OCB interest rates unexpectedly increase sharply

OCB has just adjusted online deposit interest rates for many terms, with increases ranging from 0.2 - 0.75%/year. After adjustment, the interest rate for savings accounts under 100 million VND (interests at the end of the term) was reset as follows: 1-month term increased by 0.2% to 3.9%/year; 2-month term increased by 0.3%, to 4%/year; 3-month term increased by 0.2%, to 4.1%/year. The 4-month term alone was slightly reduced by 0.1%, down to 4.1%/year.

In longer terms, interest rates continue to be adjusted. Specifically, the 5 -month term increased by 0.2%, to 4.5%/year; The terms from 6 to 11 months simultaneously increased by 0.3%, to 5%/year. Similarly, the term 12–15 months also increased by 0.3%, to 5.1%/year; 18 -month term increased by 0.3%, to 5.2%/year; 21 -month term increased by 0.35%, to 5.3%/year; The 24 -month term increased by 0.45%, to 5.4%/year. Notably, the 36 -month term was adjusted to 0.75%, raising interest rates to 5.6%/year.

For deposits from VND 100 million to VND under VND 500 million and VND 500 million or more, OCB applies a higher interest rate than the group under VND 100 million. The deposit interest rate table between limits has a gradual increase in terms from 1 to 15 months.

Currently, the interest rate difference between the deposit group under 100 million VND and the group from 100 million to under 500 million VND ranges from 0.1 - 0.15%/year, applied to terms from 1 to 15 months. Meanwhile, the difference between the group under 100 million VND and the group of 500 million VND or more is about 0.2%/year in the same term.

In contrast, the deposit interest rate at the counter for individual customers receiving interest at the end of the term, the interest rates for terms from 1-15 months decreased by 0.1%/year; terms from 18-36 months decreased by 0.2%/year.

Since the beginning of April, the market has recorded two banks adjusting to increase deposit interest rates, CIMB Bank Vietnam and OCB. Of which, OCB reduced interest rates on April 14, then suddenly turned to increase sharply after only a few days. Similarly, Eximbank adjusted interest rates in the direction of reducing short terms and increasing slightly for long terms.

On the other hand, there are 7 banks that have reduced deposit interest rates, including: VPBank, MBBank, Standard Chartered, Nam A Bank, Public Bank Vietnam, OCB and GPBank.

Highest special interest rate 6.5-9.65%

The highest interest rate is up to 7.5-9.65%, but to enjoy this interest rate, customers must meet special conditions.

ABBank leads in special interest rates, at 9.65%/year for newly opened/repetited customers with savings deposits of VND1,500 billion or more, term of 13 months.

