Many banks push interest rates up

The race to attract deposits continues to heat up as many banks push savings interest rates beyond the 8%/year mark.

In which, NCB applies a policy of adding up to 2%/year for customers depositing online savings through digital applications, with terms from 6 months or more and applicable until the end of January 31, 2026. Thanks to that, deposit interest rates for terms of 6-8 months reach 8.2%/year; terms of 9-11 months reach 8.25%/year; and terms of 12-36 months reach 8.3%/year.

Cake by VPBank also promotes incentives when adding interest rates for online deposits. For a 6-month term, the interest rate is added from 0.2–1%/year depending on the size of the deposit, bringing the actual interest rate to 7.3–8.1%/year.

At PVcomBank, customers depositing online savings on Fridays every week are added up to 1.5%/year. With the condition of depositing a minimum of 100 million VND and a term of 12 months or more, the actual interest rate can reach 7.6%/year for a 12-month term, 7.8%/year for a 13-month term and up to 8.3%/year for a term of 15–36 months.

The highest special interest rate is 6.5–9.65%/year

The highest deposit interest rate at banks currently fluctuates in the range of 6.5–9%/year, but to enjoy this interest rate, customers must meet special conditions on deposit size.

PVcomBank applies a special interest rate of 9%/year for terms of 12-13 months when depositing money at the counter, with the condition of maintaining a minimum balance of 2,000 billion VND.

MSB still applies an interest rate of 8% for customers depositing savings for a 12-month term, with deposits from 500 billion VND or more.

HDBank applies an interest rate of 8.1%/year for the 13-month term and 7.7%/year for the 12-month term, with the condition that the minimum balance is 500 billion VND.

Vikki Bank applies an interest rate of 8.4%/year for deposits from 13 months or more, with a minimum deposit amount of VND 999 billion.

For deposits from 500 million VND at OCB, this bank lists interest rates of 6.7%/year for terms of 12-15 months; term of 18 months 6.9%/year; term of 21 months 7%/year; term of 24 months 7.1%/year; term of 36 months 7.3%/year.

Viet A Bank applies an interest rate of over 6%/year for Dak Tai Savings product, with an interest rate ranging from 6.0%/year for a 6-month term to 6.8%/year for an 18-month term. The application condition is a minimum deposit amount of 100 million VND, transactions at the counter and interest payment at the end of the term.

For deposits of over 1 billion VND at Bac A Bank, the interest rate is increased to 6.4%/year for terms of 6-8 months; 6.45%/year for terms of 9-11 months; 6.5%/year for terms of 12 months; 6.6%/year for terms of 13-15 months and 6.7%/year for terms of 18-36 months.

Nam A Bank applies an interest rate of 6.5%/year for a 24-month term and 6.3%/year for a 36-month term, with the condition that the deposit amount is from 500 billion VND or more.

Many banks list interest rates above 6.5%/year without conditions

In addition to special interest rate packages, many banks are currently listing interest rates above 6.5%/year for long terms without requiring a minimum deposit amount.

Vikki Bank applies an interest rate of 6.5%/year for 6-month terms; 6.6%/year and 6.7%/year respectively for 12-month and 13-month terms. Cake by VPBank maintains an interest rate of 7.1%/year for terms from 6–36 months.

Bac A Bank lists an interest rate of 6.5%/year for terms from 6-11 months; 6.5%/year for terms of 12 months; 6.6%/year for terms of 13-15 months and 6.7%/year for terms from 18-36 months.

OCB applies an interest rate of 6.5%/year for terms of 12-15 months; term of 18 months 6.7%/year; term of 21 months 6.8%/year; term of 24 months 6.9%/year; term of 36 months up to 7.1%/year.

VIB applies an interest rate of 6.5%/year for 12-month terms; PVcomBank applies an interest rate of 6.8%/year for terms from 15–36 months.

PGBank applies an interest rate of 7.1%/year for terms of 6-9 months; term of 12-13 months is 7.2%/year; term of 18-36 months is 6.8%/year.

MBV applies an interest rate of 6.5%/year for terms of 6-11 months; 7.2%/year for terms of 12-36 months.

