Special interest rates up to 9.65%

ABBank recently announced an interest rate of up to 9.65%/year for customers depositing savings for a 13-month term, applicable to customers with deposit balances from 1,500 billion VND.

Thus, ABBank is leading the market in terms of special interest rates. Currently, the bank lists the 13-month term interest rate for ordinary customers at 6.3% - 6.5%/year depending on whether the deposit is at the counter or online.

PVcomBank is also applying a special interest rate of 9%/year for terms of 12–13 months when depositing money at the counter, with the condition of maintaining a minimum balance of 20,000 billion VND.

MSB still applies an interest rate of 8% for customers depositing savings for a term of 12 months, with deposits from 500 billion VND or more.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with a minimum balance of 500 billion VND.

Vikki Bank applies an interest rate of 8.4%/year for deposits from 13 months or more, with a minimum deposit amount of 999 billion VND.

For deposit accounts from 500 million VND at OCB, this bank lists interest rates of 6.7%/year for terms of 12-15 months; term of 18 months 6.9%/year; term of 21 months 7%/year; term of 24 months 7.1%/year; term of 36 months 7.3%/year.

Viet A Bank applies an interest rate of over 6%/year for the Dak Tai Savings product, with interest rates ranging from 6.0%/year for a 6-month term to 6.8%/year for a 18-month term. The applicable condition is a minimum deposit amount of 100 million VND, transaction at the counter and interest payment at the end of the term.

For deposits over 1 billion VND at Bac A Bank, the interest rate is increased to 6.4%/year for terms of 6–8 months; 6.45%/year for terms of 9–11 months; 6.5%/year for terms of 12 months; 6.6%/year for terms of 13–15 months and 6.7%/year for terms of 18–36 months.

Nam A Bank applies an interest rate of 6.5%/year for a 24-month term and 6.3%/year for a 36-month term, provided that the deposit amount is 500 billion VND or more.

Many banks list interest rates above 6.5%/year without conditions attached

In addition to special interest rate packages, many banks are also listing interest rates above 6.5%/year for long terms without requiring a minimum deposit amount.

Vikki Bank applies an interest rate of 6.5%/year for 6-month terms; 6.6%/year and 6.7%/year respectively for 12-month and 13-month terms. Cake by VPBank maintains an interest rate of 7.1%/year for terms from 6–36 months.

Bac A Bank lists interest rates of 6.5%/year for terms from 6–11 months; 6.5%/year for terms of 12 months; 6.6%/year for terms of 13–15 months and 6.7%/year for terms from 18–36 months.

OCB applies an interest rate of 6.5%/year for terms of 12 – 15 months; 18-month term 6.7%/year; 21-month term 6.8%/year; 24-month term 6.9%/year; 36-month term up to 7.1%/year.

VIB applies an interest rate of 6.5%/year for a 12-month term; PVcomBank applies an interest rate of 6.8%/year for terms from 15–36 months.

PGBank applies an interest rate of 7.1%/year for terms of 6-9 months; terms of 12-13 months are 7.2%/year; terms of 18-36 months are 6.8%/year.

MBV applies an interest rate of 6.5%/year for terms of 6-11 months; 7.2%/year for terms of 12-36 months.

BVBank applies interest rates of 6.6%/year for 12-month terms; 6.9%/year for 15-month terms; 7%/year and 7.1%/year for 18- and 24-month terms.

