According to Lao Dong, 2024 will see significant fluctuations in savings interest rates at commercial banks.

Comparing January and November of the same year, the average savings interest rate increased by about 0.8% - 1.2% depending on the term and each bank.

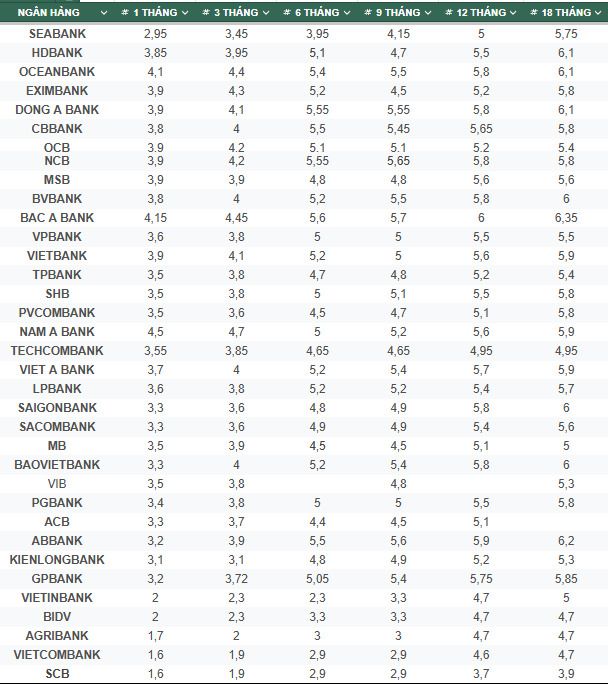

The bank with the highest interest rate increase is Bac A Bank, with the 12-month term interest rate increasing from 5.7% at the beginning of the year to 6.35% in November, equivalent to an increase of about 0.65%. This is a bank that stands out with its policy of attracting customers through attractive interest rates for long terms.

In addition, OceanBank and SaigonBank are also in the group with strong upward adjustments, bringing long-term interest rates above the 6% threshold.

The bank with the most adjustments is VietBank, with interest rates for terms from 6 to 12 months increasing by an average of 1%, showing a competitive effort to attract savings flows.

In contrast, state-owned banks such as Vietcombank, BIDV, and Agribank only made slight adjustments. Vietcombank and BIDV maintained fairly stable interest rates, with the 12-month term increasing from 5% to 5.2% (online savings), or only about 0.2%, the lowest in the system.

Accordingly, the trend of increasing interest rates is taking place unevenly, mainly concentrated in small joint stock commercial banks. According to experts, the move to increase interest rates is necessary to ensure liquidity in the context of fierce competition and credit growth higher than capital mobilization. Depositors need to consider choosing a bank that suits their needs to optimize profits from savings.

(See the highest interest rates HERE)

Details of deposit interest rates at banks, updated on November 17, 2024