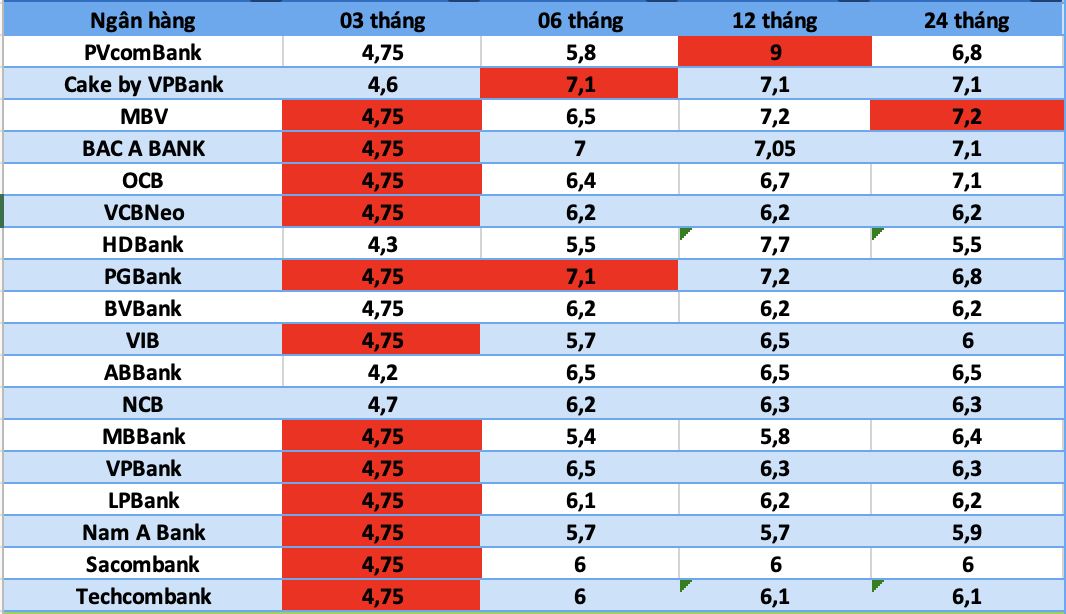

Statistics of banks with the highest savings deposit interest rates today:

