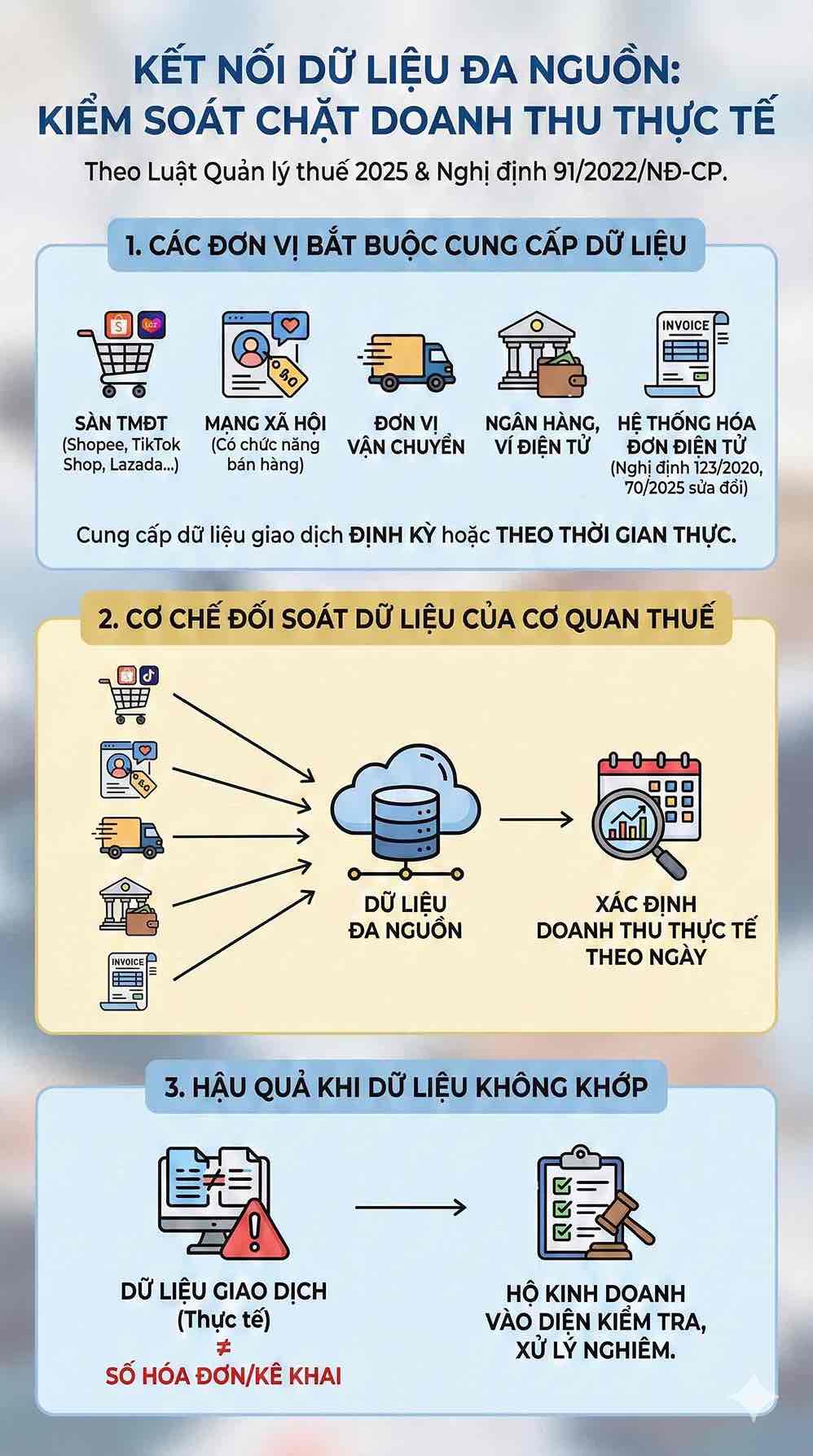

From 2026, the tax authority will implement a comprehensive revenue control mechanism for household businesses in the digital environment based on data from e-commerce platforms (e-commerce platforms) such as Shopee, TikTok Shop, Lazada, Facebook Marketplace along with payment data from banks, electronic wallets, transportation units and electronic invoice systems. This regulation is established on the basis of the 2025 Tax Administration Law (Law No. 108/2025/QH15) and guiding decrees such as Decree 91/2022/ND-CP.

Data from multiple sources is connected in real time, allowing for a full determination of revenue generated on sales platforms. The cross-checking between payment - transportation - electronic invoices helps tax authorities quickly detect acts of not registering taxes, incomplete declarations or signs of tax evasion.

Counter-audit tax data to tighten online business households

According to the 2025 Tax Administration Law and Decree 91/2022/ND-CP, the following units are required to provide periodic or real-time transaction data:

- E-commerce platforms such as Shopee, TikTok Shop, Lazada;

- Social network platform with sales function;

- Transportation unit;

- Bank, e-wallet;

- Electronic invoice system under Decree 123/2020/ND-CP (amended by Decree 70/2025/ND-CP).

Thanks to multi-source connection, tax authorities can determine actual revenue by date. When transaction data does not match the issued invoice number or declared data, business households will be put under inspection and handling.

Not registering tax codes can be fined up to 20 million VND

According to Article 10 of Decree 125/2020/ND-CP, amended by Decree 310/2025/ND-CP (effective January 16, 2026):

- Individuals and business households who do not register for tax even if they have actual business activities: fined from 2-4 million VND.

- Organizing violations: fine 10-20 million VND.

