From January 1, 2026, millions of business households across the country will no longer pay taxes under the contract method but will switch to self-declaration, self-calculation and self-payment of taxes based on actual revenue.

According to the Draft Regulations on tax declaration, calculation, deduction, payment of taxes, and use of electronic invoices of business households and individuals (2nd time) taxpayers are clearly defined:

Business households and individuals who are paying taxes under the tax contract method as prescribed in the Law on Tax Administration No. 38/2019/QH14 must self-determin the amount of tax payable according to the declaration from January 1, 2026.

Business households and individuals have paid taxes according to the declaration method according to the provisions of Law on Tax Administration No. 38/2019/QH 14,

New business households and individuals will start trading from January 1, 2026.

Below are 2 types of taxes that business households must pay from 2026 after abolishing contract tax and ending the collection and payment of card fees from January 1, 2026 in Clause 1, Article 7 according to Resolution No. 198/2025/QH15.

(1) Value Added Tax (VAT):

Business households and individuals with production and business activities with annual revenue of VND500 million or less are not subject to VAT.

According to the provisions of the Law on Value Added Tax No. 48/2024/QH15 and guiding documents for implementation, business households and individuals with production and business activities with an annual revenue of over VND 500 million pay VAT according to the direct calculation method according to revenue.

VAT payable = Revenue x %

(2) Personal income tax (PIT)

Business households and individuals with production and business activities with annual revenue of VND500 million or less do not have to pay personal income tax.

Personal income tax on business income of business households and individuals with annual revenue exceeding the prescribed level will be determined as follows:

personal income tax = Taxable income x Tax rate

In which:

Taxable income is determined by the revenue of goods and services sold tru (-) expenses related to production and business activities during the tax calculation period.

