Deposit interest rates increase slightly, remain stable in the medium term

Vietcombank Securities Company (VCBS) believes that long-term deposit interest rates will continue to increase from the beginning of 2025, with an additional adjustment of 0.2 - 0.3 percentage points in the coming time. Lending interest rates may also increase slightly due to increased credit demand, especially in the context of businesses expanding production and business after COVID-19.

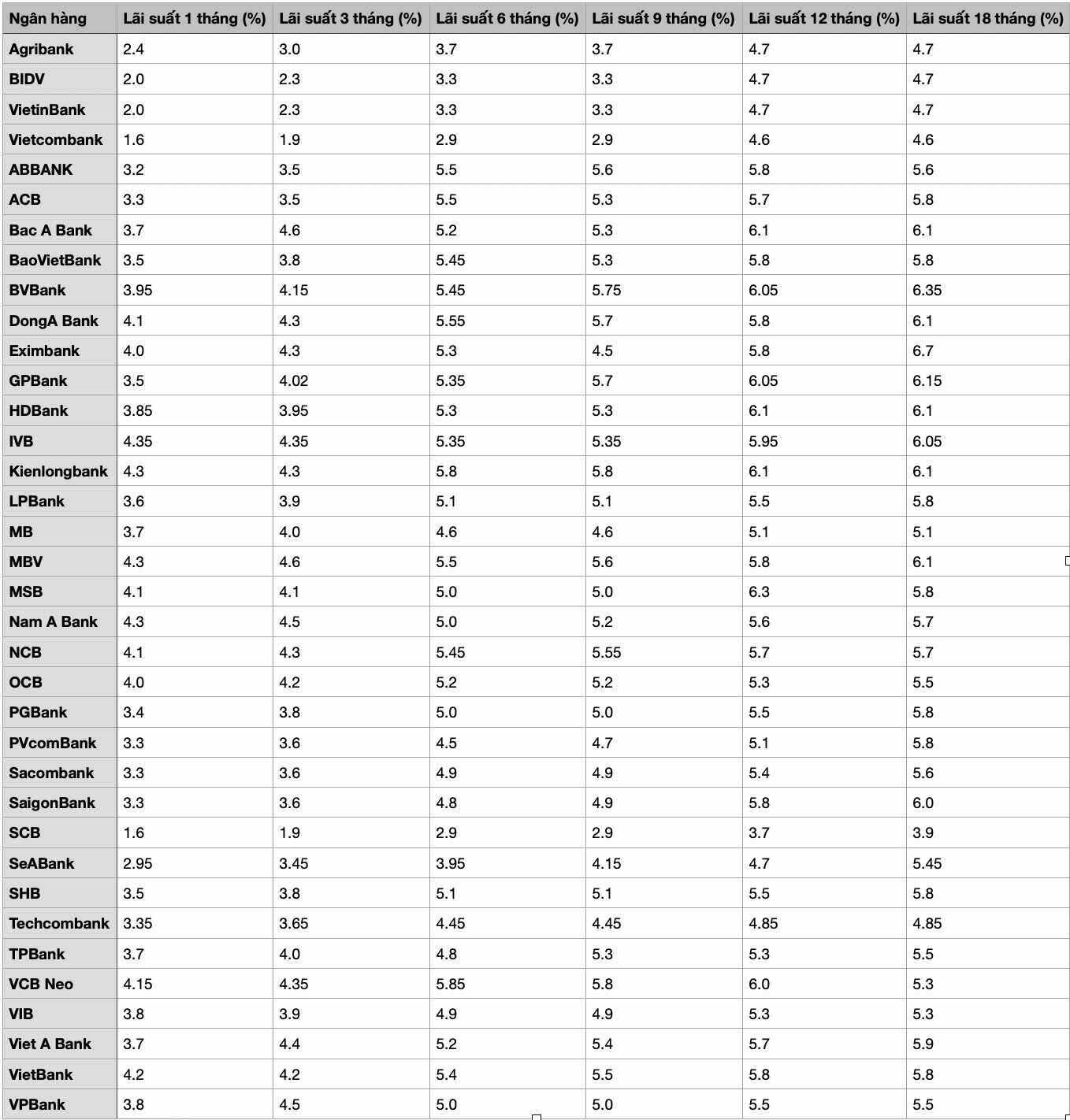

In fact, since the end of 2024, interest rates have clearly differentiated between large and small banks. Currently, the highest mobilization interest rates are mainly concentrated in 12- and 18-month terms, with rates above 6%/year at some banks.