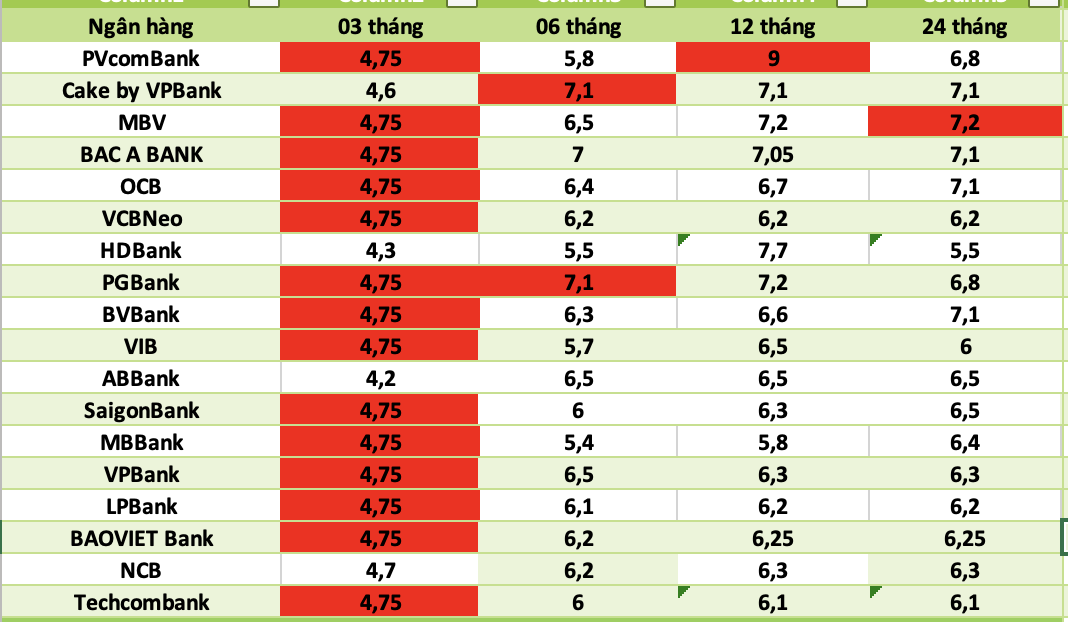

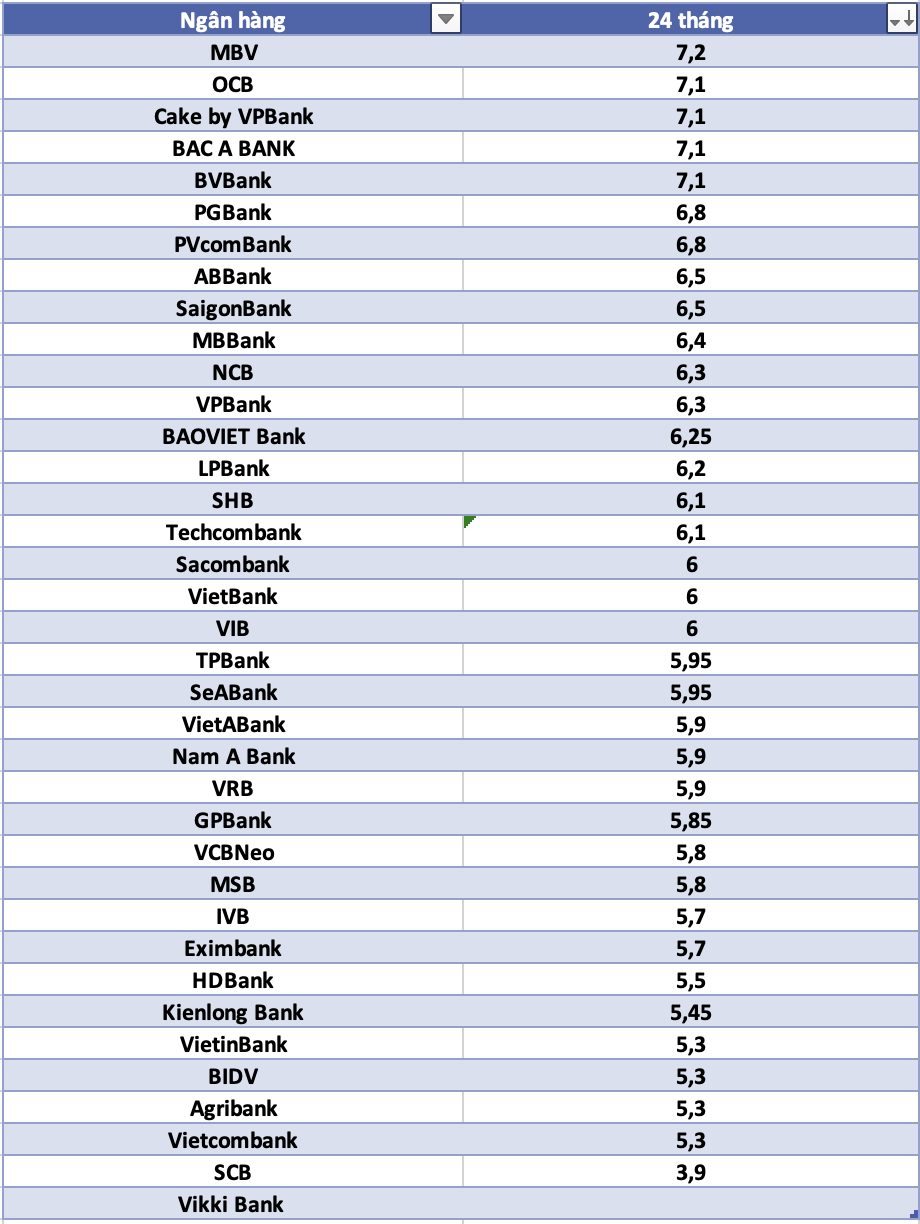

Statistics of banks with the highest savings deposit interest rates today:

