The deposit market is recording a trend of promoting incentives through additional interest rate programs, mainly concentrated in online deposit channels. This development has caused the actual received interest rate for some terms, including the 6-month term, to exceed the 8%/year mark.

Cake by VPBank is applying an additional 0.9%/year policy for customers depositing money from a 6-month term, the implementation period is until the end of February 28, 2026.

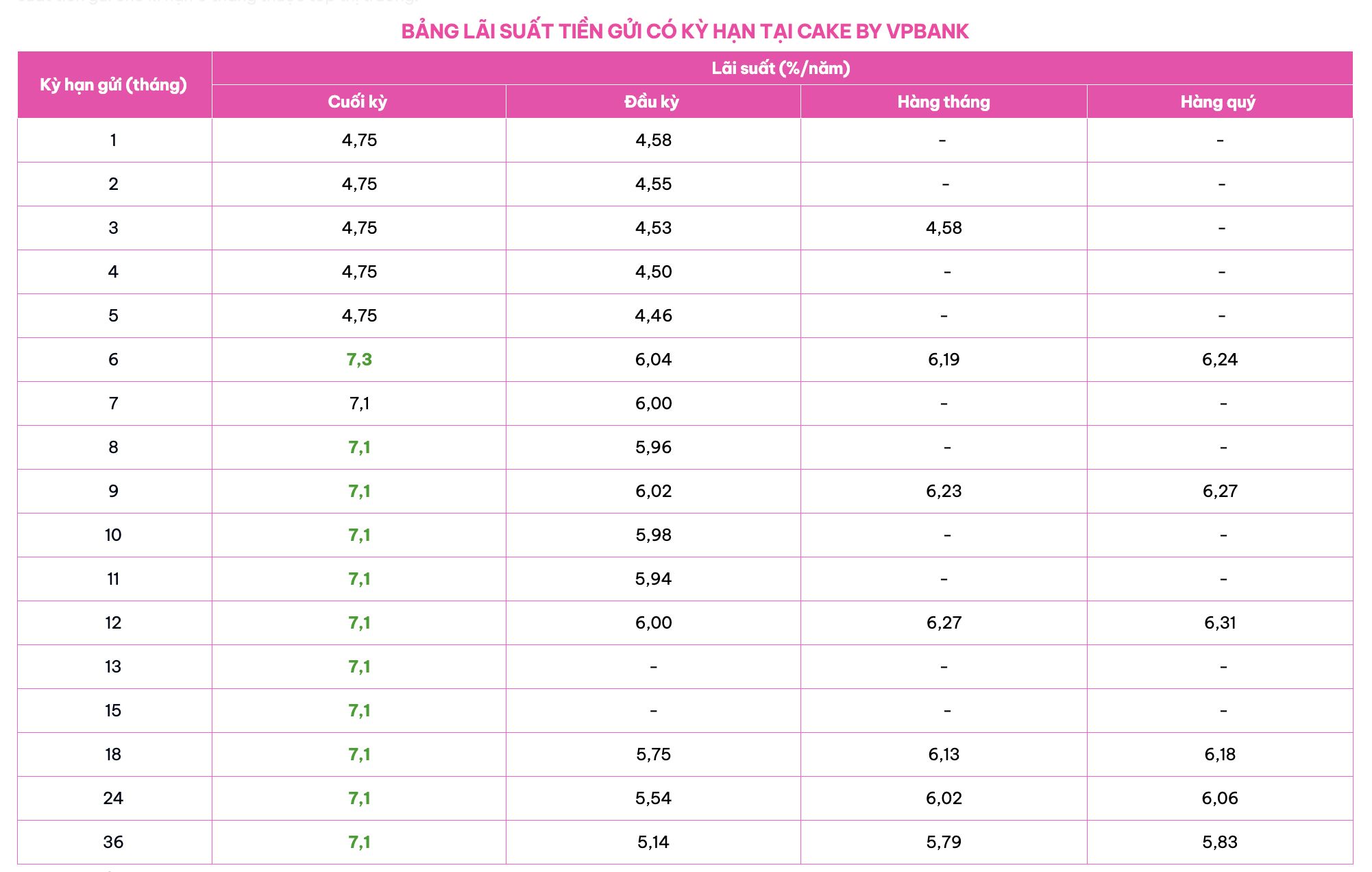

Before applying incentives, this bank listed the highest interest rate in the range of 7.1–7.3%/year. After adding up, the interest rate customers enjoy ranges from 8–8.2%/year depending on the term and application conditions.

At PVcomBank, the bank implements an additional program of up to 1.5%/year for customers who deposit online on Fridays every week. The applicable condition is to deposit money through digital channels, with a term of 12 months or more and a minimum deposit amount of 100 million VND.

With this additional amount, a deposit of 100 million VND can enjoy an interest rate of 7.6%/year for a 12-month term and 7.8%/year for a 13-month term. If choosing terms from 15–36 months, the actual received interest rate is up to 8.3%/year, a rare level in the market for small deposits.

Meanwhile, BVBank is deploying an online deposit certificate product with the highest interest rate of up to 7.8%/year. Customers can purchase deposit certificates via digital channel with a minimum amount of 10 million VND, applicable to four terms including 6, 9, 12 and 15 months. The corresponding interest rate is 6.5%/year for terms of 6 and 9 months; 6.8%/year for a term of 12 months; and highest 7.8%/year for a 15-month term.

In addition to additional interest rate programs, some banks have officially listed savings interest rates exceeding the threshold of 7%/year such as OCB, Bac A Bank, PGBank, MBV and Cake by VPBank. This development shows that the deposit interest rate level continues to be maintained at a high level, especially for medium and long-term terms.

Interest rate information is for reference only and may change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.