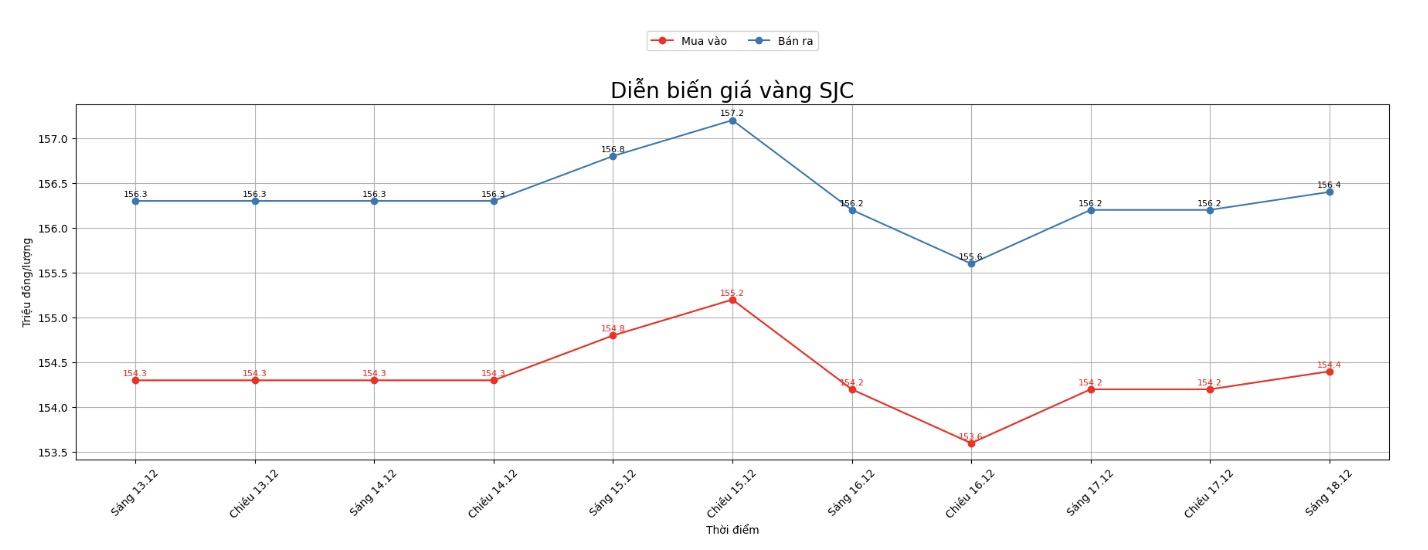

Updated SJC gold price

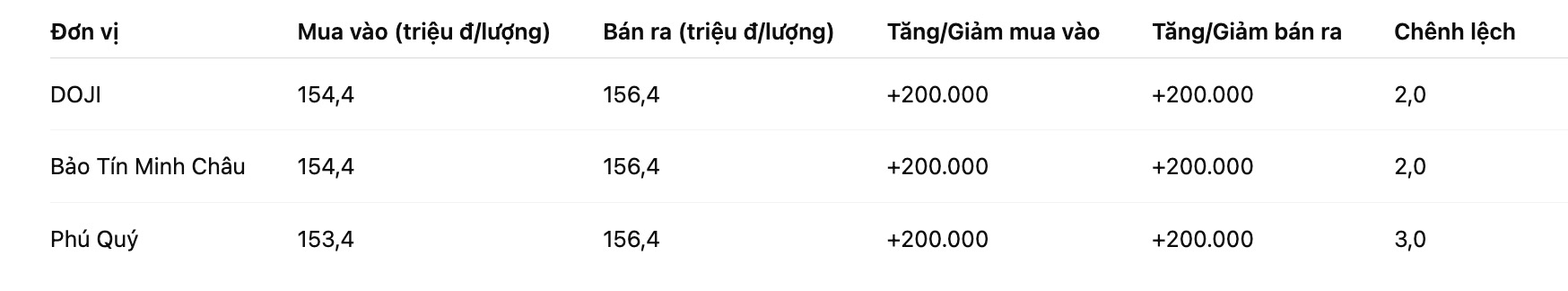

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at VND154.4-156.4 million/tael (buy in - sell out), an increase of VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.4-156.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.4-156.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

