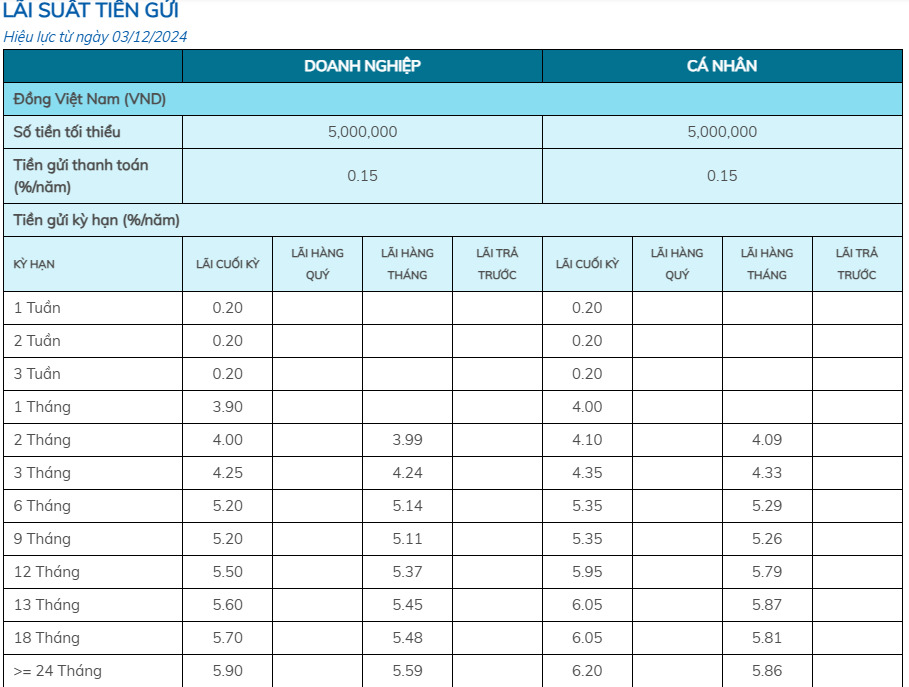

According to Lao Dong, on December 6, after increasing the deposit interest rate to the highest level of 6.5%/year in early December, Indovina Bank Joint Venture Bank (IVB) reduced the 18-month term interest rate to 6.05%/year and the 24-36-month term to 6.2%/year, while the short- and medium-term interest rates remained the same.

However, IVB is currently listing interest rates as high as 6.45%/year for flexible savings deposits with long terms of 5-15 years. In addition, in this deposit category, interest rates for terms of 12-48 months are also applied within the range of 5.95-6.25%/year.

Should I save money at the end of the year?

Currently, savings interest rates range from 4.7% to 6.5% per year for common terms from 6 to 12 months. In the second half of 2024, this interest rate may increase by about 0.5-1% depending on the term. The main reason is the high demand for credit in the economy when businesses expand production activities at the end of the year.

The policy of increasing savings interest rates is applied to make the Vietnamese Dong more attractive in the context of the USD/VND exchange rate trending up. However, the real positive interest rate (after deducting inflation) is still low, causing depositors to be cautious when choosing an investment channel.

Some experts believe that saving is a safer option than risky investment channels such as real estate or stocks at this stage. Although the USD exchange rate has increased, this is still under control, and deposit interest rates will be maintained at an attractive level to ensure domestic capital flows.

In addition, the monetary policy of the US Federal Reserve (Fed) can also affect interest rates in Vietnam. If the Fed lowers interest rates, the pressure to increase domestic deposit interest rates will decrease, giving savers more flexible options.

If you have idle money, saving is now a reasonable choice, especially with long terms of 12 months or more to benefit from stable interest rates and credit growth. However, you need to carefully consider inflation and exchange rate factors before making a decision.

Which term deposit and bank is the best?

The highest 1-month savings interest rate is 4.15%/year, applied at Nam A Bank, followed by OceanBank with 4.1%/year and Bac A Bank with 4.05%/year.

For the 3-month term, the highest interest rate is Nam A Bank with 4.7%/year. Followed by OceanBank with 4.4%/year and Bac A Bank and IVB with 4.35%/year.

The 6-month term recorded the highest interest rate of 5.65%/year at CBBank. Three banks NCB, GPBank and Dong A Bank followed with an interest rate of 5.55%/year. Bac A Bank ranked third with an interest rate of 5.5%/year.

For the 9-month term, IVB leads with an interest rate of 5.95%/year; GPBank takes the second place with an interest rate of 5.9%/year; NCB follows with an interest rate of 5.7%/year, followed by Bac A Bank and CBBank with 5.6%/year, and Dong A Bank applies a rate of 5.55%/year.

For 12-month term, GPbank leads with an interest rate of 6.25%/year, Bac A Bank is second with an interest rate of 5.9%/year. Next are three banks listing an interest rate of 5.8%/year including SaigonBank, NCB, CBBank.

For the 18-month term, GPBank leads with an interest rate of 6.35%/year, followed by Bac A Bank and IVB with high interest rates of 6.25%/year. Next are three banks listing interest rates of 6.1%/year, including Dong A Bank, HDBank, and OceanBank.

See more daily bank interest rates HERE.