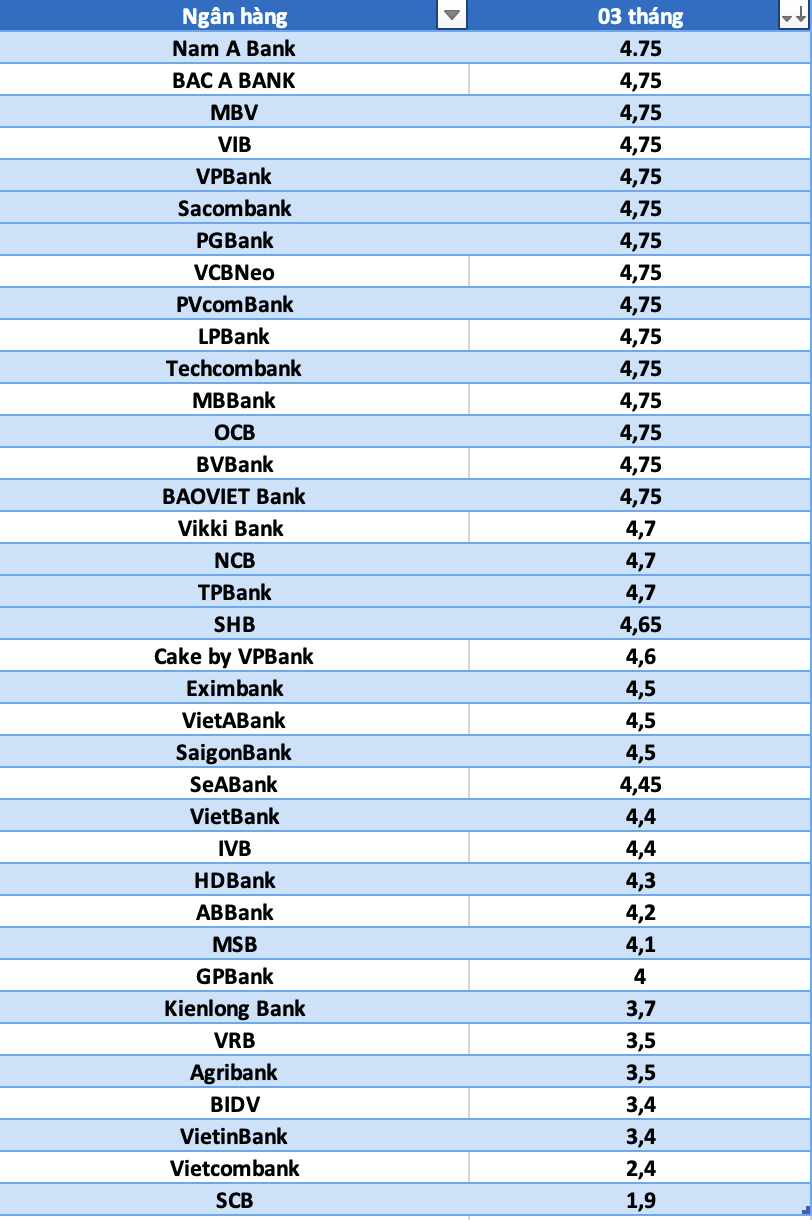

Comparison of the highest bank interest rate for a 3-month term

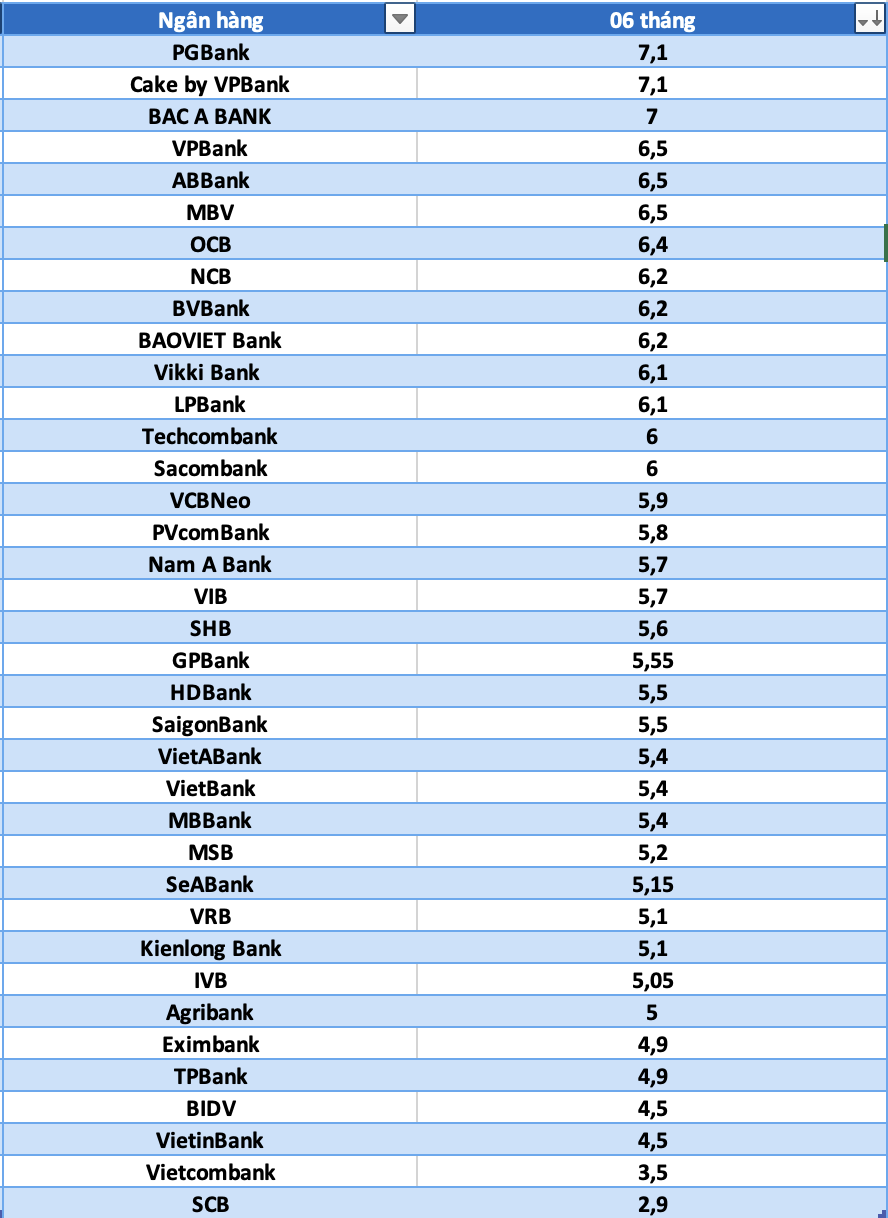

