday and the consumer price index (CPI) expected to be released on Friday. These two reports appeared quite close together on the release schedule due to some earlier time adjustments.

Bloomberg believes this job report will be more important than usual, as in addition to monthly job data and unemployment rates, the January report also includes an annual adjustment of the number of jobs. This update is expected to show a downward adjustment to job growth in the recent period.

According to forecasts by economists, the US economy may create about 69,000 jobs in January, while the unemployment rate is forecast to remain at 4.4%, near the highest level in four years.

Regarding CPI data, analysts will look for further signals that inflation is continuing its cooling trend. Forecasts show that core inflation – excluding food and energy – may record the lowest growth rate since the beginning of 2021.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...