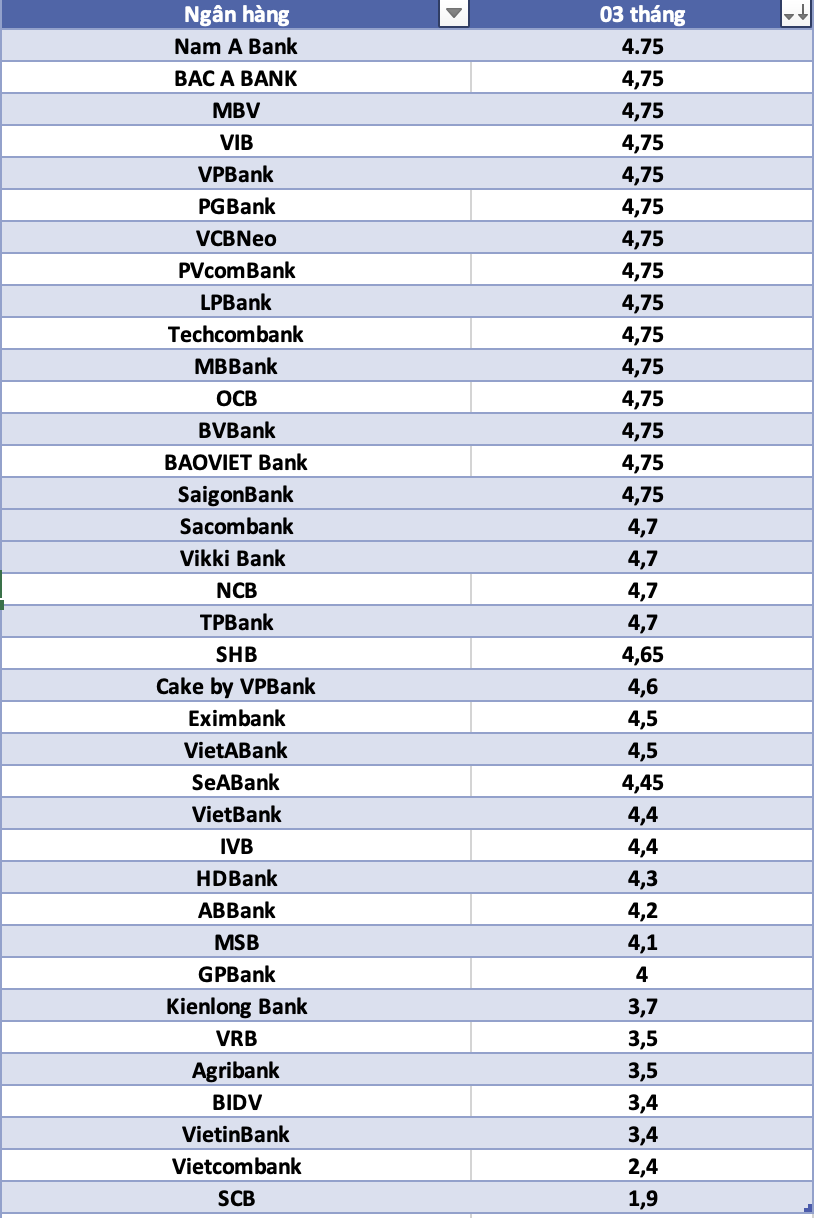

Comparing the highest bank interest rates for a 3-month term

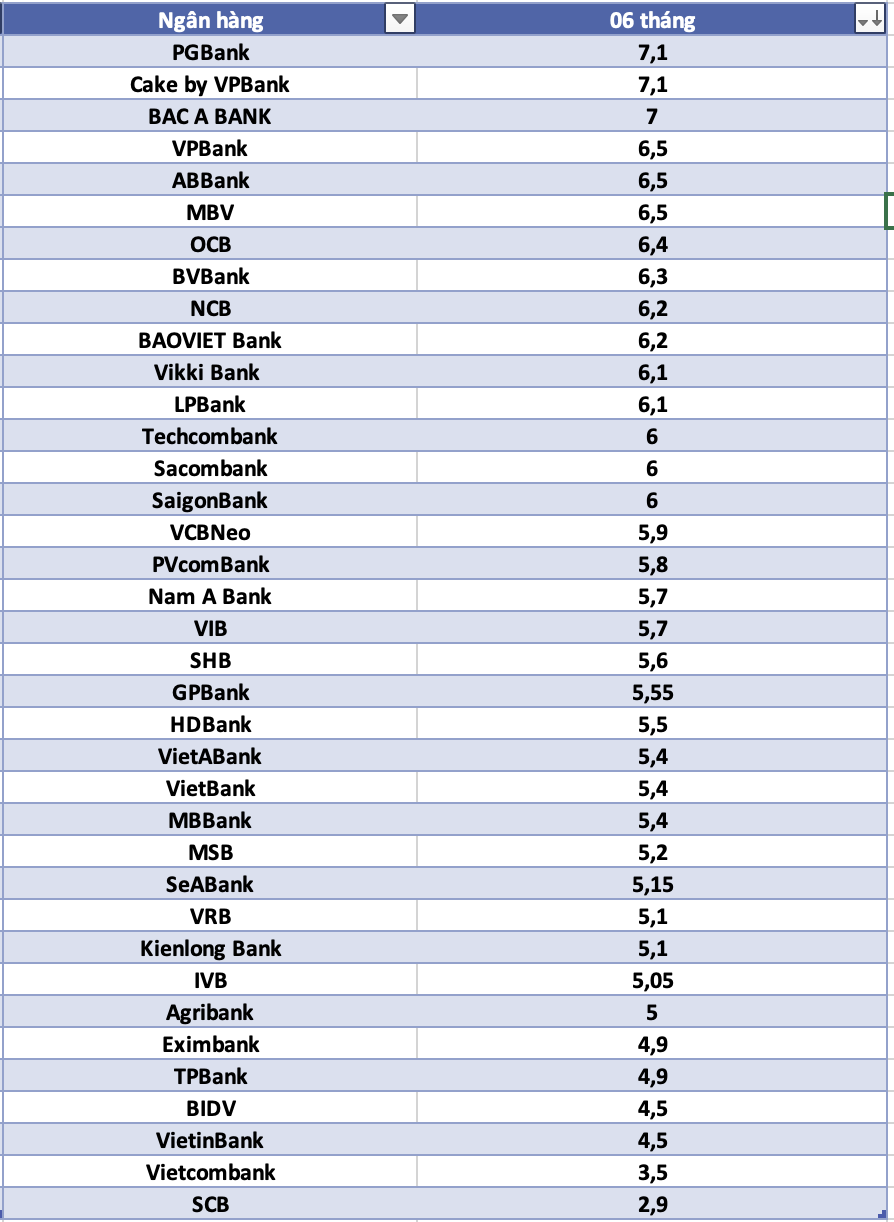

Interest rates for 6-month