Savings deposit interest rates at banks for a 6-month term

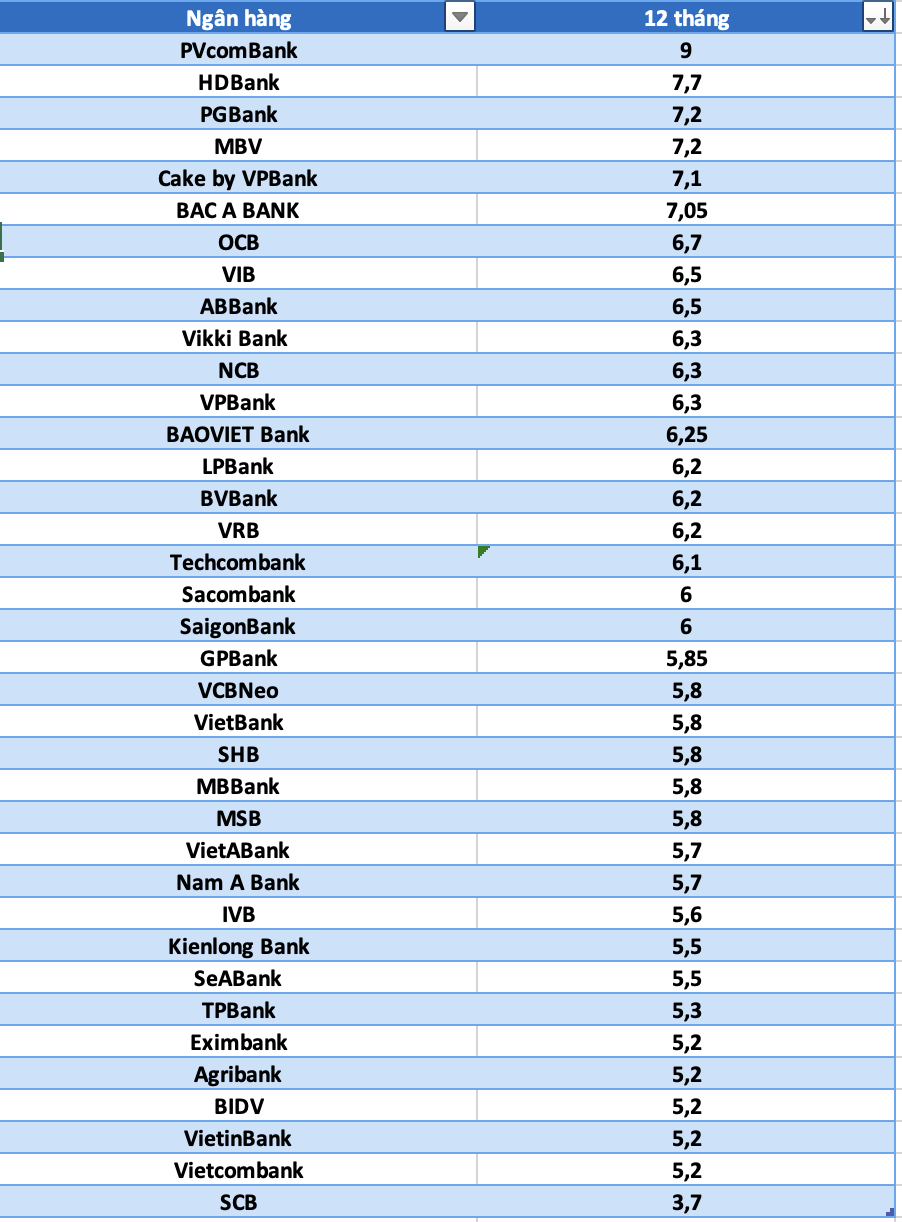

12-month savings deposit, which bank's interest rate is the highest?

