After a year of explosive price increases, gold and silver still have little room to increase in 2026, according to the latest assessment from BMO Capital Markets. The Canadian bank believes that the rally in precious metals, especially gold, is still supported by structural macro factors.

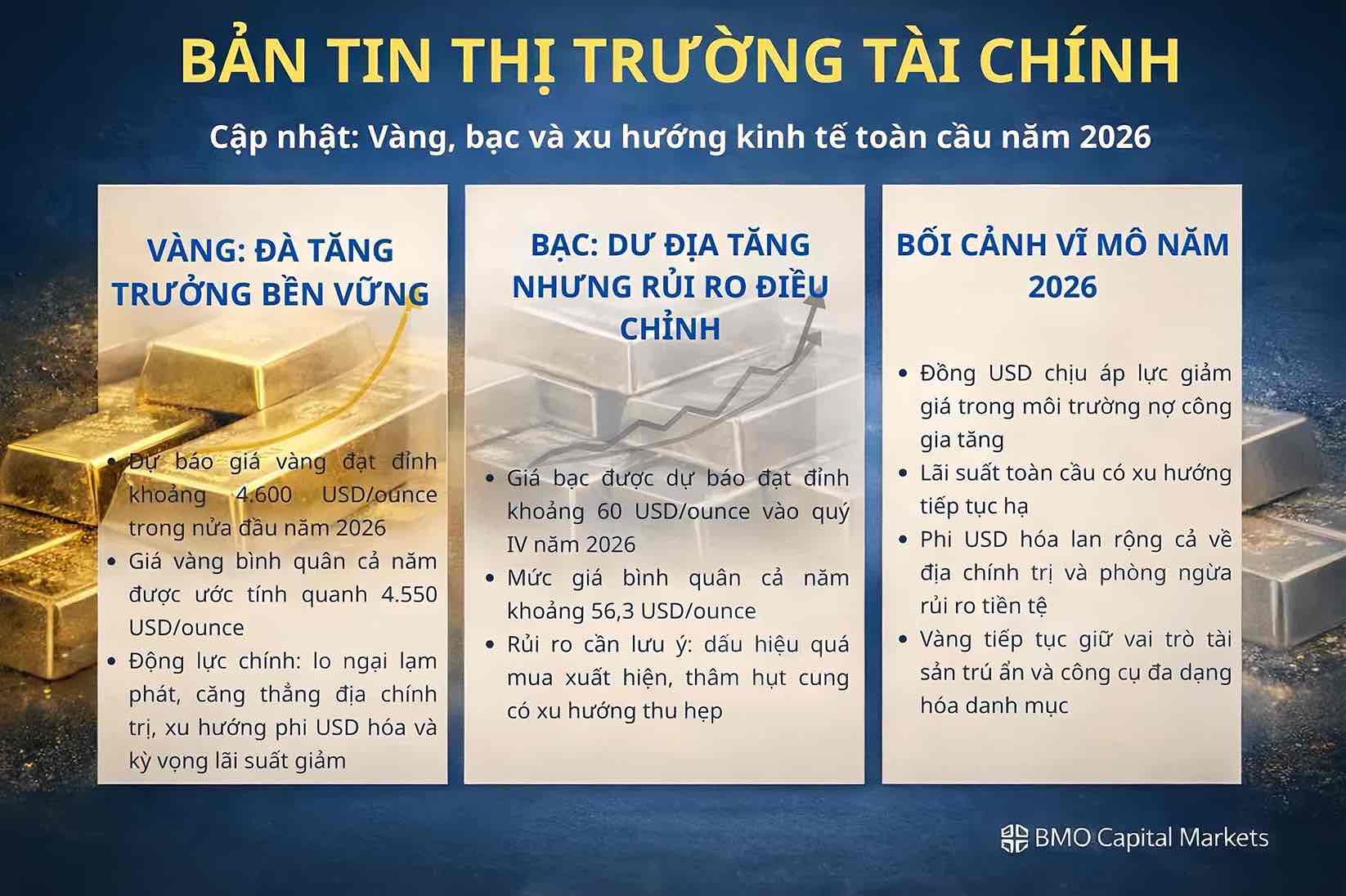

In its 2026 outlook report, BMO raised its gold price forecast to an average of $4,550/ounce for the whole year, and expected prices to peak in the first half of the year, around $4,600/ounce. Compared to the previous forecast, the adjustment increased by 3% and 5%, respectively.

BMO believes that gold prices will continue to outperform other precious metals next year, although the bank maintains a positive view on the entire group of commodities.

For silver, the price is forecast to increase significantly to 56.3 USD/ounce for the whole year of 2026, up 14% compared to before. However, BMO becomes more cautious when thinking that silver and platinum are showing signs of overbought, in the context of a narrowing supply deficit. According to the bank, silver prices are likely to peak in the fourth quarter, around $60/ounce.

From a long-term perspective, the BMO emphasized that gold's multi-year increase has not ended. The precious metal is also supported by short-term factors such as inflation concerns and long-term drivers such as expectations of currency depreciation and the trend of global monetary policy easing.

A notable point in the report is the assessment of the "new era of gold", associated with the trend of de-dollarization. According to BMO, both geopolitical de-dollarization to reduce sanctions risks and depend on the USD system and de-dollarization to prevent public debt risks and currency depreciation are boosting global demand for gold.

With interest rates expected to fall and the US dollar under pressure from high public debt levels, BMO believes that gold's role as a safe haven asset and portfolio diversification tool will continue to be strengthened in 2026 and beyond.