On January 13, speaking with Lao Dong reporter, the leader of Thai Binh Provincial Tax Department confirmed that on January 8, 2025, Thai Binh Provincial Tax Department issued Decision No. 137/QD-CTTBI on gradually paying tax debt for Huong Sen Group Joint Stock Company.

The Decision is issued on the basis of the Law on Tax Administration; Article 66 of Circular No. 80/2021/TT-BTC dated September 29, 2021 of the Minister of Finance; the request to gradually pay tax arrears of Huong Sen Group Joint Stock Company in Official Dispatch No. 01/TDHS dated January 3, 2025 and attached documents; as well as the request of the Head of the Department of Debt Management and Tax Debt Enforcement - Thai Binh Provincial Tax Department.

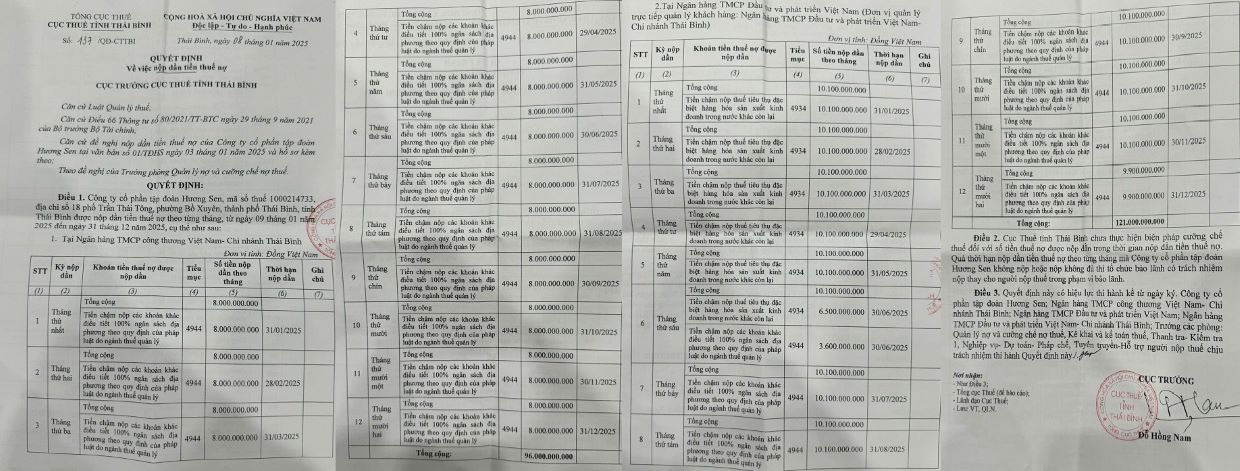

According to the content of this decision, Huong Sen Group Joint Stock Company (No. 18 Tran Thai Tong, Bo Xuyen Ward, Thai Binh City, Thai Binh Province) is allowed to gradually pay tax arrears monthly, from January 9, 2025 to December 31, 2025.

At the Vietnam Joint Stock Commercial Bank for Industry and Trade (Vietinbank) Thai Binh branch, the amount of tax debt payment in installments each month of Huong Sen Group Joint Stock Company is 8 billion VND, a total of 96 billion VND from January to December 2025.

At the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), whose direct customer management unit is the Thai Binh branch, the amount of tax debt payment in installments from January to November 2025 of Huong Sen Group Joint Stock Company is 10.1 billion VND, the amount paid in December 2025 is 9.9 billion VND (total of 121 billion VND from January to December 2025).

According to the above decision of the Thai Binh Provincial Tax Department, this agency has not yet taken tax enforcement measures for the tax debt amount paid gradually during the period of paying tax debt gradually.

If Huong Sen Group Joint Stock Company fails to pay or fails to pay in full the tax arrears within the deadline for monthly tax arrears, the guarantor organization shall be responsible for paying on behalf of the taxpayer within the scope of the guarantee.

