Year-end savings interest rates increased significantly

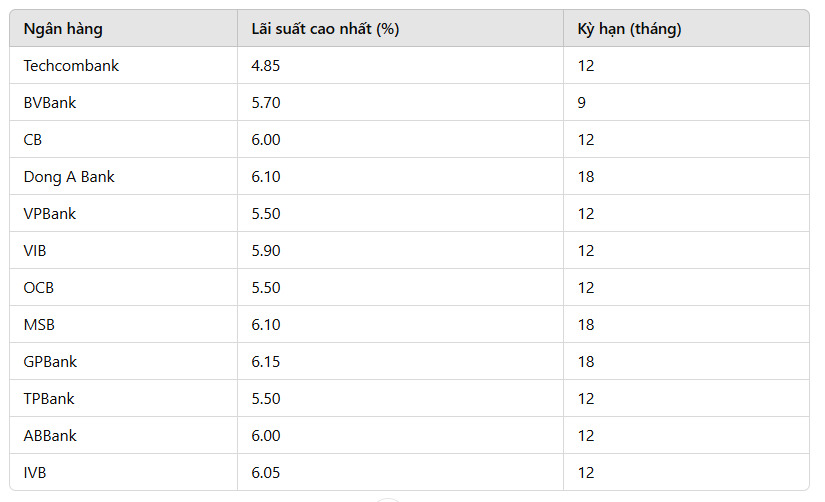

According to statistics, 12 banks have increased deposit interest rates since the beginning of December, including: Techcombank, BVBank, CB, Dong A Bank, VPBank, VIB, OCB, MSB, GPBank, TPBank, ABBank and IVB.

Currently, savings interest rates range from 4.7% to 6.15% per year for common terms from 6 to 12 months. In the second half of 2024, this interest rate may increase by about 0.5-1% depending on the term. The main reason is the high demand for credit in the economy when businesses expand production activities at the end of the year.

The policy of increasing savings interest rates is applied to make the Vietnamese Dong more attractive in the context of the USD/VND exchange rate trending up. However, the real positive interest rate (after deducting inflation) is still low, causing depositors to be cautious when choosing an investment channel.

Some experts believe that saving is a safer option than risky investment channels such as real estate or stocks at this stage. Although the USD exchange rate has increased, this is still under control, and deposit interest rates will be maintained at an attractive level to ensure domestic capital flows.

The monetary policy of the US Federal Reserve (Fed) can also affect interest rates in Vietnam. If the Fed lowers interest rates, the pressure to increase domestic deposit interest rates will decrease, giving savers more flexible options.

If you have idle money, saving is currently a reasonable choice, especially with long terms of 12 months or more to benefit from stable interest rates and credit growth. However, you need to carefully consider inflation and exchange rate factors before making a decision.

Banks with the highest interest rates at various terms

For a 1-month term, the bank with the highest interest rate is Cbbank at 4.15%/year. Nam A Bank is second, applying an interest rate of 4.5%/year. Ranked third is a group of banks including Vietbank, OCB, IVB and Bvbank, with an equal interest rate of 4.0%/year.

Nam A Bank continues to lead in the 3-month term with an interest rate of 4.7%/year. Cbbank follows closely with an interest rate of 4.35%/year, while Abbank ranks third with an interest rate of 4.45%/year, providing an attractive choice for customers.

For the 6-month term, Cbbank stands out with the highest interest rate, reaching 5.85%/year. Gpbank is in second place, applying an interest rate of 5.35%/year. Bac A Bank completes the top 3 with an interest rate of 5.15%/year.

For the 9-month term, Cbbank once again holds the leading position with an interest rate of 5.85%/year. Dong A Bank and Gpbank are tied for second place, both applying an interest rate of 5.7%/year, providing many competitive options.

The 12-month term recorded Gpbank leading with an interest rate of 6.05%/year, slightly higher than its competitors. In second place is Cbbank with an interest rate of 6.0%/year, equal to Bac A Bank and Baovietbank, creating even competition.

Finally, at the 18-month term, Gpbank continued to maintain its number one position with an interest rate of 6.15%/year. Oceanbank and Dong A Bank ranked second with an interest rate of 6.1%/year, while Bac A Bank ranked third with an interest rate of 5.95%/year.

See more daily bank interest rates HERE.