Business households face great risks when cash flow mixes on the same account

Stepping into 2026, when the 2025 Tax Administration Law began to operate in the direction of data analysis, business households shared bank accounts for both personal needs and business transactions facing higher risks than ever before. In the new management model, all data related to electronic invoices, banking transactions, electronic wallets and operations on e-commerce platforms are automatically connected, compared and analyzed.

This makes the mixed cash flow a factor that easily distorts revenue recognition when the system sees a discrepancy between the number of invoices made and the total amount actually received. Affeals transferred by relatives for support, savings, personal reimbursement, payment for others or unusually large value transactions can all be marked as "unusual", even if they are not related to business.

Current law does not require business households to separate accounts, but the reality of new supervision makes many households face the risk of being asked to explain cash flow, being randomly comparing data or even being classified as high-risk if they cannot prove the nature of the transaction.

Personal transactions are monitored more closely in the tax risk analysis system

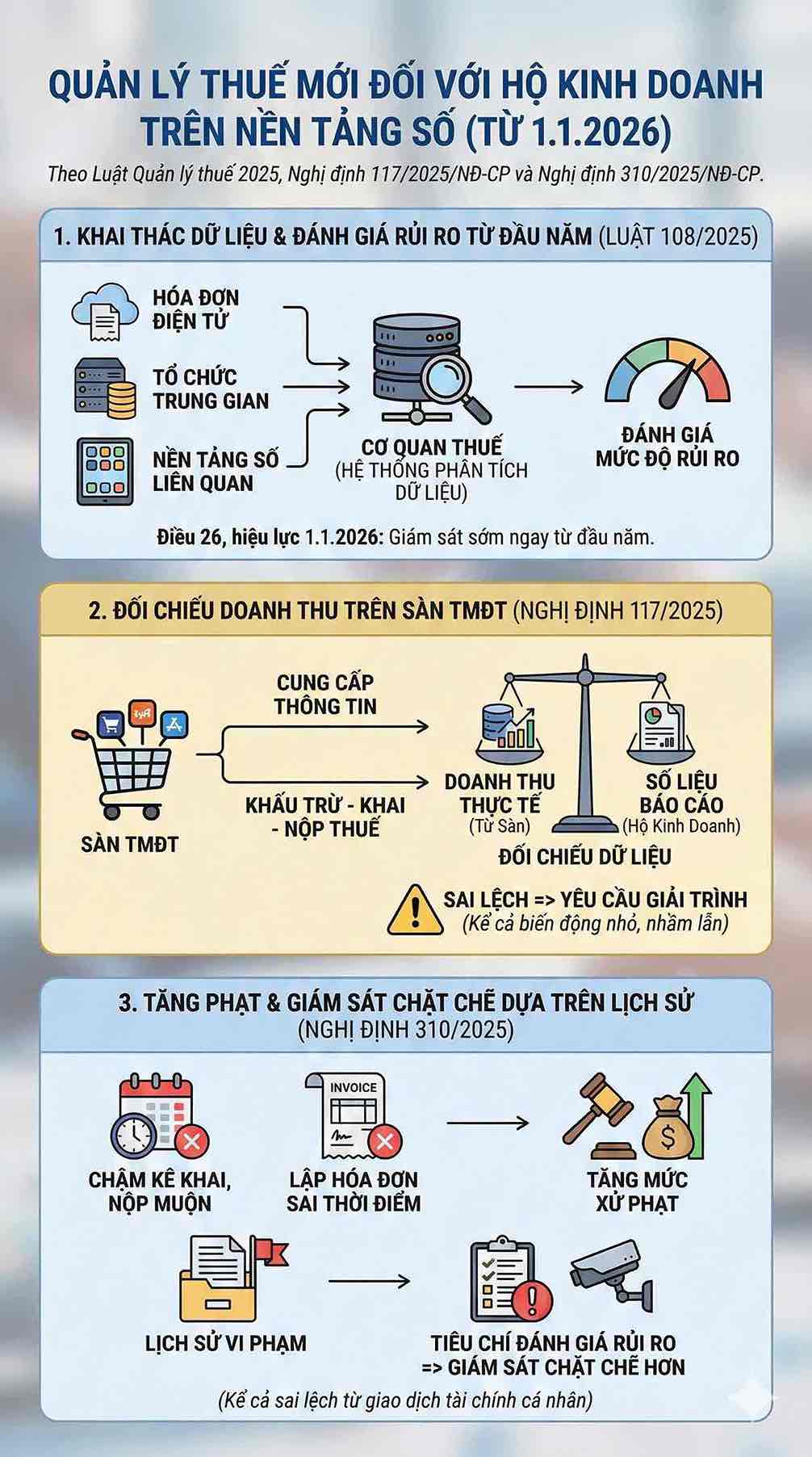

According to the 2025 Tax Administration Law (08/2025/QH15), tax authorities are entitled to exploit data from many information systems serving tax management, including electronic invoice data, data from intermediary service providers and related digital platforms. Part of Article 26 on electronic invoice management and compliance - risk assessment mechanism has taken effect from January 1, 2026, meaning that business households begin to enter the early monitoring phase right from the beginning of the year.

In Decree 117/2025/ND-CP, the Government clearly stipulates the tax management mechanism for business activities on e-commerce platforms, including the responsibility to provide information when requested by the tax authority, as well as the responsibility for deduction - declaration - tax payment in some cases. Thanks to this, the tax authority has sufficient basis to compare actual revenue with the reported business household data. Distortions, whether arising from seasonal fluctuations, time errors or data recording errors, can lead to requests for explanation.

For households that regularly delay declarations, submit dossiers late or make invoices at the wrong time, Decree 310/2025/ND-CP (amended Decree 125) has increased penalties and clarified many violations. The history of taxpayers' violations is one of the factors used by tax authorities when assessing the level of risk in management. Therefore, households with a history of errors will be monitored more closely, even when new errors arise from personal financial transactions.

Account separation helps business households avoid tax risks in 2026

Although the law does not stipulate the obligation to separate personal accounts and business accounts, in the context of data-based tax management, account separation is becoming the most important self-protection measure for business households.

When cash flow is clearly separated, the comparison between invoices, revenue reports and bank transactions becomes transparent, helping business households significantly reduce the risk of misunderstanding revenue and avoid being put at high risk. This is especially important when from 2026, the tax exemption threshold of 500 million VND/year begins to be applied. Business households need to prove actual revenue so as not to be misdetermined as a group of obligations.

Conversely, if they continue to share accounts, business households may have to explain each amount of money when cash flow fluctuates abnormally. The law does not consider all money transferred to the account as revenue, but the responsibility to prove it belongs to taxpayers. Lack of documents, lack of explanation or inconsistent data can lead to the risk of being considered for retroactive collection according to the system's risk analysis mechanism.

Transparency from the beginning not only helps business households comply with the law but also significantly reduces pressure when tax authorities deploy management using digitized data nationwide.