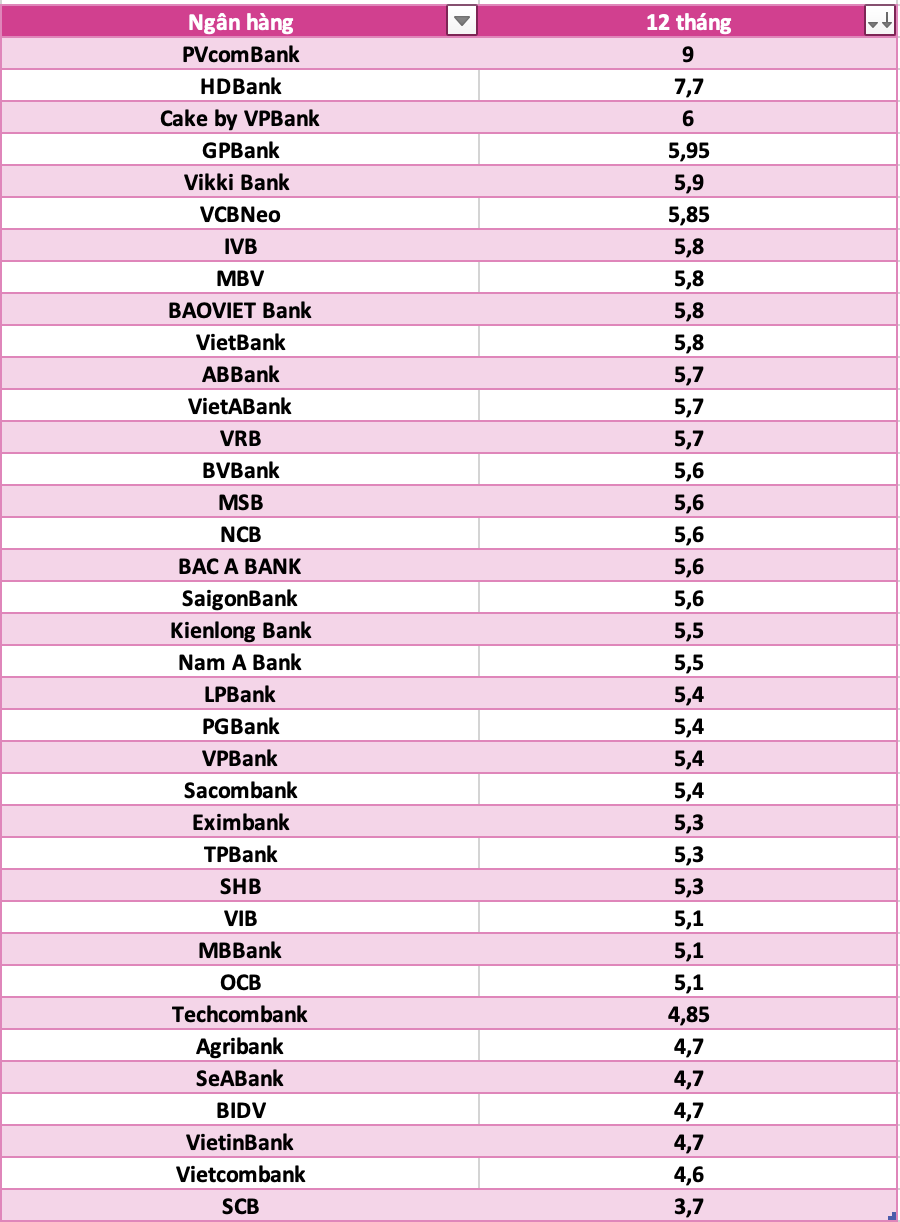

PVcomBank also applies a special interest rate of 9%/year for a term of 12-13 months when depositing money at the counter. The applicable condition is that customers must maintain a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion.

Vikki Bank applies the interest rate of 7.5%/year for term deposits of 13 months or more, with a minimum amount of VND 999 billion; Bac A Bank is listing the highest interest rate of 6% with a term of 18-36 months for deposits of over 1 billion; IVB applies 6.15% interest rates for 36 -month term, conditions applicable to deposits of VND 1,500 billion or more.

ACB applies an interest rate of 6%/year for a 13-month term with interest paid at the end of the term when customers have a deposit balance of VND200 billion or more.

At LPBank, for deposits of VND300 billion or more, the mobilization interest rate applied to customers receiving interest at the end of the term is 6.5%/year, receiving monthly interest of 6.3%/year and receiving interest at the beginning of the term is 6.07%/year.

Banks with interest rates exceeding 6%

Currently, interest rates above 6%/year are being listed by some banks for long-term deposits but do not require a minimum deposit amount.

Cake by VPBank applies 6%/year interest rate for 12-18 months and 6.3%/year for terms 24-36 months; Vikki Bank applies 6% interest rate for 24 -month term; VietABank applies 6% interest rates for terms of 18 and 24 months, 6.1% for 36 -month term; HDBank applies 6% interest rate for 18 -month term; GPBank applies the interest rate of 6.05%/year for 12-month term, 6.15%/year for terms of 13-36 months.

