Gold prices increased again, approaching a historical peak as investors focused on upcoming US inflation data, while closely monitoring escalating geopolitical tensions in Venezuela. With this trend, silver hit a new peak, while platinum bounced to its highest level since 2008.

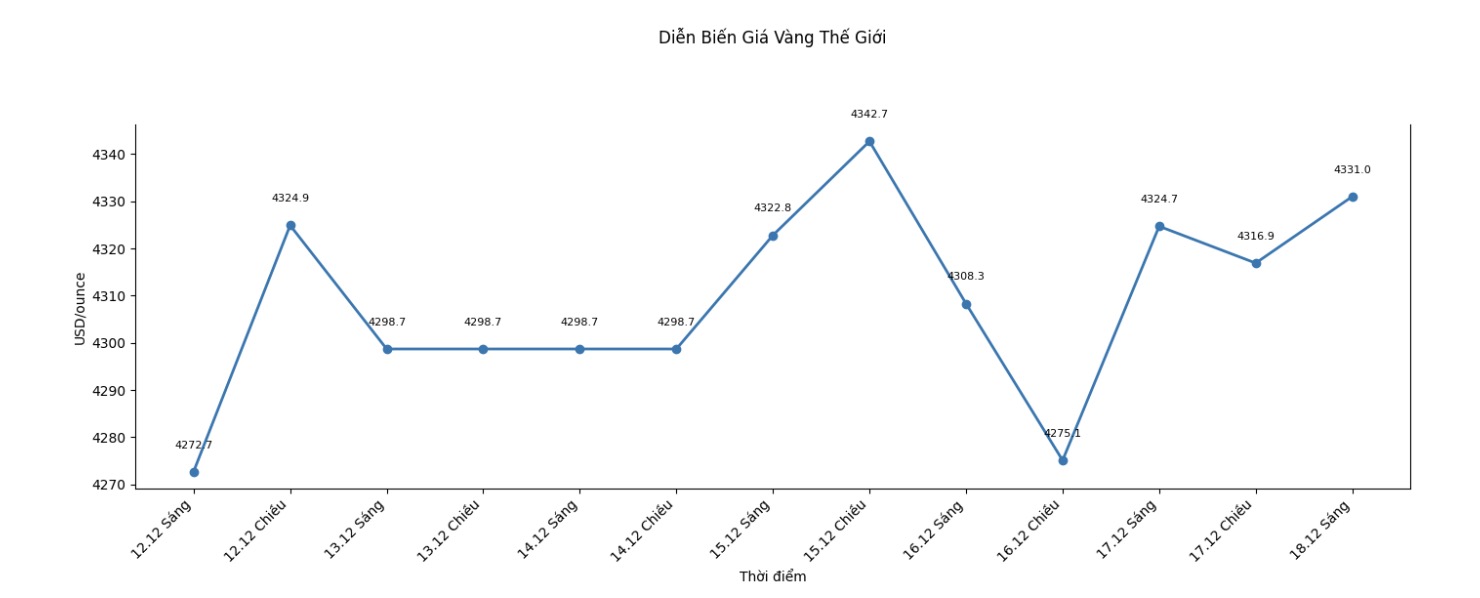

In the trading session early this morning Vietnam time, gold prices were trading around 4,350 USD/ounce, recovering after a slight adjustment session before - the session ended a streak of increases for five consecutive days. The US inflation data expected to be released tonight is considered a key factor, helping the market better assess the room for interest rate cuts by the US Federal Reserve (Fed) in the coming time. Before this time, many senior Fed officials are expected to make public statements.

Gold prices were also strongly supported by tensions in Venezuela, when US President Donald Trump ordered a blockade of all sanctioned oil tankers. Washington has also increased pressure on the Trump administration of President Nicolas Putin, as the US increases its military presence in the region and does not rule out the possibility of carrying out ground attacks.

In our observations, stress is getting higher, said David Wilson, senior commodity strategist at BNP Paribas. According to him, almost all factors supporting gold prices from inflationary pressure, fluctuations in the US stock market to the slowdown of global growth are appearing simultaneously. Mr. Wilson predicted that gold prices could reach the 5,000 USD/ounce mark next year.

Gold prices are not far from the historical record of over $4,381/ounce set in October. Since the beginning of the year, the precious metal has gained more than 60%, aiming for its strongest increase in a year since 1979. Gold's "hot" rally was driven by strong net buying by central banks, the trend of withdrawing capital from government bonds and major currencies, along with increased safe-haven roles in the context of geopolitical instability.