term savings deposits at banks

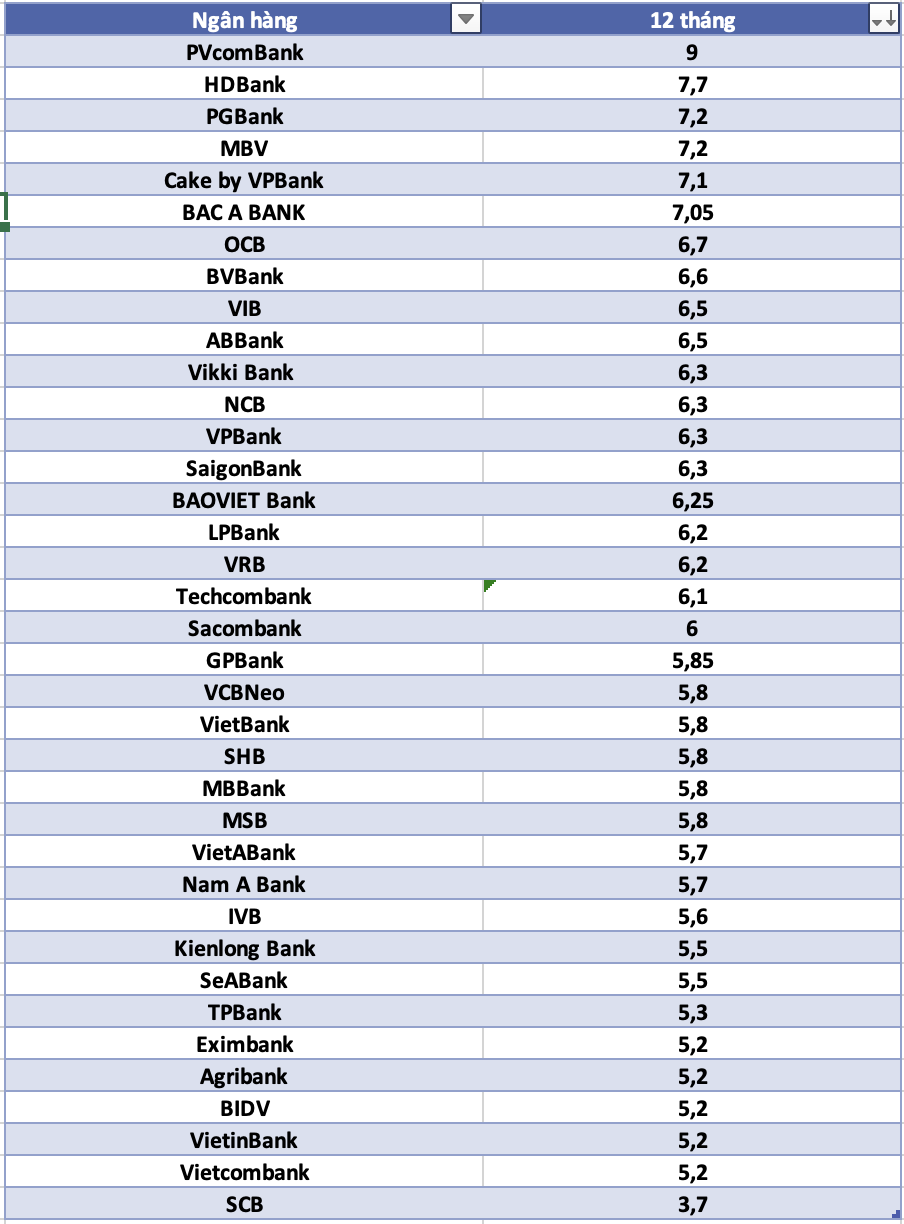

12-month savings deposit, which bank's interest rate is the highest?

Agribank bank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest for 24-month term

Interest rate information is for reference only and may change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.