The average deposit interest rate is forecast to increase by about 0.5% in 2025, but this increase will not have a major impact on the lending interest rate level. The State Bank is also expected to continue to maintain a flexible monetary policy to support economic growth and control inflation.

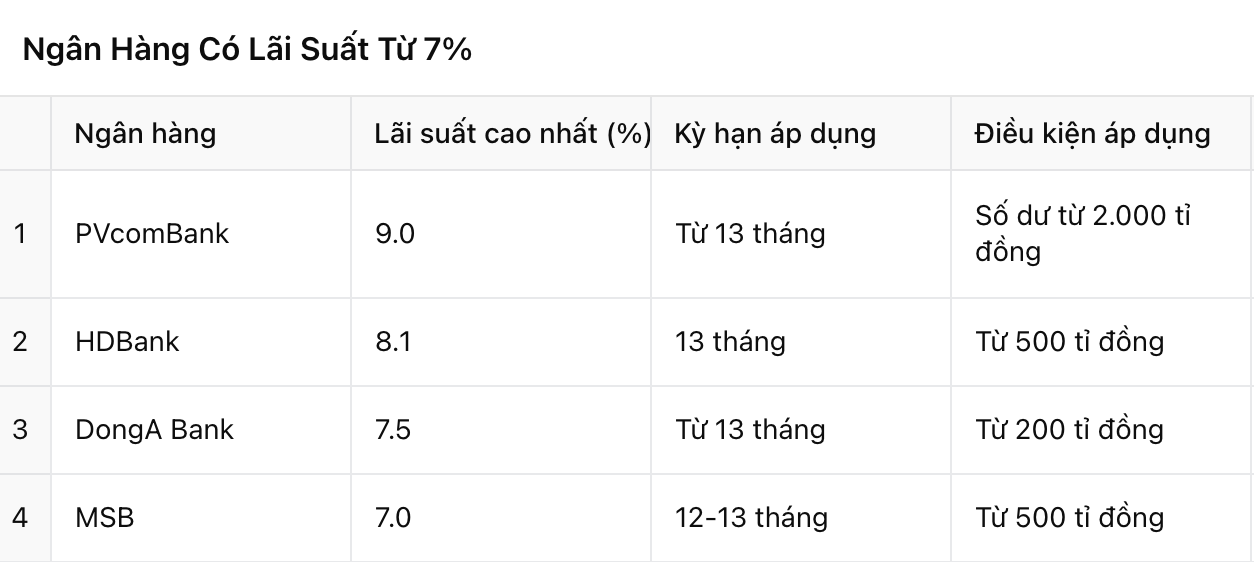

Which bank is paying interest rate from 7%/year?

According to the latest update, some banks are applying special interest rates of over 7%/year:

PVcomBank continues to lead the market with a special interest rate of 9.0%/year for deposits of VND 2,000 billion or more.

HDBank applies an interest rate of 8.1%/year for a 13-month term, for customers depositing from 500 billion VND.

Dong A Bank listed an interest rate of 7.5%/year for terms of 13 months or more, applied to amounts from 200 billion VND.

MSB is applying an interest rate of 7.0%/year for 12-13 month term savings books with a balance of 500 billion VND or more.

In addition, many other banks also maintain deposit interest rates above 6%/year, helping savers have more optimal options in the context of interest rates tending to increase.

Details of the latest savings interest rates at banks (January 2025):