Business households have been and are fulfilling tax obligations according to the declaration method instead of fixed tax from January 1, 2026. However, the concern is not about tax payment obligations but about the fragile boundary when tax declaration is delayed.

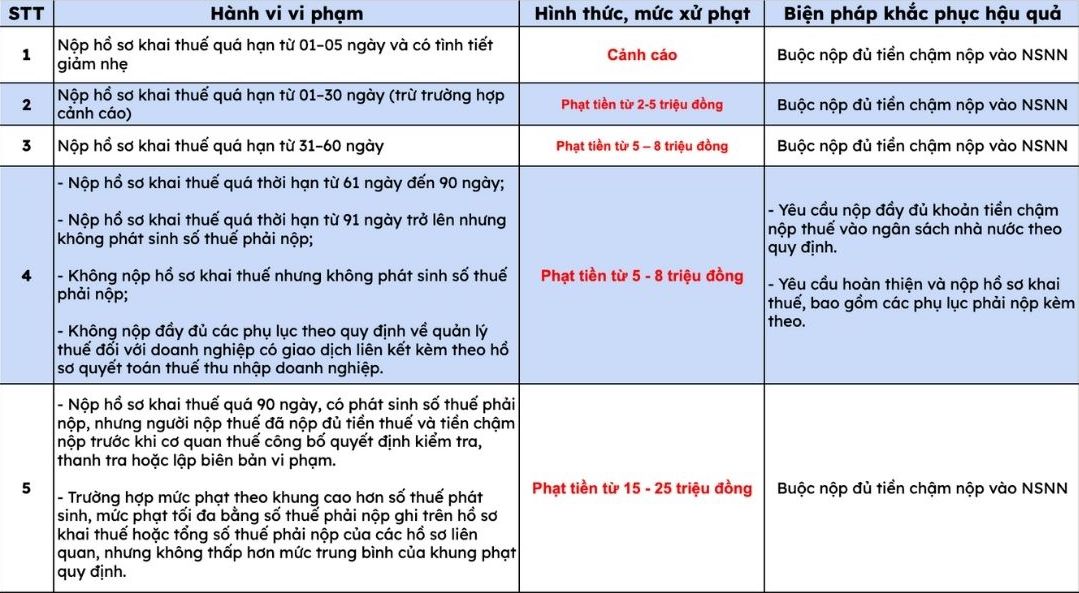

For cases where business households and individuals are late in submitting tax declaration dossiers, they will be penalized according to Article 13, Decree 125/2020/ND-CP, amended and supplemented by Decree 310/2025/ND-CP.

According to regulations, the penalty level for late payment of tax declaration dossiers is applied depending on the number of late payment days and the situation of tax obligations arising, specifically as follows:

Notably, in cases where the fine amount is greater than the arising tax amount, the maximum fine amount is equal to the tax amount to be paid on the tax declaration dossier as prescribed.

How to calculate late payment tax

In addition to administrative fines, business households that are late in submitting tax declaration dossiers and incur payable tax amounts also have to pay late payment tax according to the provisions of the Law on Tax Administration.

According to Clause 2, Article 59 of the Law on Tax Administration No. 38/2019/QH14 (amended and supplemented by Law No. 56/2024/QH15), the rate of late payment is 0.03%/day calculated on the amount of late payment tax.

Delayed payment = Delayed tax amount × 0.03% × Number of delayed payment days

The number of late payment days is calculated continuously, including holidays, from the immediately following day after the tax payment deadline to the day before the taxpayer actually deposits money into the state budget.

For a specific example, business households are late in submitting tax declaration dossiers, in addition to the amount of tax incurred to be paid, business household owners also have to pay tax arrears.

The amount of late payment tax is 100 million VND.

Business households are delayed in submitting tax declaration dossiers for 1 year. The corresponding amount of late payment is 10.95 million VND.

Business households are late in submitting tax declaration dossiers for 2 years. The corresponding amount of late payment is 21.9 million VND.

If the application deadline is extended, the amount of late payment will continue to be increased.

Principles of application of penalties

According to Clause 5, Article 5, Decree 125/2020/ND-CP, for the same administrative violation of tax, the fine level applied to organizations is equal to 2 times the fine level for individuals.

Tax declaration deadline by month, by year

Based on Clause 1, Article 44, Tax Administration Law 2019, the deadline for filing tax declarations is determined according to the tax calculation period as follows:

Business households carry out monthly declarations: At the latest on the 20th of the month immediately preceding the month of tax obligation arising.

Business households carry out quarterly declarations: At the latest on the last day of the first month of the next quarter arising tax obligations.

According to Clause 2, Article 44, Tax Administration Law 2019, the deadline for submitting tax declaration dossiers for the year is specifically stipulated:

Deadline for receiving tax finalization documents for the year: At the latest the last day of the 3rd month from the end of the calendar year or fiscal year.

Deadline for receiving tax returns for the year: At the latest the last day of the first month of the solar year or fiscal year.

Deadline for personal income tax finalization of individuals directly finalizing: At the latest the last day of the 4th month from the end of the solar year.