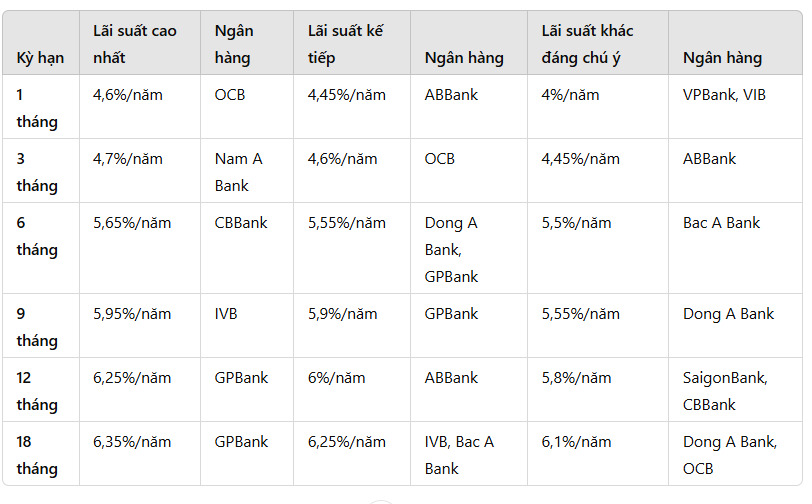

Differentiated savings interest rates

Currently, savings interest rates are still kept at a reasonable level, bringing stable profits to depositors in the short term. In this context, economic experts believe that mobilization interest rates will remain stable, with a slight increase of about 0.2%/year by the end of the year. This is mainly due to good control of inflation and economic stability, along with little pressure from international central banks such as the US Federal Reserve when they reduce interest rates.

However, the market is still somewhat fragmented. While major banks have kept interest rates relatively unchanged, some smaller banks continue to maintain higher interest rates to attract customers. This gives depositors more options for savings products with attractive interest rates, although the difference between banks is not large.

While the main trend is stability, some minor interest rate adjustments could still occur in 2025 if the economy recovers strongly or credit growth suddenly increases.

The highest interest rate appears at 9.5%/year

According to Lao Dong, with a special interest rate, the highest in the market is the interest rate of 9.5%/year listed at PVcomBank. PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

HDBank also listed an interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/savings card, not applicable to mobilization in the form of initial interest or periodic interest.

In addition, lower savings rates, from 7.0%/year, are also listed at many banks.

Dong A Bank is listing a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

MSB currently offers a special interest rate of 7.0%/year to customers with newly opened savings books or savings books opened from January 1, 2018, automatically renewed with a deposit term of 12 months, 13 months and a deposit amount of VND 500 billion or more.

See more daily bank interest rate updates HERE.