Resolution 57 creates momentum to promote digital banking

Immediately after the Politburo issued Resolution No. 57-NQ/TW on breakthroughs in science, technology, innovation and national digital transformation, ministries, branches and localities across the country urgently implemented and quickly put the Resolution into practice. In particular, the banking industry is identified as one of the pioneering forces, considering digital transformation as a key strategy to improve operational efficiency and towards sustainable development.

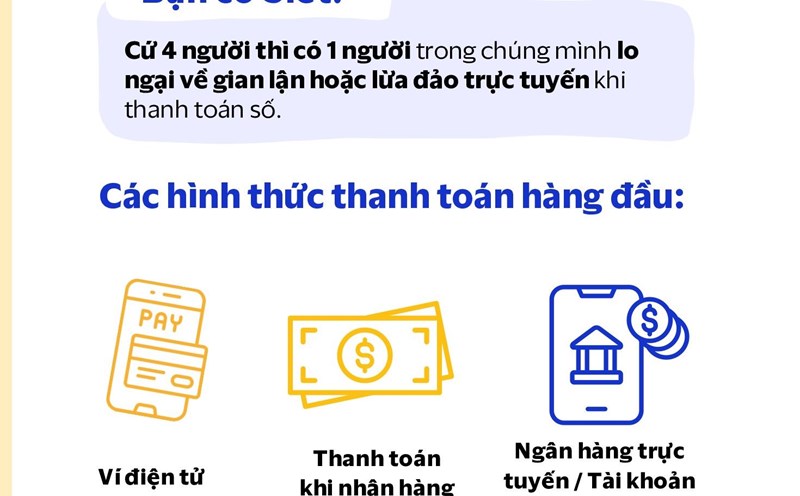

Connecting national databases, promoting cashless payments and developing digital banking have created a solid foundation, helping people and businesses access financial services quickly and conveniently. In particular, cross-border payments and online loans have made many important strides in recent times.

However, along with the achieved results, there are still many challenges, from completing the legal corridor for digital signatures and electronic identification, improving digital processes in loans, expanding the cross-border payment ecosystem, to ensuring information security and safety. These are urgent requirements that need to be realized in the coming time.

That requires synchronous coordination between many industries and levels, along with a strong enough technical infrastructure platform to effectively deploy digital banking solutions and services.

In order to clarify the role of cross-border payments and online loans, and at the same time find solutions to remove obstacles in implementation practice, Lao Dong Newspaper in coordination with the State Bank of Vietnam organized the Workshop " cross-border payments and online loans: Digital utilities for business and consumption".

The workshop took place at 2:00 p.m. on September 11, 2025 at the headquarters of Lao Dong Newspaper (No. 6 Pham Van Bach, Cau Giay, Hanoi), with the participation of leaders of the State Bank of Vietnam, representatives of relevant ministries and branches, economic - financial experts, commercial banks, technology enterprises and financial institutions.

Solutions to improve legal procedures, technology infrastructure and expand international cooperation

In the context of globalization and strong e-commerce development, the need for a safe, fast and affordable cross-border payment system is becoming increasingly urgent. At the same time, online loans are emerging as an effective support tool for businesses and people, helping to expand financial access, especially in the period of extensive digital transformation of the banking industry.

At the workshop, speakers and experts will focus on discussing solutions to promote cross-border payments, expand cooperation and international connections; analyze the role of online loans in improving credit and consumer access efficiency; and discuss the completion of legal frameworks, standards and technology infrastructure for fast, safe and transparent payments. In addition, the workshop also shared international experience and implementation practices in Vietnam, thereby proposing mechanisms and policies to support innovation in the digital banking and financial system.