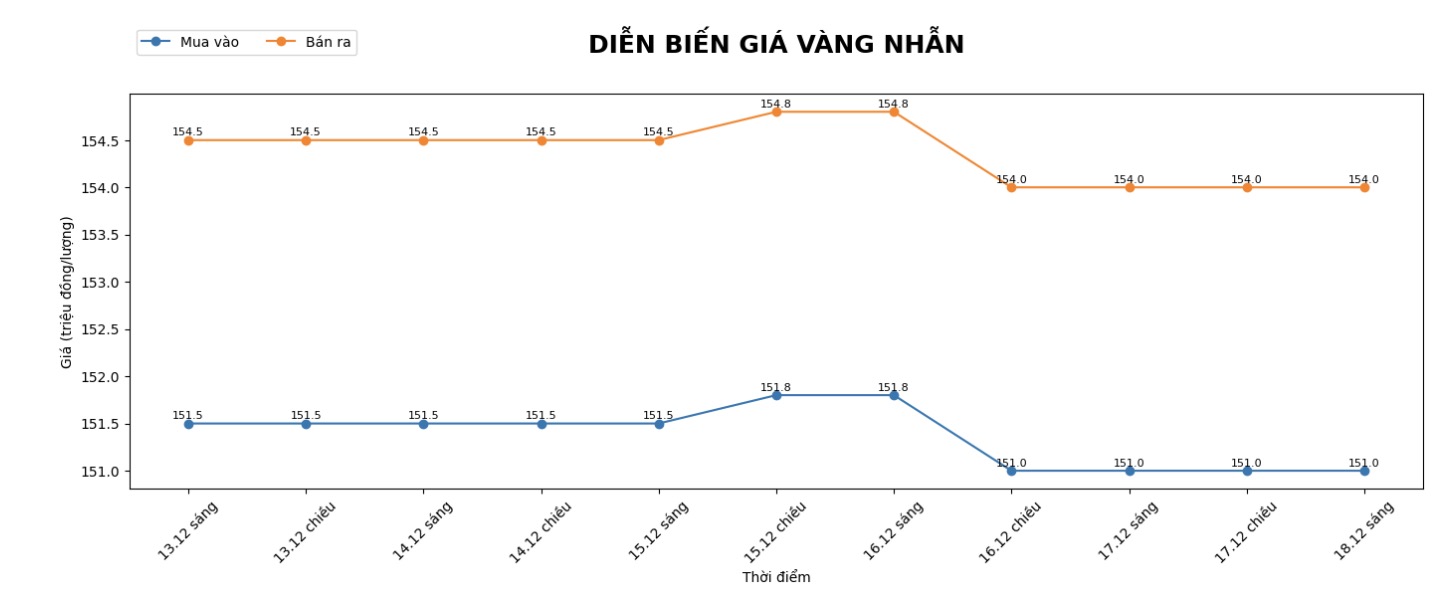

9999 round gold ring price

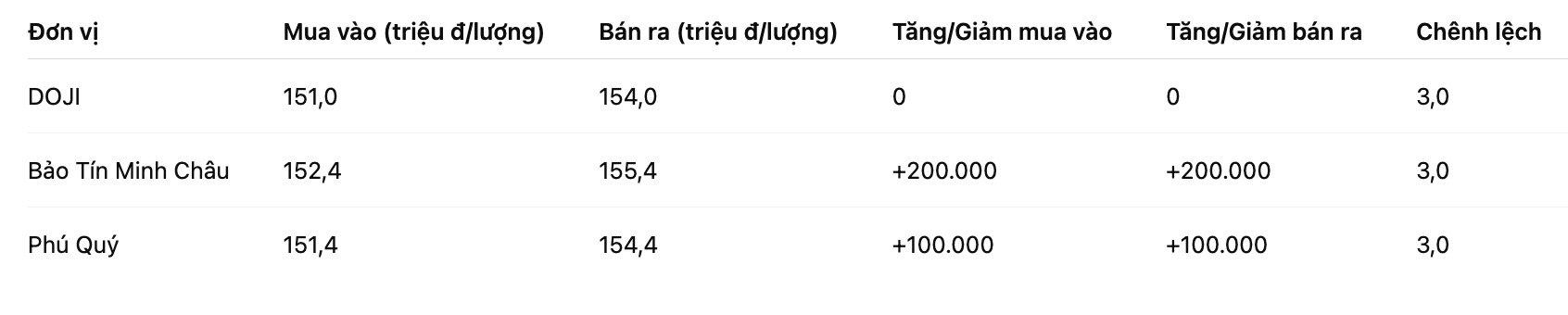

As of 9:10 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.4-155.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.4-154.4 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