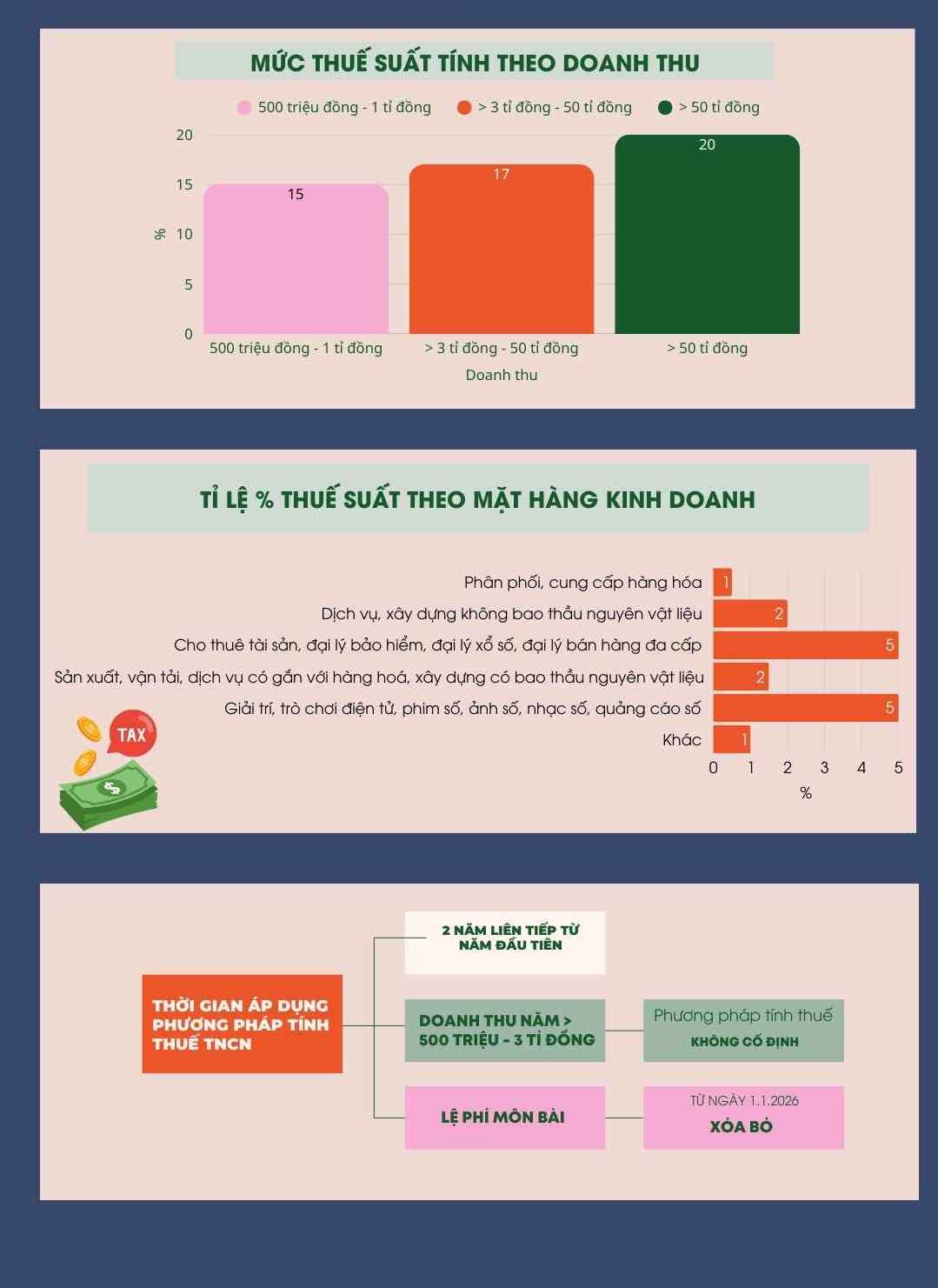

Business households and individuals with annual revenue exceeding the level prescribed in Clause 1 of this Article to 03 billion VND: tax rate of 15%;

Business households and individuals with annual revenue of over 03 billion VND to 50 billion VND: tax rate of 17%;

Business households and individuals with annual revenue of over VND 50 billion: tax rate of 20%.

Business households and individuals with annual revenue of over VND 500 million - VND 3 billion can choose to pay taxes according to the provisions of Point a and Point b, Clause 2 of this Article or pay taxes according to the formula:

personal income tax = Tax rate x Taxable revenue

Taxable revenue is determined by the excess revenue of less than VND500 million/year.

In case the household or individual has many business locations and many business lines, the household or individual will be deducted VND 500 million from the annual revenue, before calculating personal income tax of the business location or business line chosen by the household or individual, but the total deduction is not more than VND 500 million for all business activities of the household or individual.

Tax rate for each business item:

- Distribution and supply of goods: tax rate of 0.5%;

- Services and construction not including bidding for raw materials: tax rate of 2%. In particular, property leasing activities, insurance agents, lottery agents, and multi-level sales agents: tax rate of 5%;

- Production, transportation, services associated with goods, construction with raw material packages: tax rate of 1.5%;

- Activities of providing digital information content products and services on entertainment, electronic games, digital movies, digital photos, digital music, digital advertising: tax rate of 5%;

- Other business activities: tax rate 1%.

Households and individuals leasing real estate, except for accommodation business activities, and paying personal income tax are determined as follows:

personal income tax = Revenue exceeding the prescribed level x Tax rate (5%).

The method of calculating personal income tax prescribed in Clause 2 and Clause 3, Article 4 shall be applied stably for 2 consecutive years from the first year of application.

In case a business household or individual with an annual revenue of over VND 500 million to VND 3 billion is applying the method of calculating personal income tax at a percentage of revenue, the right to apply this method is not fixed.

For 2 consecutive years, business households have self-declaration, or tax authorities have data showing that actual revenue has exceeded VND3 billion/year, from the following year it is mandatory to change the tax calculation method as follows:

No personal income tax is anymore calculated as a percentage of revenue.

personal income tax must be calculated on taxable income.