Investors are closely monitoring the possibility of the Fed continuing to loosen monetary policy, after the agency just implemented the third consecutive interest rate cut last week - a factor that is especially favorable for non-interest-bearing assets such as gold. However, the market currently only rates the possibility of the Fed cutting interest rates in January at below 25%.

According to Ms. Nicky Shiels, Head of Research at MKS Pamp SA, gold price is expected to reach an average of about 4,500 USD/ounce in 2026. In the short term, she believes that gold prices will likely enter an accumulation phase, before forming a more sustainable and dovish uptrend, after this year's "standing trends".

Meanwhile, platinum prices have surged, at times jumping to nearly 5%, to their highest level since 2008, following the European Union's proposal to ease emissions regulations for new vehicles and consider lifting a practical ban on internal combustion engines. platinum and palladium are two important metals in the catalytic transformer that helps reduce engine emissions. According to analysts, the purchasing power from automakers has appeared clearly in the past week.

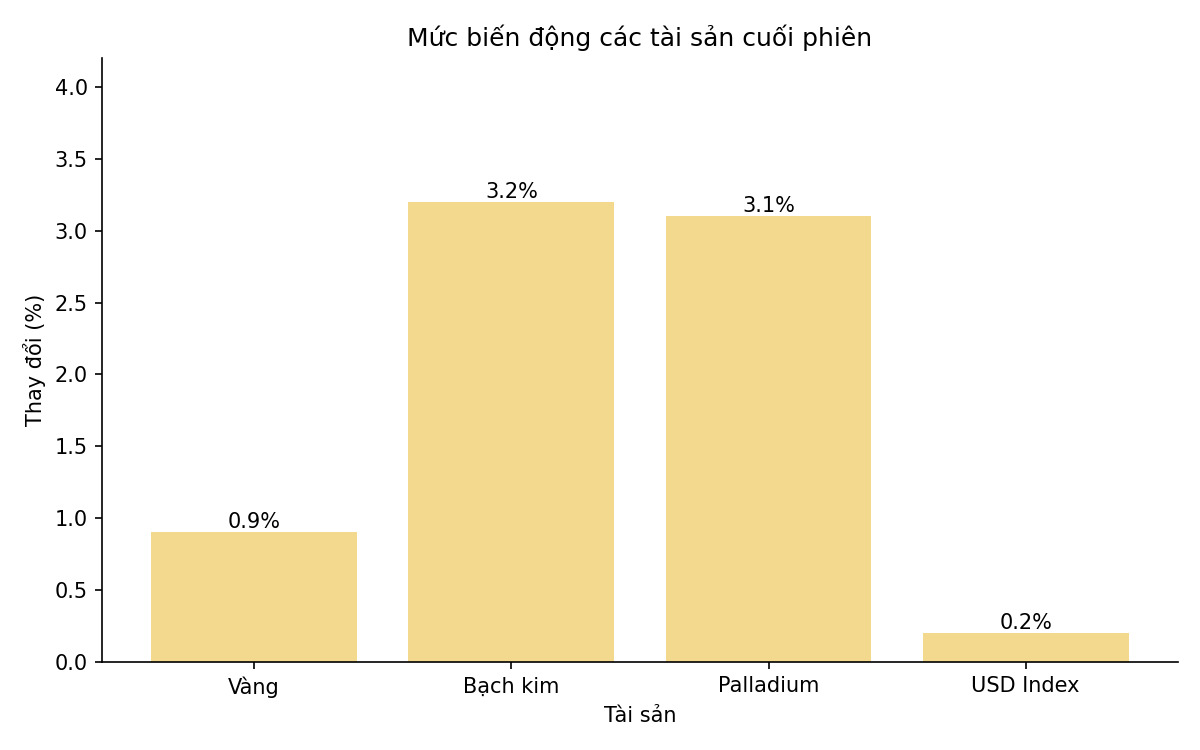

At the end of this morning's trading session in Vietnam time, gold prices increased by 0.9% to 4,341.17 USD/ounce. Previously, silver prices soared to a record high of 66.5284 USD/ounce. platinum prices rose 3.2%, palladium rose 3.1%, while the Bloomberg Dollar spot Index increased by 0.2%.