According to Lao Dong, on November 20, An Binh Commercial Joint Stock Bank (ABBank) continued to adjust the mobilization interest rate with a significant increase for terms under 6 months. This is the second increase in the month of ABBank.

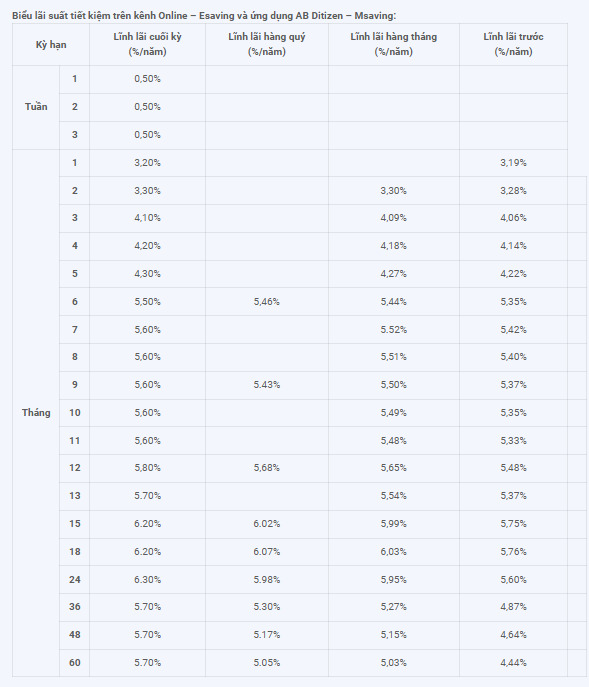

The interest rate table at ABBank records the following changes:

1-month interest rate increased by 0.1 percentage point, at 3.2%/year.

3-month interest rate increased by 0.2 percentage points, at 4.1%/year.

4-month interest rate increased by 0.6 percentage points, at 4.2%/year.

5-month interest rate increased by 0.7 percentage points, at 4.3%/year.

6 month interest rate at 5.5%/year.

9-month interest rate at 5.6%/year.

12-month interest rate decreased by 0.1 percentage point, at 5.7%/year.

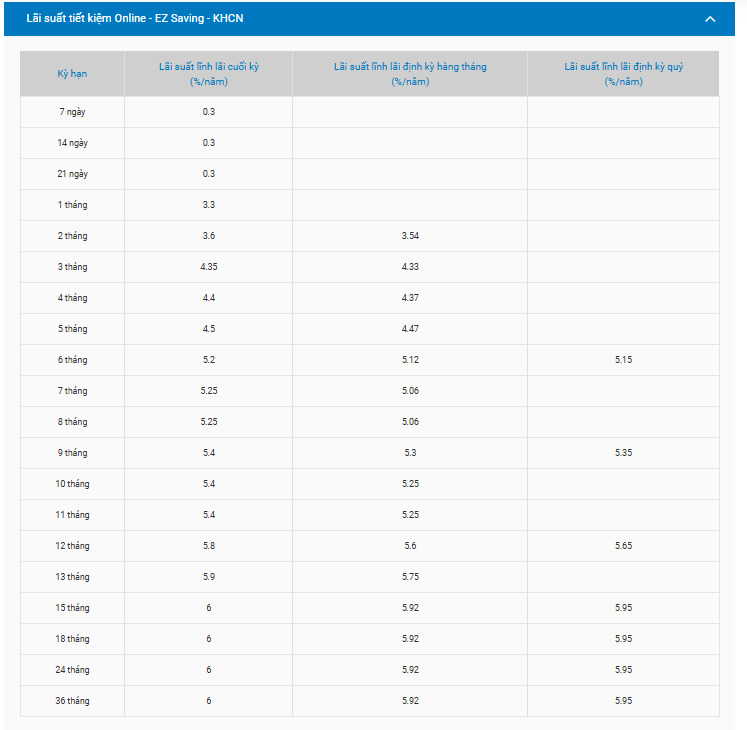

On the same day, Bao Viet Commercial Joint Stock Bank (BaoVietBank) also recorded an interest rate increase with a similar trend.

1 month interest rate at 3.3%/year.

3-month interest rate increased by 0.35 percentage points, at 4.35%/year.

4-month interest rate increased by 0.3 percentage points, at 4.4%/year.

5-month interest rate increased by 0.3 percentage points, at 4.5%/year.

6 month interest rate at 5.2%/year.

9-month interest rate at 5.4%/year.

12-month interest rate at 5.8%/year.

Interest rate for 15-36 months is 6.0%/year.

According to the new regulations of the State Bank, from today, the interest rate for terms from 1 to less than 6 months applied to VND deposits will not exceed 4.75%/year.

Since the beginning of November, 13 banks have increased their deposit interest rates, including BaoViet Bank, ABBank, HDBank, Agribank, and VIB. Of these, ABBank, Agribank, and VIB have adjusted their interest rates up twice.

(See more information on the highest interest rates HERE)

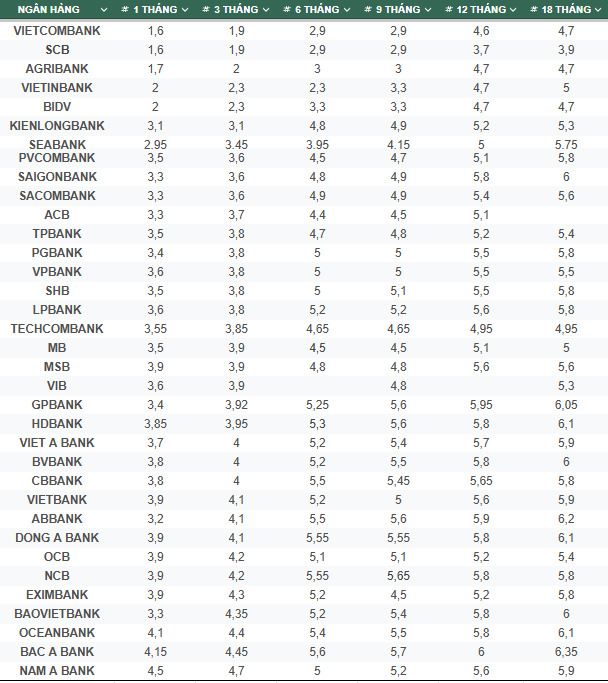

Details of deposit interest rates at banks, updated on November 20, 2024