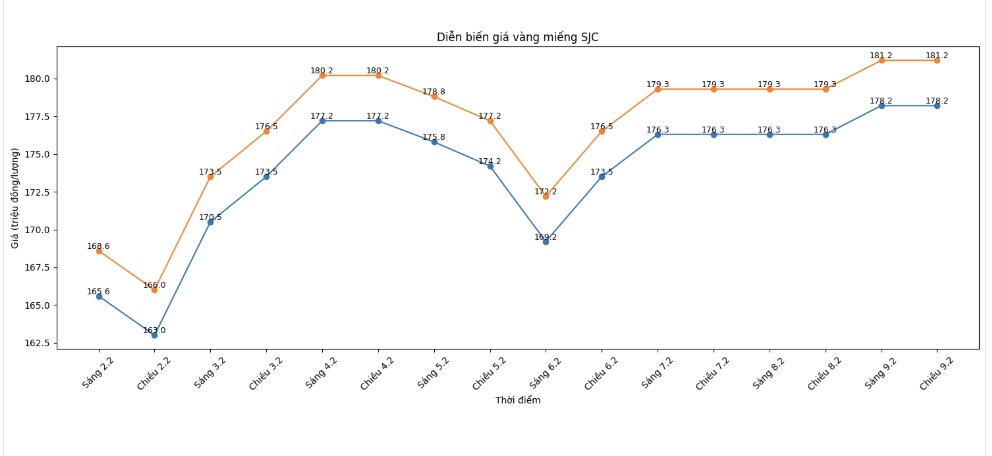

SJC gold bar price

As of 6:10 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 178.2-181.2 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Phu Quy Gold and Gems Group at the threshold of 177.2-180.4 million VND/tael (buying - selling); an increase of 900,000 VND/tael on the buying side and an increase of 1.1 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3.2 million VND/tael.

Bao Tin Minh Chau listed SJC gold bar prices at the threshold of 177,4-140.4 million VND/tael (buying - selling); an increase of 1.1 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

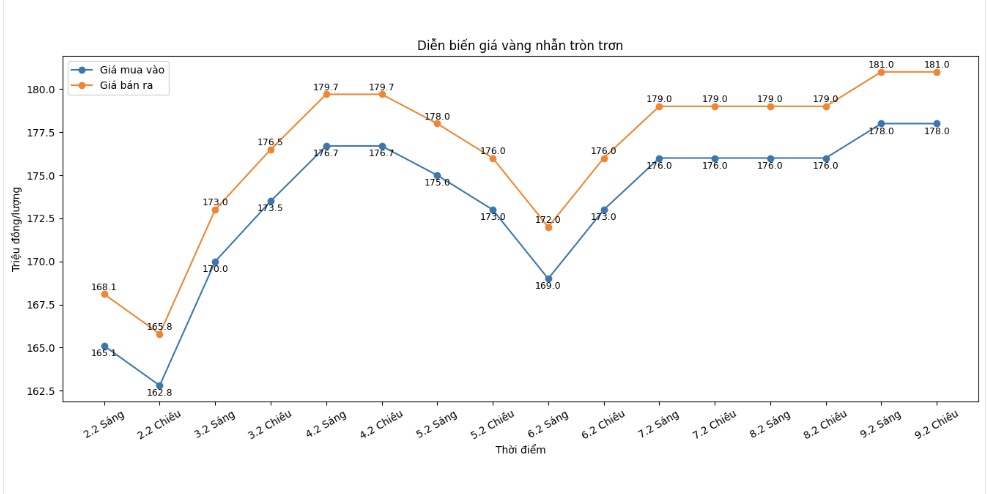

9999 gold ring price

As of 6:15 PM, DOJI Group listed the price of gold rings at 178-181 million VND/tael (buying - selling); an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 176.9-179.9 million VND/tael (buying - selling, an increase of 600,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 176.8-179.8 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

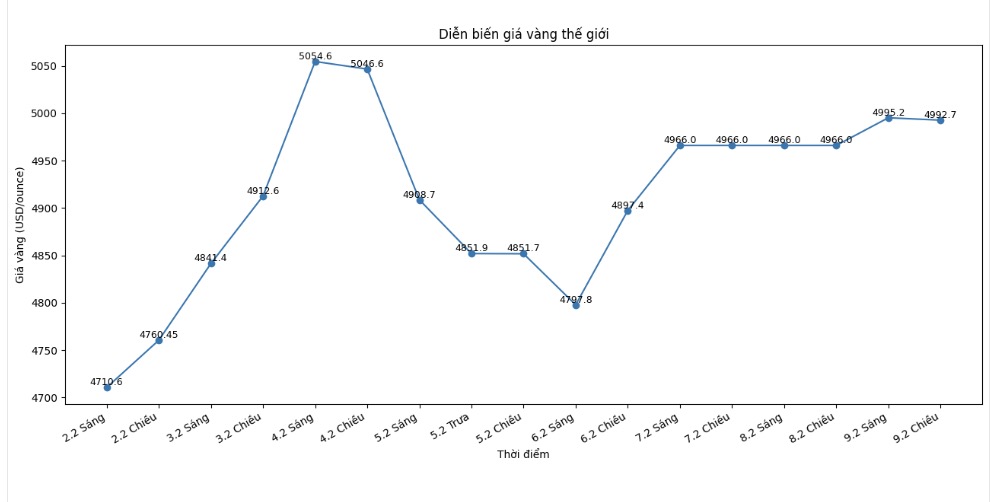

World gold price

At 6:15 PM, world gold prices were listed around 4,920.7 USD/ounce; up 26.7 USD compared to the previous day.

Gold price forecast

The strong increase in gold and silver prices in recent sessions is attracting great attention from global investors, especially in the context of the weakening USD and the market waiting for a series of important US economic data. The fact that gold prices quickly returned above the psychological threshold of 5,000 USD/ounce shows that demand is still present, although short-term fluctuations are increasing significantly.

According to experts, the current price increase is greatly influenced by the monetary factor. The USD falling to its lowest level in many days has made gold - an asset valued in USD - more attractive to investors holding other currencies.

Mr. Kelvin Wong - senior market analyst at OANDA - said that the correlation between the USD and gold and silver in this period may only be short-term, but enough to trigger strong daily increases in precious metals.

Besides the monetary factor, the "cheap goods hunting" activity after deep correction sessions also contributes to pulling gold prices back quickly. KCM's chief analyst - Mr. Tim Waterer said that the price returning above the 5,000 USD/ounce mark reflects buying sentiment when prices fall, but the next trend will largely depend on upcoming economic data, especially the US jobs and inflation report.

Investors are currently closely monitoring the policy expectations of the US Federal Reserve (Fed). The market is still betting on the possibility that the Fed will begin a cycle of interest rate cuts in the near future, although there is no absolute consensus on the timing.

In a low interest rate environment, gold - an unprofitable asset - is often beneficial. However, experts also warn that if US economic data continues to show stability, monetary easing expectations may be adjusted, leading to new fluctuations in gold prices.

From a long-term perspective, many analysts believe that the current strong fluctuations do not mean that the upward trend of gold is broken. After a period of hot increase and consecutive records, the market entering a correction and accumulation phase is considered necessary to absorb some speculative factors. The foundational demand, especially from central banks and physical demand in Asia, is still assessed as quite solid.

Notable economic calendar of the week

US Retail Sales.

US non-farm payroll.

US Weekly Unemployment Benefit Application; Current House Sales in the US.

US Consumer Price Index (CPI).

Gold price data is compared to the previous day.

See more news related to gold prices HERE...