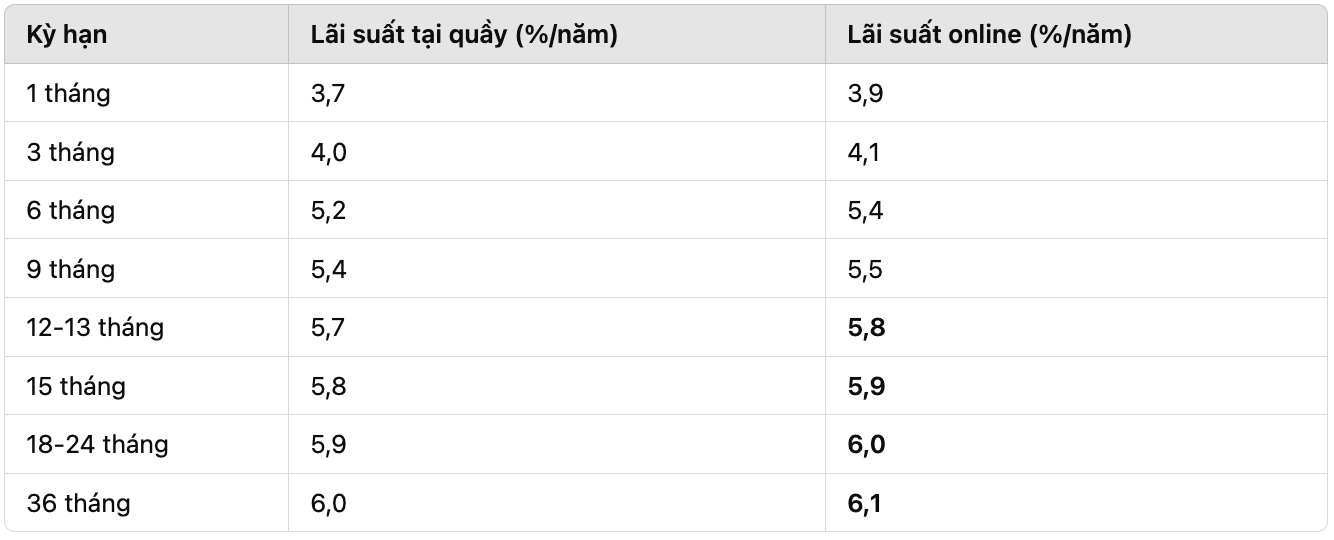

Viet A Bank increases long-term interest rates

Interest rates on February 13, 2025 recorded that Viet A Bank has just adjusted to increase interest rates for many long terms, becoming the third bank to adjust interest rates after Tet.

After 3 months of keeping the same, Viet A Bank has increased the interest rate for 12-36 month term deposits by 0.1%/year. Currently, the highest interest rate at this bank is 6.1%/year for online savings deposits with a term of 36 months.

"Big guy" BIDV adjusts

Recently, the "big guy" BIDV has applied a new interest rate schedule from February 5, 2025, marking the first interest rate increase in more than two years. This is the first adjustment by this bank since March 2024.

Deposit at the counter:

Term 24-36 months: 4.8%/year (+0.1 percentage point compared to before).

Term 12-18 months: 4.7%/year (unchanged).

Term 6-9 months: 3%/year (unchanged).

Term 3-5 months: 2%/year (unchanged).

1-2 month term: 1.7%/year (unchanged).

Send savings online:

Term 24-36 months: 4.9%/year (+0.1% compared to deposit at the counter).

Term 12-18 months: 4.7%/year.

Term 6-11 months: 3.3%/year.

Term 3-5 months: 2.3%/year.

Term 1-2 months: 2%/year.

Although the increase is not significant, this is a signal that the trend of increasing deposit interest rates has spread to the group of state-owned banks. BIDV is currently the bank with the largest deposit market share in the system, with VND 1.95 quadrillion in deposits by the end of 2024.