Not registering taxes means not having a tax code, not being able to make electronic invoices and not being able to fulfill the obligation to declare according to the 2025 Tax Administration Law. If there are signs of concealing revenue, individuals may be considered in the group of tax evasion acts.

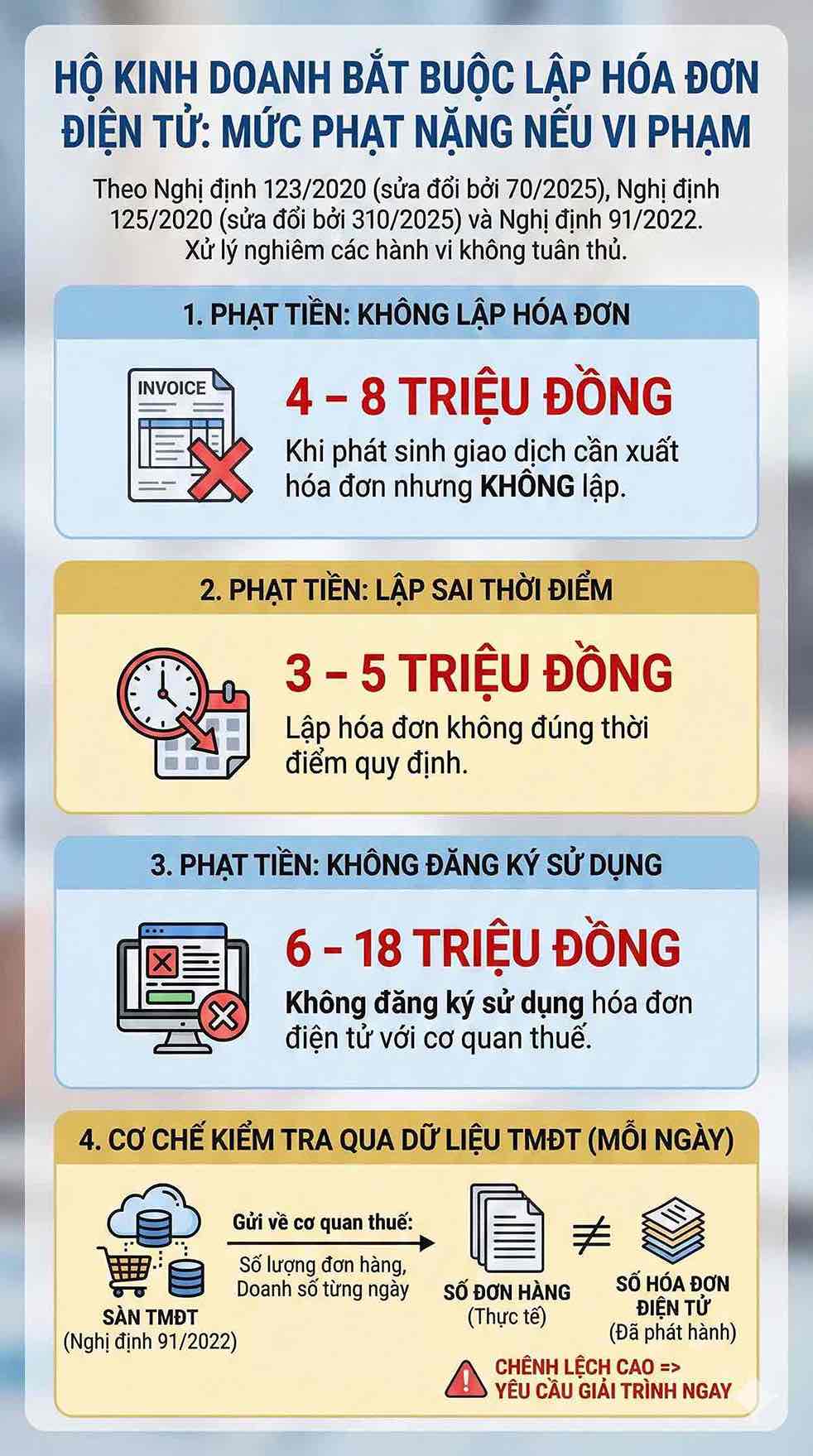

Not registering for electronic invoice issuance may be fined up to 18 million VND

According to Decree 123/2020/ND-CP, amended by Decree 70/2025/ND-CP, combined with Article 24 of Decree 125/2020/ND-CP (amended by Decree 310/2025), the penalty level includes:

- Fine of 4-8 million VND if no invoice is made;

- Fine of 3-5 million VND if set at the wrong time;

- A fine of 6-18 million VND if not registering to use electronic invoices.

Data from the e-commerce platform according to Decree 91/2022 is sent to the tax authority every day. If a household has a large number of orders but issues too few invoices, the tax authority will request immediate explanation.

For example: A household has 600 orders in a month but only issues 150 electronic invoices. This difference is sufficient basis for tax authorities to inspect and fine.

False declaration of revenue penalized with 20% of tax arrears

Article 17 of Decree 125/2020/ND-CP, amended by Decree 310/2025/ND-CP stipulates:

- False declaration of revenue causing insufficient tax payable: fine 20% of the insufficient tax

- Deferred payment: 0.03%/day according to the 2025 Tax Administration Law

- Tracking all remaining tax arrears based on actual data

Thanks to data from banks, e-wallets and e-commerce platforms, tax authorities can track cash flow daily. The act of receiving money into personal accounts but not declaring it is considered to hide revenue, one of the signs constituting tax evasion.

When payment - transportation - electronic invoice data is interconnected, online business households can hardly hide revenue or declare insufficiently. The multi-platform counter-inspection mechanism established by the 2025 Tax Administration Law and related decrees helps tax management activities become more transparent, minimizing budget revenue loss.