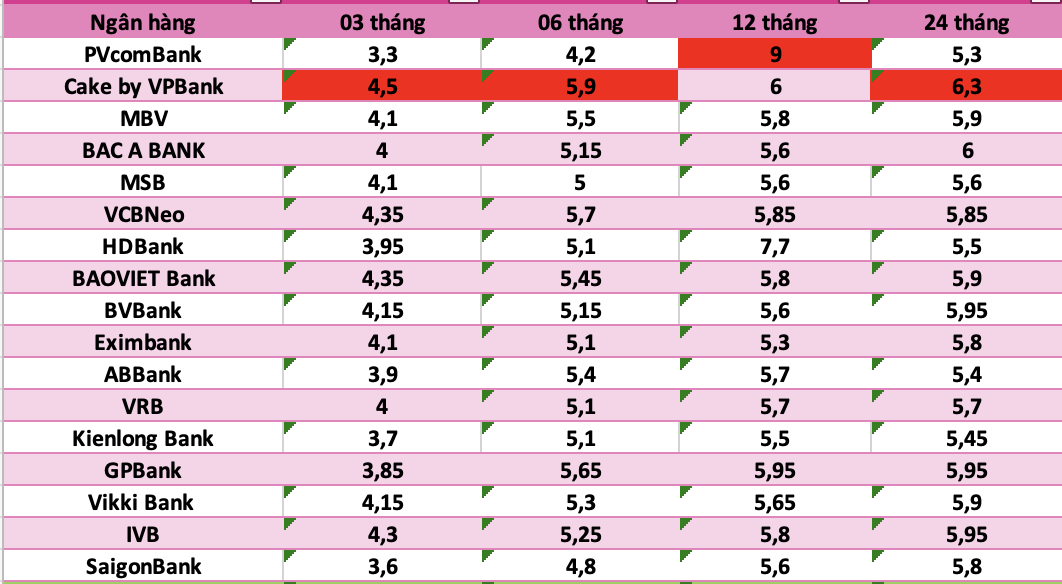

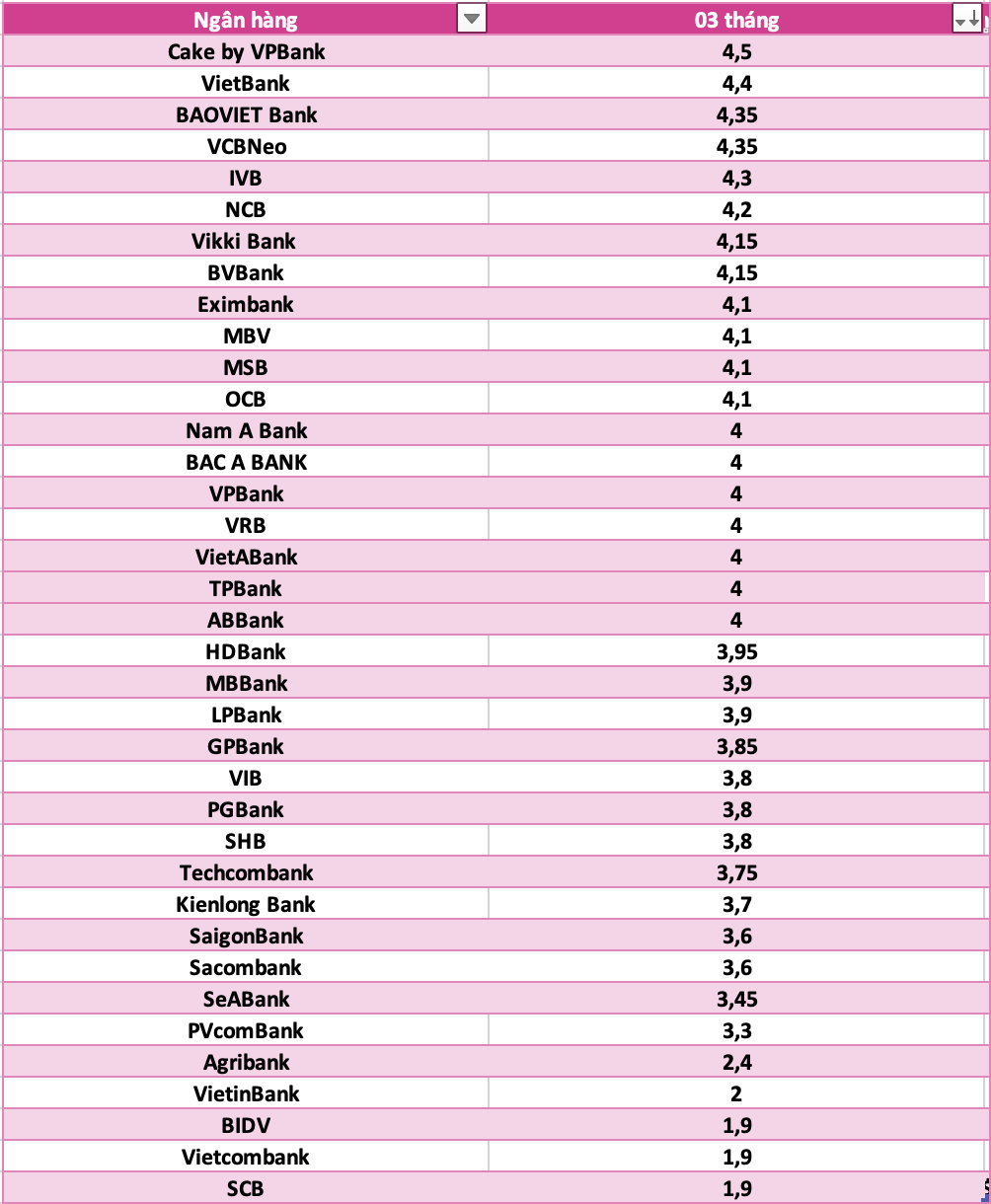

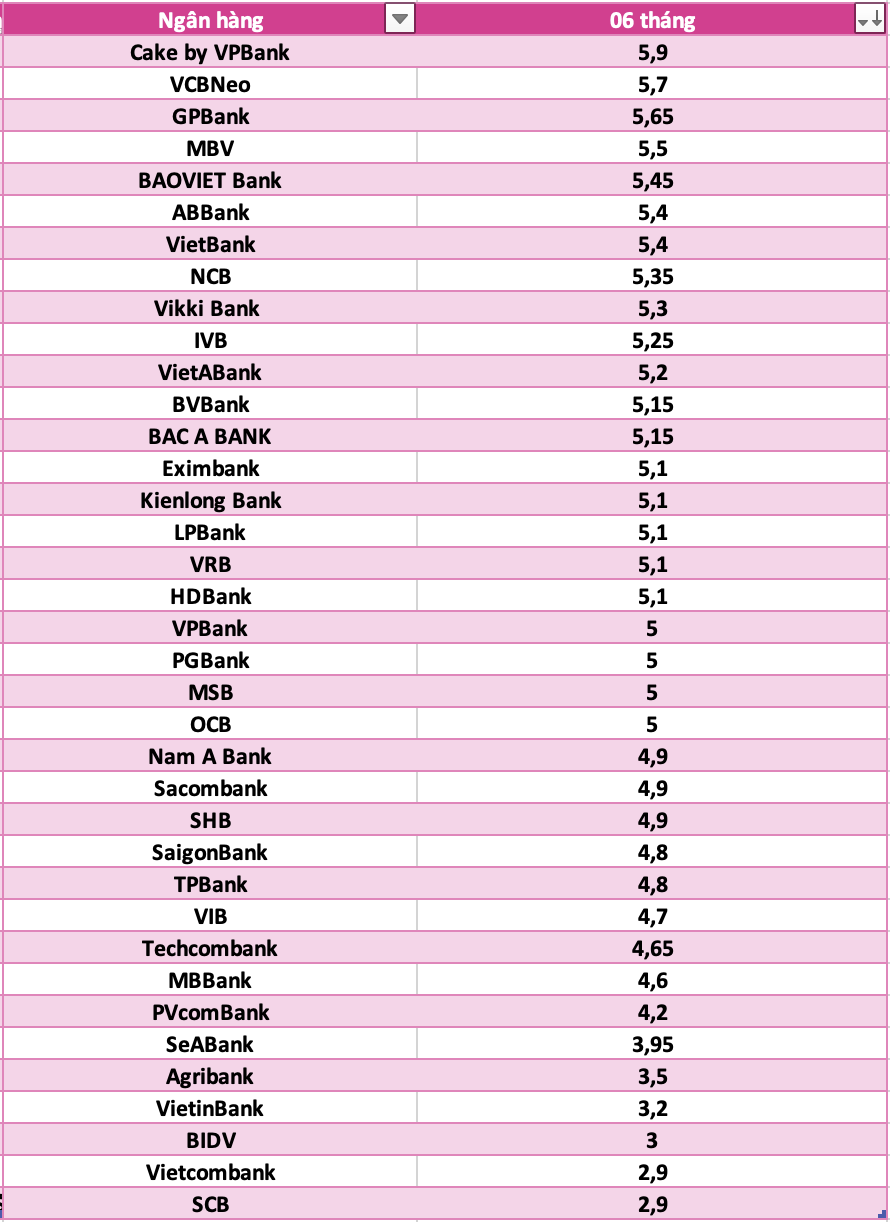

Statistics of banks with the highest savings interest rates today:

Compare the highest bank interest rates for 3-month terms

Interest rates for savings deposits at banks for 6-month terms

Want to deposit savings for 12 months, which bank has the highest interest rate?