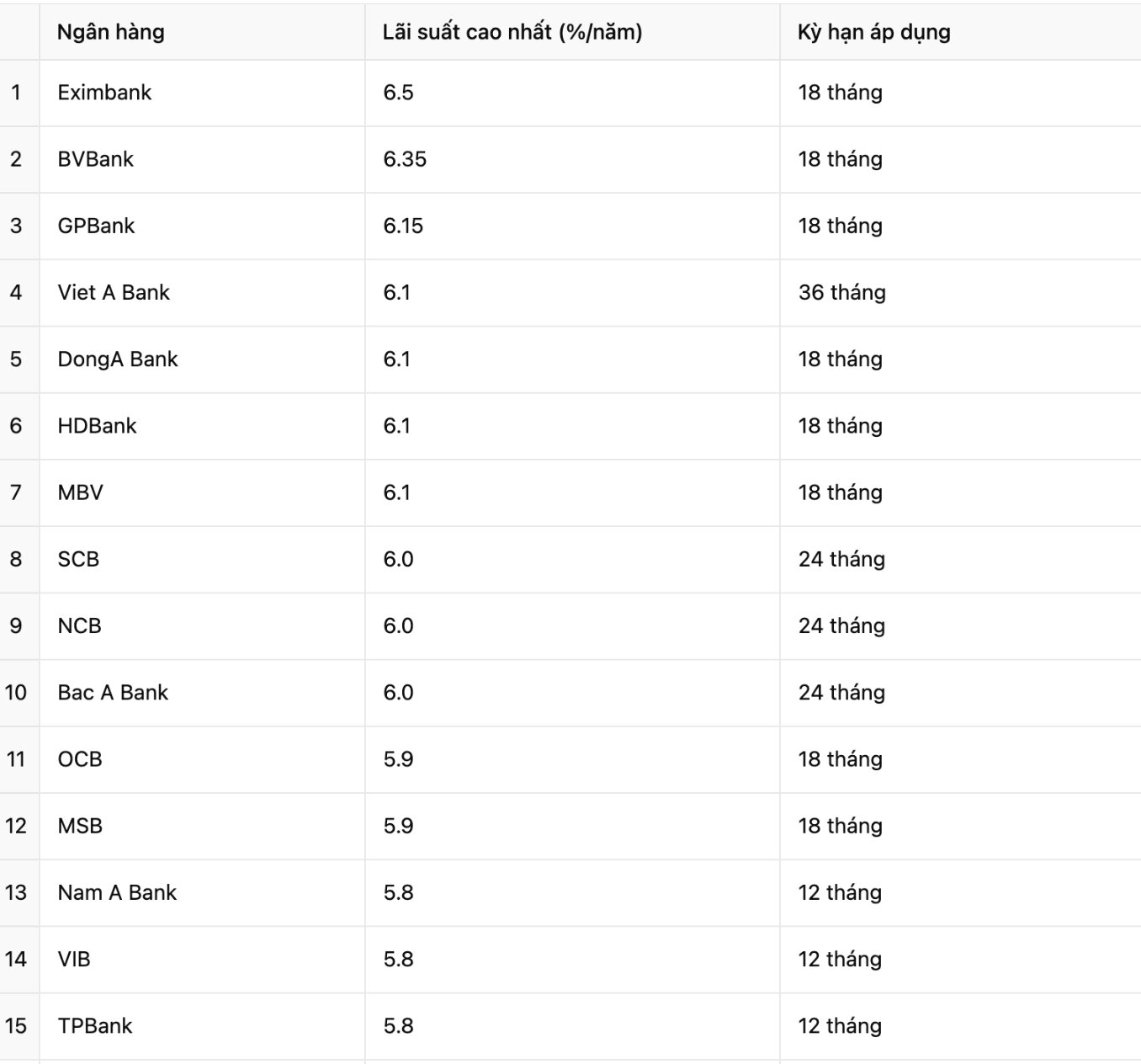

Highest deposit interest rates at banks on February 13, 2025

Deposit interest rates continue to fluctuate due to banks’ capital needs in the early part of the year. According to analysts, some banks may continue to adjust to attract deposits, especially in the group of joint stock commercial banks.

Upcoming interest rate trends

According to analysis from MBS, the trend of increasing deposit interest rates has appeared since the second half of 2024 and will last until early 2025. In January 2025, 12 banks increased deposit interest rates, with adjustments ranging from 0.1 - 0.9 percentage points per year.

Private commercial banks are the leading group in raising interest rates, mainly to ensure capital sources for this year's credit plan.

MBS's analysis team forecasts that 12-month deposit interest rates at major commercial banks will fluctuate around 5 - 5.2% in 2025.

However, the State Bank has directed to keep deposit interest rates stable and continue to strive to reduce lending interest rates to support the economy. This will be an important factor affecting interest rate movements in the coming time.