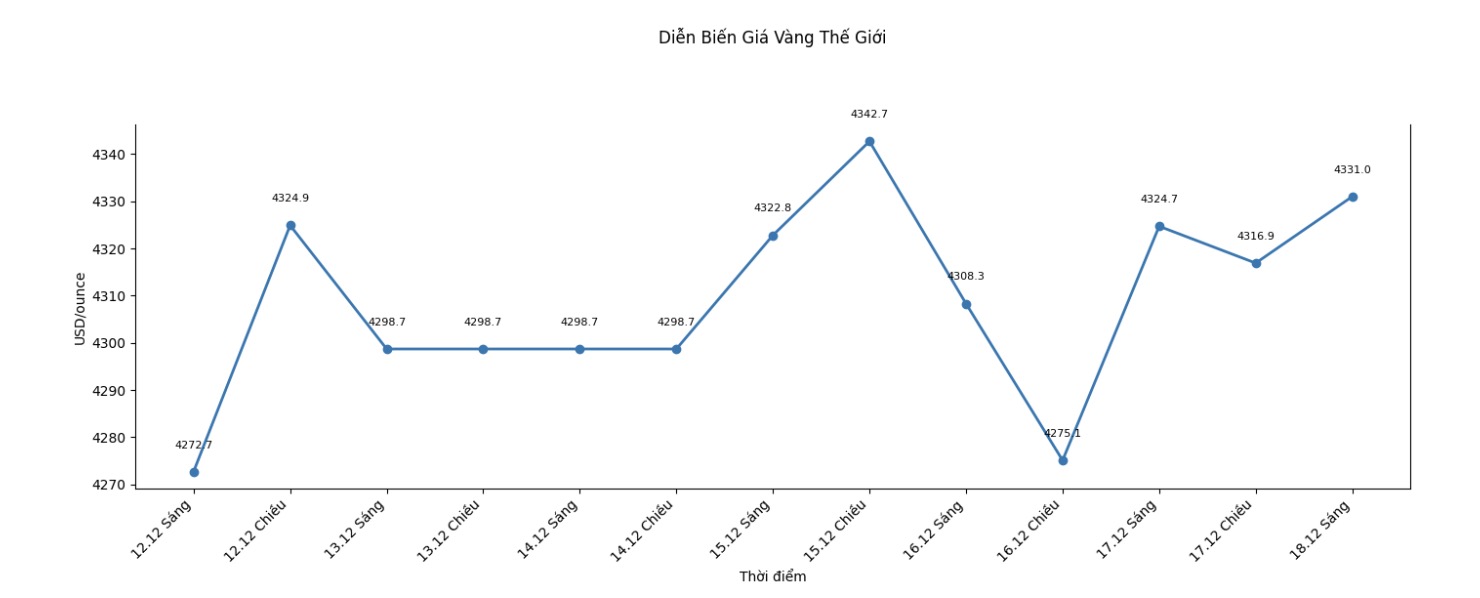

World gold price

At 9:12 a.m., the world gold price was listed around 4,331 USD/ounce, up 6.3 USD compared to a day ago.

Gold price forecast

Many forecasts say that instability in financial and commodity markets is still unpredictable. In the context of the unprecedented peace process in Ukraine, the possibility of new restrictive measures related to Russia's energy sector continues to be considered, thereby creating more fluctuations for the global market.

This year, gold's strong rally of up to 65% has surprised many investors and analysts. Although the precious metal has turned out to be expensive, as prices are holding firm at a new support zone above $4,300 an ounce, a portfolio manager still believes that the market has plenty of room to grow in 2026.

In a recent interview, Eric Strand - founder and portfolio manager of AuAg Funds - said that gold is still on track towards the long-term target of 10,000 USD/ounce and any price lower than that threshold next year can be considered a "bargain".

Looking forward to the next 12 months, Strand believes that 5,000 USD/ounce is a completely feasible target. However, instead of focusing too much on a specific number, he emphasized that investors should pay more attention to the trend, which he said will continue to increase.

Strand avoids giving rigid short-term price points, but his orientation is very clear. Gold above $5,000/ounce by 2026 will not surprise him, and in the long term, the $10,000/ounce mark is completely feasible if monetary easing continues.

Technically, the next bullish target for the February gold contract is to push the closing price above the strong resistance zone at the contract's peak/record, equivalent to 4,433 USD/ounce. On the other hand, the short-term bearish target for the bears is to push the futures price below the solid technical support zone at 4,200 USD/ounce.

The most recent resistance level was determined at the peak formed in the overnight trading session at 4,373.6 USD/ounce, followed by the peak in December at 4,387.8 USD/ounce.

The first support level was at the bottom of the overnight session at 4,330.7 USD/ounce, followed by the bottom of this week at 4,297.4 USD/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...