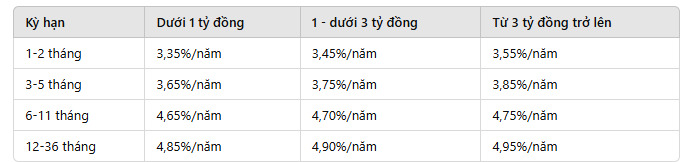

According to Lao Dong, on February 4, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) unexpectedly increased its deposit interest rate after having just reduced it by 0.2%/year for short-term terms previously. Currently, online deposit interest rates range from 3.35% - 4.95%/year, depending on the deposit amount and term.

The bank also applies a policy of adding 0.5%/year for the first deposit account and 0.3%/year for customers who prioritize deposits for 3-5 months. The actual mobilization interest rate can exceed 5%/year.

Bank pays high interest up to 9.0%

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.0%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.0%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of initial interest or periodic interest.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

In addition, lower savings rates, from 7.0%/year, are also listed at many banks.

High interest rates with no deposit conditions

1 month term:

Eximbank is currently leading with the highest interest rate, reaching 4.5%/year (weekend). Second place is MBV, KienLongBank with 4.3%/year. Bac A Bank and OCB are in third place, applying an interest rate of 4.0%/year.

3 month term:

Eximbank continues to lead with the highest interest rate of 4.75%/year (weekend). MBV ranks second with 4.6%/year. Bac A Bank and NCB rank third, with interest rates of 4.2%/year and 4.3%/year, respectively.

6 month term:

CBBank stands out with the highest interest rate, reaching 5.85%/year, followed by KienLongBank with an interest rate of 5.8%/year. Bac A Bank ranks third with 5.55%/year. MBV and NCB follow, both applying an interest rate of 5.5%/year.

9 month term:

CBBank continues to lead with an interest rate of 5.85%/year. MBV ranks second with 5.6%/year. Bac A Bank ranks third, with an interest rate of 5.45%/year.

12 month term:

MBV and Gpbank are in the lead with an interest rate of 6%/year. Bac A Bank is in second place with 5.8%/year. CBBank is in third place, also with 6.0%/year.

18 month term:

Eximbank leads the long-term with an interest rate of 6.6%/year. Bac A Bank follows with an interest rate of 6.2%/year. MBV, Oceanbank, and KienLongBank are ranked third, with an interest rate of 6.1%/year.