Mr. Tran Van Tra - Deputy General Director of Huong Sen Group Joint Stock Company - said: "The company commits to comply with the regulations on gradually paying tax arrears within 2025 for the amount of 217 billion VND according to the decision of the Thai Binh Provincial Tax Department".

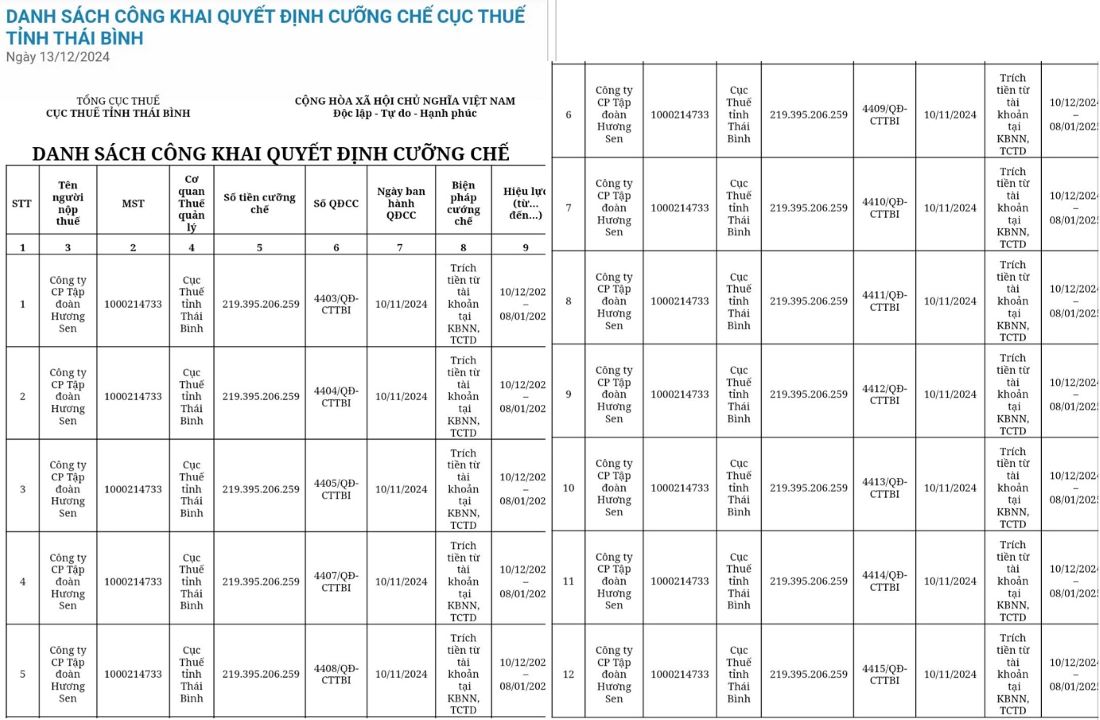

Previously, on December 13, 2024, the Thai Binh Provincial Tax Department publicly posted a list of 12 tax enforcement decisions against Huong Sen Group Joint Stock Company (the decisions were issued from November 10, 2024).

The public content stated that the amount of tax enforcement against this enterprise was 219.3 billion VND; the enforcement measure was to withdraw money from accounts at the State Treasury and credit institutions (effective from December 10, 2024 to January 8, 2025).

According to Lao Dong reporters, Huong Sen Group Joint Stock Company is a large-scale enterprise operating in Thai Binh, producing and trading beer, alcohol, soft drinks and some other fields. During its operation, this company has always been the enterprise with the second highest state budget contribution in Thai Binh province in the past 20 years (ranging from 260 - 800 billion VND/year).

However, in recent years, due to the impact of difficulties in the world and domestic economy, the production and business activities of the enterprise have been greatly affected. Many domestic and foreign customers of Huong Sen Group Joint Stock Company have encountered financial difficulties, causing the company to be somewhat affected.

Decree 100/2019/ND-CP of the Government, effective from January 1, 2020, with strict regulations on administrative sanctions for violations related to the use of alcohol, beer and alcoholic beverages, has also had a direct impact on the market, leading to a decrease in consumption output and business revenue.