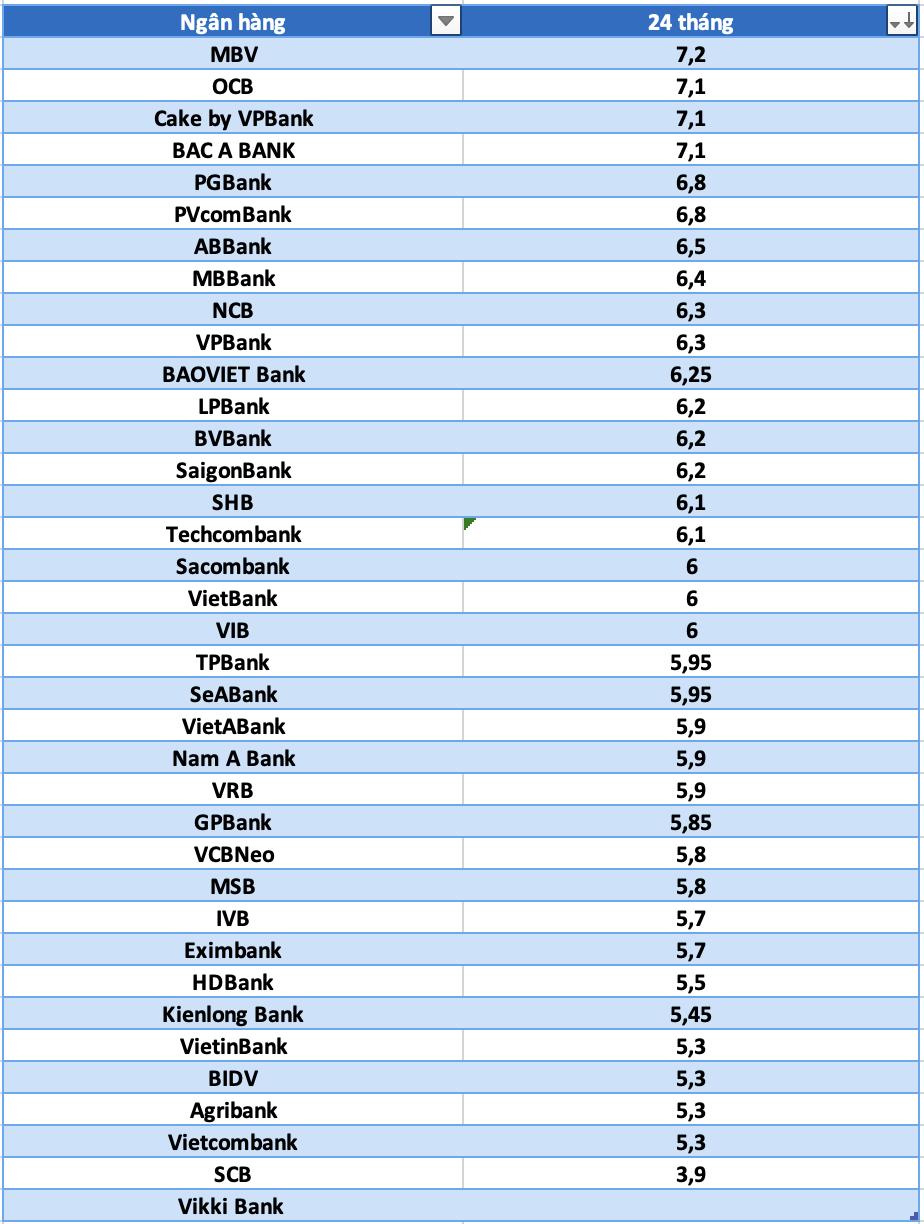

Agribank bank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest for the 24-month term

Readers can refer to more articles about interest rates HERE

It's a bit of a bit of a bit of a bit of a bit of a bit.