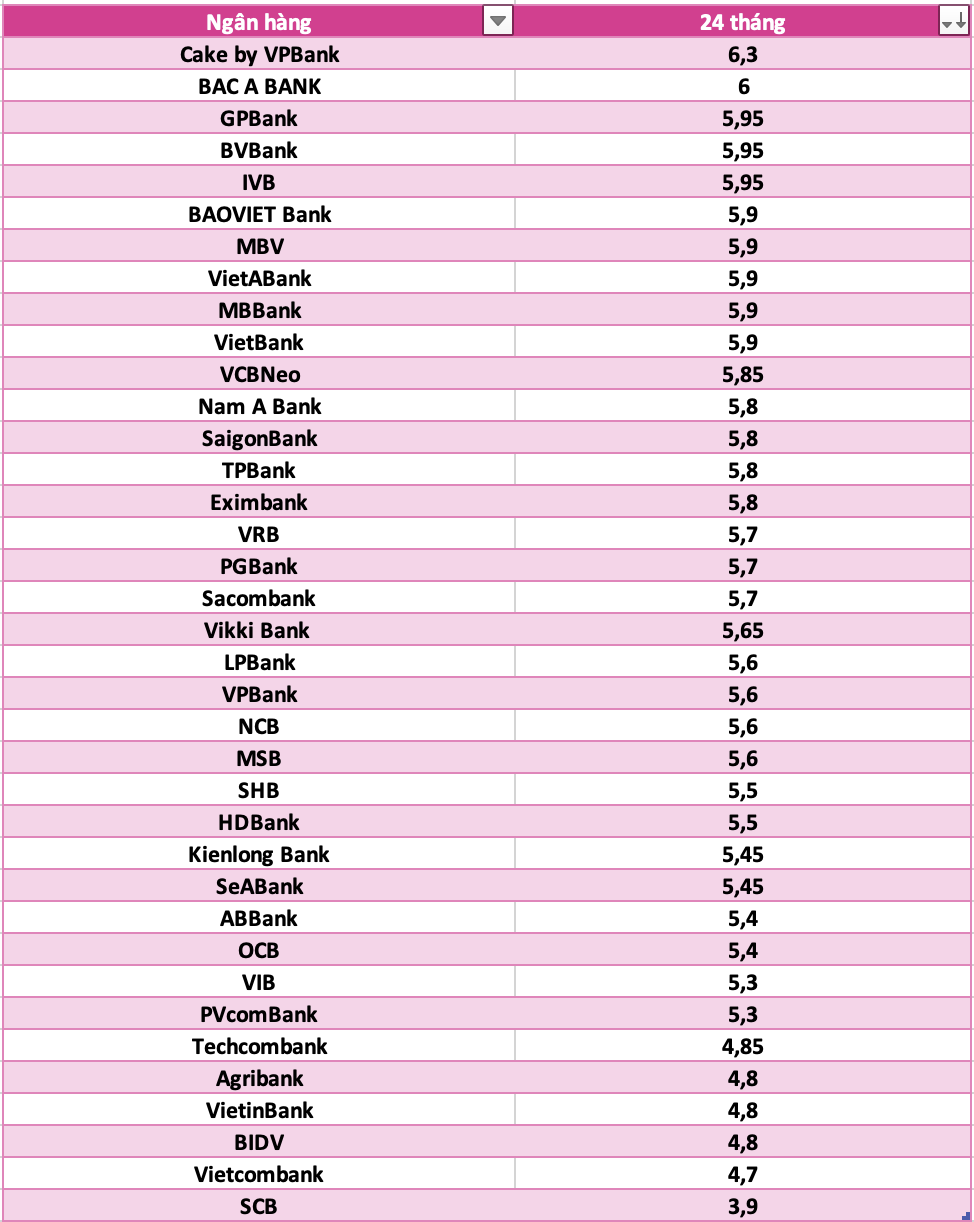

Latest update on Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest for 24-month terms.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles on interest rates HERE.