Gold prices moved sideways in the session on Thursday, supported by dovish signals from the US Federal Reserve (Fed), but their increase was held back by the USD maintaining its strength ahead of a series of important US inflation data. Meanwhile, silver prices continue to anchor near the historical peak.

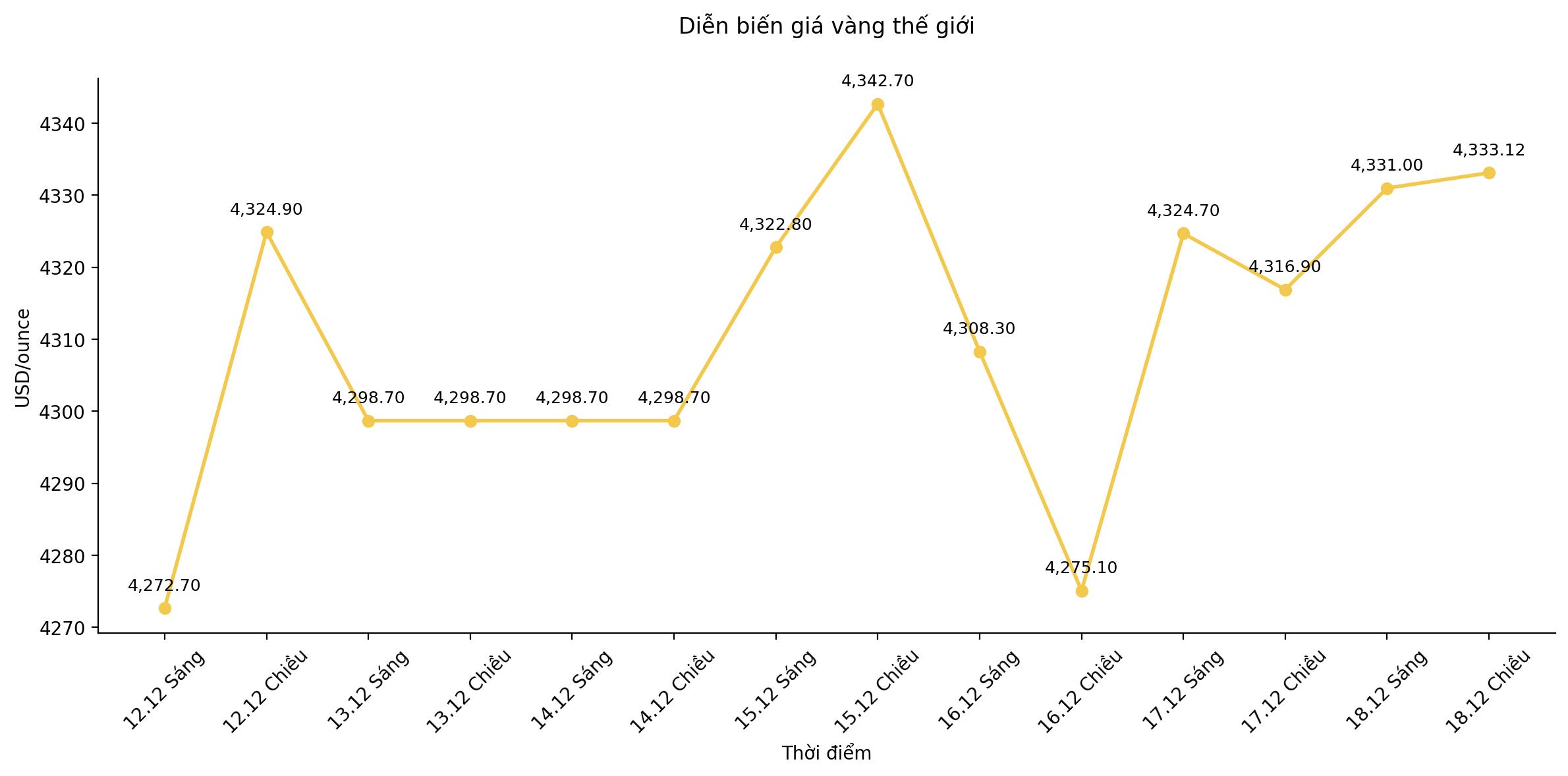

As of the afternoon trading session on December 18, spot gold prices fell 0.2%, down to $4,333.12/ounce, after rising more than 1% in the closing session on Wednesday. US gold futures also fell 0.2%, trading around $4,363.60 an ounce.

The USD Index maintained its previous increase, after reaching a peak of nearly a week in yesterday's session, thereby limiting the upward space of precious metals priced in greenback.

In contrast to gold, spot silver prices increased by 0.1%, to 66.36 USD/ounce, after setting a new record of 66.88 USD/ounce in the previous session. Since the beginning of the year, silver has increased by 130%, far exceeding the increase of about 65% of gold, thanks to solid industrial demand, stable investment cash flow and increasingly tight supply.

Some experts believe that silver prices could challenge the $70/ounce mark next year, especially if the US interest rate cut cycle continues to support positive sentiment in the precious metal market.

Kelvin Wong, senior market analyst at OANDA, said that recent statements from Fed Governor Christopher Waller show that the US central bank can maintain a rate cut cycle, thereby creating a support for both gold and silver. However, he also noted that profit-taking pressure may appear when prices are at a high level.

Previously, Mr. Waller affirmed that the Fed still has room to cut interest rates in the context of the cooling labor market, and emphasized that he will "resolutely protect the independence" of central banks, while waiting for an interview with US President Donald Trump regarding the issue of Fed Chairman Jerome Powell's reign.

Data released earlier this week showed that the US unemployment rate in November increased to 4.6%, higher than the Reuters survey's forecast of 4.4% and the highest level since September 2021.

Last week, the Fed cut interest rates for the third and also the last time this year, at 25 basis points. Currently, the market is betting on two additional interest rate cuts, each with 25 basis points in 2026.

In a low interest rate environment, non-yielding assets such as gold often benefit.

Investors are now focusing on the US consumer price index (CPI) for November, due today, before the personal consumption expenditure (PCE) data was released on Friday.