Reducing the number of steps, keeping the highest tax rate

According to the Ministry of Finance, the current personal income tax rate includes 7 levels with a tax rate of 5% to 35%. Putting too many levels and narrowing the gap between levels makes taxpayers more likely to fall into a situation of "jumping stages", having to pay additional taxes when settling at the end of the year even though the number of additional fees is insignificant.

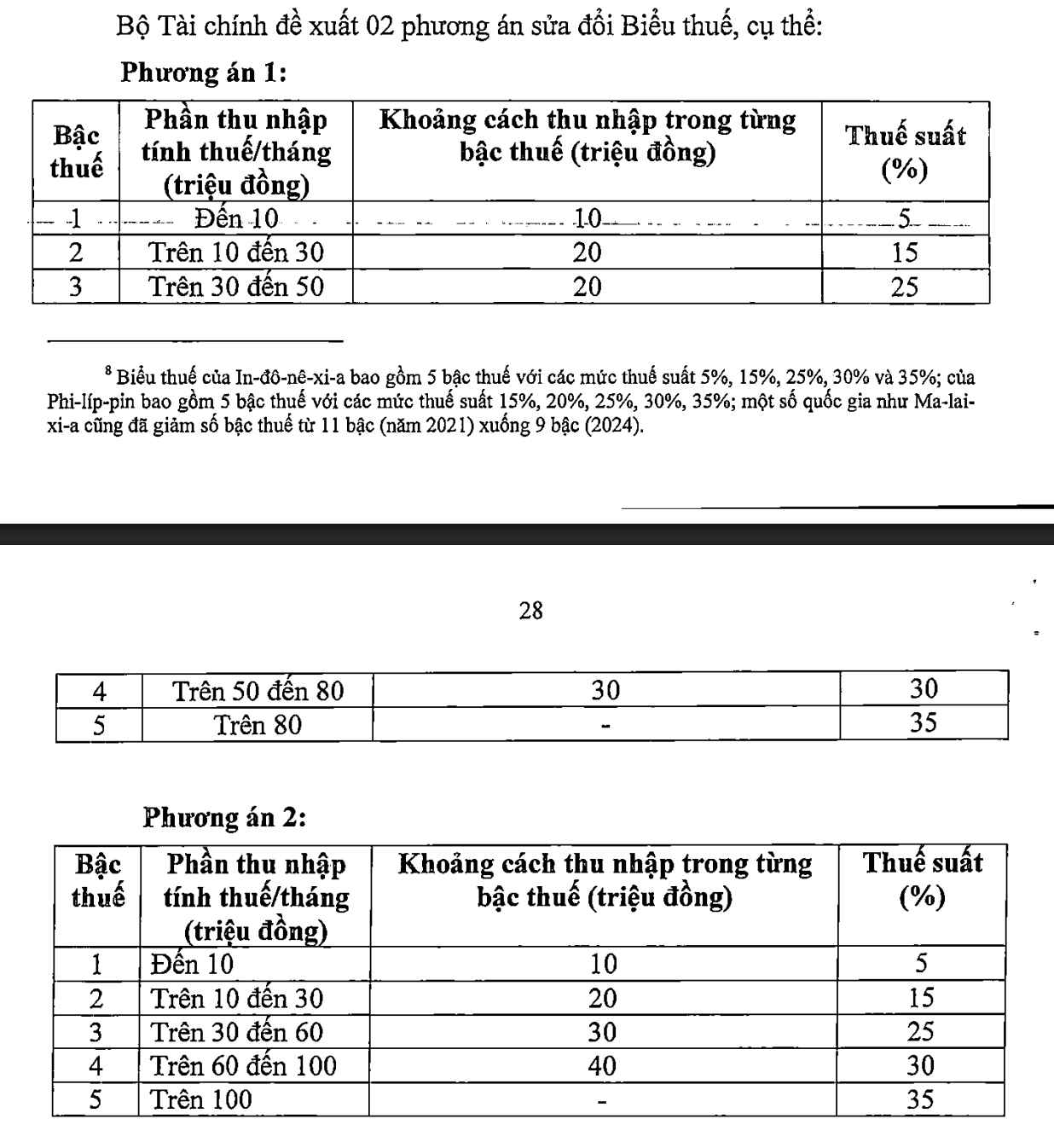

To overcome this, the Ministry of Finance proposed to reduce the tax rate to 5 levels. In the two options, option 2 was chosen because it widened the income gap at high levels. Accordingly: Up to 10 million VND/month is subject to a tax rate of 5%; from 10 to 30 million VND is 15%, from 30 to 60 million VND is 25%; from 60 to 100 million VND is 30%, over 100 million VND is 35%.

The Ministry of Finance also said that the international trend in recent years is to reduce the number of steps to simplify the tax table.

Maintain a ceiling of 35% to comply with international practices

Some opinions propose to extend the income gap even higher, while reducing tax rates to high levels, especially reducing the tax ceiling from 35% to 30% or 25%. However, the Ministry of Finance cited international experience and said that many countries in the region still apply the highest rate of 35% such as Thailand, Indonesia, Philippines; even higher, up to 45% in China, Korea, Japan, India.

The drafting agency explained that maintaining the 35% rate along with raising the family deduction level and adding additional deductions (health, education, etc.) will reduce the tax burden for people with average and low incomes. Thanks to that, many individuals will no longer be subject to tax, while high-income people will also have their tax payable reduced compared to the current tax.

For example, an individual who has a dependent, an income of 20 million VND/month is currently paying 125 thousand VND, according to plan 2 will no longer have to pay taxes. People with an income of VND 25 million/month reduced tax from VND 448,000 to VND 34,000 (down about 92%), an income of VND 30 million/month decreased from VND 968,000 to VND 258,000 (down about 73%).

Budget impact and population living standards

According to the 2024 Population Level Report of the Statistics Office, the average income per capita in Vietnam is 5.4 million VND/month; the richest 20% have an average income of 11.8 million VND/person/month. Meanwhile, the new family deduction proposed for taxpayers is 15.5 million VND/month, nearly 3 times higher than the average income per capita and exceeding the average income of the richest group.

The Ministry of Finance believes that the new tax table focuses on regulating the middle-high-income group. The 5% tax rate at level 1 applies to taxable income of 0 - 10 million VND/month, equivalent to income of 20 - 35 million VND for individuals with one dependent. Level 2 is at 15%, applied to taxable income of 10 - 30 million VND/month, equivalent to income of 35 - 56 million VND for individuals with one dependent.

Regarding the budget, if adjusted to reduce family deductions, option 1 is expected to reduce revenue by VND 12,000 billion, option 2 is reduced by VND 21,000 billion. If the tax table is adjusted, option 1 will reduce revenue by VND 7,120 billion, option 2 will reduce VND 8,740 billion.

Based on the impact analysis, the Ministry of Finance recommends that the Government choose option 2.